Table of Contents

Introduction

Regulations put in place since the global financial crisis have tightened compliance and documentation standards for banks—in some cases dramatically. These new demands have had a meaningful negative impact on customer experience. Customers are required to answer more questions, fill out more forms, provide additional documentation, and often wait longer for a response from their banks.

Left unresolved, this degradation of the customer experience (CE) will drive down customer satisfaction levels and place client relationships in jeopardy. The issue is especially troublesome at a time in which "fintech" providers are using their non-regulated status and cutting-edge technology to deliver a seamless and fast customer experience in lending, payments and other traditional bank businesses. Simply put, to remain competitive, banks must take action to deliver a first-rate experience for their customers.

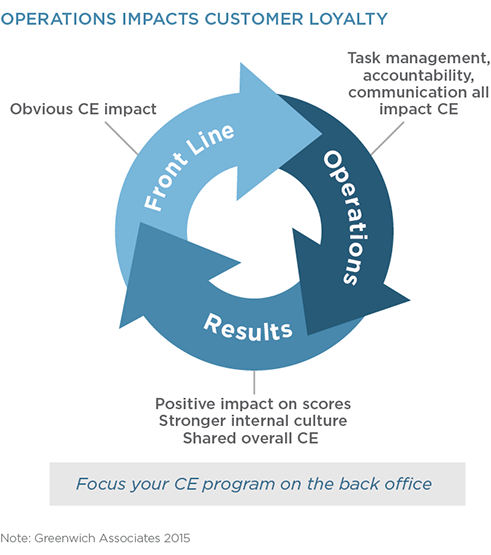

Doing so will benefit banks in one important way: Examining how compliance and documentation rules affect customer experience will demonstrate the critical impact of back-office functions. Many banks and other businesses consistently make the mistake of conflating customer experience with "customer-facing." In other words, even organizations that spend significant resources on customer experience management (CEM) programs often focus their efforts exclusively on front-line staff and procedures while excluding back-office and other non-customer-facing functions.

In reality, a bank’s back-office performance plays a huge role in defining the customer experience. The efficiency, or lack thereof, of back-office functions will determine whether customers get their statements in a timely manner, their deposits, transfers and other transactions are executed quickly and properly, how long customers wait for response on a loan request, and how easy or hard it is to resolve problems when they do arise. All these and a host of other variables will, in turn, help determine whether the customer has a positive or negative experience.

With new regulations making it harder than ever to ensure these functions run quickly and efficiently, it is incumbent upon banks to insulate customers from the impact of these rules to the greatest extent possible. Achieving this goal will require coordinated action between the front-line and back-office staff responsible for functions affected by new compliance and documentation demands.

All personnel must be aware that enhancing the customer experience is now considered a strategic priority. Most specifically, they must understand that their own jobs and functions affect the experience of customers and buy into the notion that improving their own performance will improve things for the customer and for the organization as a whole. This is the very definition of "employee alignment."

Employee Alignment Defined

Employee alignment can be a powerful business performance tool. Used in tandem with a CEM program, a well-designed employee alignment effort will:

1) Motivate employees to make excellent customer service their top priority

2) Enable employees to deliver excellent customer service by giving them the tools they need, and ensure that all customer-facing and back-office functions support an exceptional customer experience.

For organizations committed to improving customer experience and delivering top-notch service, CEM is the correct and necessary starting point. However, although a well-executed CEM program delivers important insights from direct customer feedback, it really only shows half the picture.

Solid CEM results will reveal how the organization is performing with its customers. Employee alignment will help answer the question of why. It does so by supplementing CEM data and conclusions with the perspective of internal employees who service customers and perform essential back-office functions every day. That final point is critical: A properly run employee alignment program sheds light into how all internal employees and functions—including non-customer-facing employees—influence customer experience.

That process will identify the organizational strengths, weaknesses and roadblocks that define customer experience and provide opportunities for improvement while also streamlining operations and reducing costs. For banks in particular, such opportunities are invaluable. Over the past five years, "ease of doing business" has become an increasingly important driver of customer satisfaction in the banking industry.

Although customer feedback can reveal how banks and other organizations are doing in this key metric and identify avenues for improvement, it is the employees within the company that know firsthand what works and what doesn’t. Employees know what barriers prevent them from delivering outstanding customer service in their daily work, and they know what systems, procedures and functions keep the organization from delivering an exceptional customer experience overall.

