Though MiFID II implementation is still well over a year away, larger global and European asset managers are already taking actions to address its core requirement to separate payment for research from execution. Increasingly, these institutions are declaring themselves “fully unbundled,” meaning that the trading desk is removed from and blind to the allocation of payments for research, rather than indicating the adoption of a particular budgeting or payment mechanism.

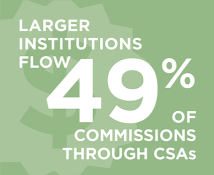

Unbundling is most apparent in the increased flow of transactions through commission sharing agreements (CSAs) on the part of the very largest institutions. Broader behavioral shifts also reflect a general shrinking of the commission wallet share being allocated to research/advisory services and a shortening of research provider lists. Clearly, pressure on broker-dealers will increase, particularly for those without the scale and quality of research to thrive in the new environment.

If institutions follow through on their stated intentions, however, the market will see even more dramatic change in the landscape. Although perhaps not a second “Big Bang,” the gulf between “haves” and “have nots” on both the buy side and sell side is bound to widen.

MethodologyBetween March and May 2016, Greenwich Associates interviewed 197 European equity portfolio managers and 178 European equity traders regarding their overall commission expenditures, allocations for research/advisory services (encompassing research product, analyst service, sales service, and corporate access), use of execution services, and relationships with sell-side brokers.