Going Beyond Information Gathering

Gathering such information is only the first step, however. One of the most important benefits of a properly implemented employee alignment program is the galvanizing effect it can have on a company’s workforce. The employee alignment survey will reveal the extent to which employees understand the importance of the customer experience, the company’s strategy for managing it and how their own role impacts the end result.

Armed with this information, companies can proactively work to align all aspects of the business—including front-line personnel, back-office staff, senior management, and overall corporate strategy—toward the singular goal of providing an extraordinary customer experience.

However, assessing employee alignment requires more than a run-of-the-mill employee survey. More general employee surveys have been administered by human resources departments and focused on topics such as employees’ job satisfaction, ratings of managers and understanding of the company’s broad business strategy.

An employee alignment program, on the other hand, is dedicated entirely to customer experience and factors in employees’ understanding of:

- The concept of the customer experience

- Why customer experience is important

- The company’s strategy for managing and improving customer experience and whether employees buy into that strategy

- How employees’ roles impact customer experience and what internal procedures, technology or even individuals help or prevent them from delivering exceptional customer service

When compared with CEM findings, employee alignment results allow companies to pinpoint internal gaps and breakdowns that degrade customer experience and take action to correct them. These opportunities for improvement include both "quick hits," or specific operational snags that are having a negative impact, and secular or strategic issues that are undermining performance.

Usually, these disconnects align with CEM results: In areas where customers report having terrible experiences, employees will also report breakdowns. However, sometimes employee alignment programs reveal "unknown unknowns," or issues that create problems for customers, but of which senior management and even line managers were completely unaware. The results are often surprising. In more than one instance, an employee alignment survey has revealed that the internal group with the lowest level of buy-in to the CEM program was senior management.

Employee Alignment in Action

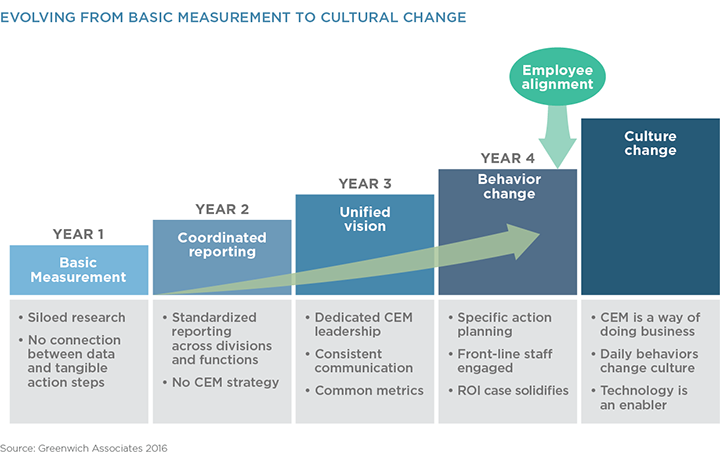

The following graphic shows the typical evolution of companies that adopt CEM. Operated at its highest and most sophisticated level, CEM will drive change in organizations. As illustrated, the benefits from the first years of a CEM program come mainly in the areas of measurement and reporting. Prior to implementing the CEM program, the company has no reliable means of measuring and assessing its performance in servicing its customers. Employee alignment, therefore, evolves much later in the process.

A Multi-Year Process

The first 12 months of the CEM program are usually devoted to producing accurate, repeatable and actionable data documenting the current state of the organizations’ customer experience. In the second year, companies are working to create standardized reporting templates that allow management to view trended data across divisions and functions. By years three and four, the company has begun using CEM to initiate organizational change. This starts at the strategic level, as senior management uses new insights to integrate customer experience into its list of organizational priorities and communicates this new emphasis to employees.

Simultaneously, the company is starting to use specific findings in the CEM data to trigger actions that address immediate problems in the short term and make systemic adjustments that will improve the customer experience over a long-term horizon. At this stage, front-line staff is fully engaged with CEM, and senior management can make a strong ROI case for the program.

However, organizations should not make any further investments in their CEM program until there is full alignment across the organization. By this point, the organization is looking to use CEM to bring real operational (and, eventually, cultural) change. But changes of this magnitude are not possible without the understanding and buy-in of all employees. Without a pervasive internal commitment to the initiative, additional dollars invested in CEM could be wasted.

To avoid this risk and maximize the impact of CEM, the organization should now integrate this system of performance measurement, reporting and improvement into the culture. This entails aligning front-line functions, back-office support, strategy, and leadership toward the customer experience. Achieving this employee alignment obviously requires feedback from customers that will provide the baseline measure of performance. However, it also requires data from the three internal groups themselves.

This data can be acquired through a combination of in-person interviews, online surveys and telephone interviews. The process usually starts with in-person interviews with senior managers to fully document overall business and CEM strategies, and to understand how top executives perceive results to date. Then, the survey should be extended to all front-line and back-office staff.

Success Factors

The first and most important determinant of success to any employee alignment program is a robust level of participation among employees. Participation rates—and the overall quality of program results—are heavily influenced by five factors:

1) Pre-survey communication

2) Senior management support

3) Survey execution quality

4) Proper questionnaire design

5) Post-survey communication

Effective pre-survey communications not only inform employees about the upcoming survey, they also explain to employees why the CEM and employee alignment initiatives are important in the context of the organization’s overall strategy.

To drive these points home and truly motivate employees to participate, at least some of the communications should come from senior management. Simply demonstrating that the survey is considered a priority among management will increase participation rates and improve the quality of the data by ensuring that all parties take the process seriously.

Survey Design and Execution

Another important factor in encouraging employees to participate is extensive testing of online survey tools and trials of the questionnaires for telephone and in-person interviews. Especially with online surveys, organizations generally have one chance to get employees to participate. Employees who log on and discover technical snags or are forced to endure a long and poorly designed survey will close the program and never return.

Greenwich Associates works closely with its employee alignment clients to create questionnaires that achieve organizational goals while also being easy to navigate. To deliver meaningful results, the employee alignment survey must overlap with the CEM survey. The questionnaires must cover that ground, while also hitting important internal topics—all without making the survey so long and cumbersome that employees become bored and drop off.

Finally, organizations cannot allow employees to think that their comments go unheard. Management must follow up with post-survey communications that go beyond simply thanking employees for their participation, and actually present examples of aggregate findings and conclusions. The goal here is to:

1) Demonstrate that management is listening and actually using employee input to guide the customer experience strategy and ultimately the corporate strategy, and

2) Provide specific examples of how employee feedback is triggering change.

Weighing the Benefits of Anonymity

There is one more factor that plays a big role in determining the success of a survey: anonymity. Guaranteeing anonymity to participants is an effective means of both encouraging employee participation and soliciting honest responses. There is a trade-off, however. Anonymity also lessens the usefulness of final results.

Greenwich Associates advises employee-alignment clients to identify survey participants by title/function and business unit. These demographic descriptors will allow the company to identify and act upon areas of strength and areas of opportunity. At the same time, the company must ensure all participants that survey results will be presented only in aggregate, so that co-workers and managers will not be able to attribute findings to any individual, or even group, within the organization.

United Bank Case Study

In 2015, senior management at United Bank (UBNK), a leading New England bank with more than 50 branches in two states, more than700 employees, and over $6.4 billion in assets, received results froman employee alignment study launched, in part, to gather insights from internal staff following a recent acquisition. The study yielded a true"aha" moment: The data demonstrated a clear linkage between shareholder return and the willingness of United Bank employees to recommend their own bank to friends and peers.

The employee alignment study data showed that key drivers of customer satisfaction and loyalty aligned with employee satisfaction.

Empowerment - Enable employees to give the best possible customer service

Prioritization - Motivate employees to make excellent customer service their top priority

Job Tools - Compete effectively to provide better customer service

Given these findings, senior management recognized the concrete benefits the bank could derive by increasing employee satisfaction and loyalty. The best way to do that, they concluded, was to rally employees around a cause that was bigger than themselves and that provided meaning to their everyday work. That cause: serving the bank’s customers. As the bank put it, the goal would be to "Ignite a spirit to serve."

The bank was convinced that success in this effort ultimately would transcend internal measures and—by improving customer’s experience in interacting with United Bank—boost rates of customer retention, thereby driving improvements in other key business performance measures.

With those targets in mind, the bank decided to accelerate and expand its employee alignment program. A survey planned for the following year was moved forward into 2015 as a "Pulse Study," or a short, quick-hit survey designed to rapidly follow up on findings from the original survey and to communicate to employees that management had heard their comments and was taking them seriously.

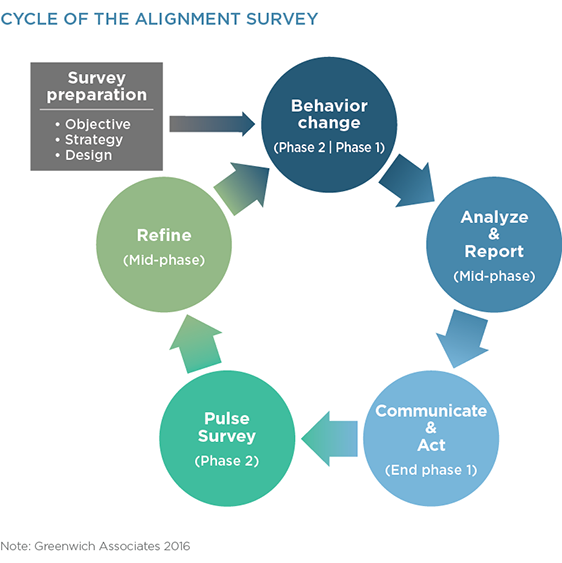

The following graphic shows the process through which the bank executed its complete, two-phase employee alignment program.

Alignment Cycle in Action

The bank’s first step in executing this plan was to secure buy-in and support from the top levels of senior management. This support included both the budgetary and financial commitment required to build a strong, comprehensive CEM program that included a robust employee alignment strategy and internal communications expressing the importance of this initiative to senior management and the bank as a whole. Next, the bank appointed a dedicated CEM leadership team to develop and manage the strategy.

To put that strategy into effect and integrate CEM into the fabric of everyday operations, the Bank extended its employee alignment program with the accelerated survey. United Bank’s human resources department launched a proactive communications program that informed employees about the upcoming survey and educated them about the importance of the effort in the context of the Bank’s overall business strategy. These communications were supplemented with direct communications from senior management emphasizing the same themes and urging participation.

A key part of those communications were assurances that responses would be kept confidential. Although the company collected demographic information from respondents to make the resulting data actionable,results were at all times presented publicly only in aggregate. The bankal so undertook extensive testing of online survey tools and trials of the questionnaires for telephone and in-person interviews.

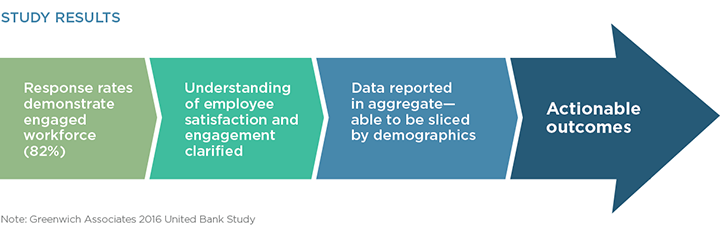

Thanks in large part to its effectiveness in each of these areas, United Bank achieved a participation rate of 82%. Considering average participation rates for employee surveys are in the mid-40% range, that result represented an impressive success.

Finally, the bank also distributed post-survey communications. While making sure to protect the promised level of confidentiality, the bank crafted and disseminated the "story" that the data revealed, with the narrative tailored to various internal audiences.

Realizations from the Alignment Study

The bank learned several important things from the study, including:

- Bank support staff placed a high priority on how their work contributes to the success of the bank. This finding was a key success factor and positive message to bank management. At many organizations, back-office and support staff feel disconnected from customers and often from the business strategy as a whole. Evidence that employees were strongly engaged with the bank’s overall performance and success showed that United Bank was well-positioned to achieve its goal of aligning all aspects of the organization toward serving the customer.

- Employees in different stages of their tenure with the bank generally had different expectations and satisfaction levels. New hires were clear about the bank’s objectives and their own roles, while longer-tenured employees were not. The solution: Extend to existing, legacy employees the same "onboarding" programs developed to help integrate new employees and staff from the recently acquired bank.

- Generational differences were small when it comes to the pride and satisfaction employees felt in working for the bank. This finding discredited any assumptions about the fickleness or unique needs of millennial employees, suggesting that programs designed to improve employee satisfaction levels do not necessarily have to be tailored for specific age groups.

- Salary level was not necessarily an indicator of whether an employee recommends the bank as a place to work.

By enabling these and other important changes, the employee alignment program helped infuse CEM into the fabric of United Bank operations and culture.