Table of Contents

U.S. companies are getting a look at the new world order in banking. Despite the shakeout that unfolded following the global crisis, the structure remains largely the same in one important way: The U.S. corporate banking market is dominated by the “Big Four” of Bank of America Merrill Lynch, J.P. Morgan, Wells Fargo, and Citi. But corporate treasury departments should be aware that changes are occurring beneath the surface.

For the second year in a row, an unusually large amount of corporate banking business and relationships is up for grabs in the United States. Forty-five percent of the companies participating in the Greenwich Associates 2016 U.S. Large Corporate Banking Study are moving or considering moving business from one bank to another in the coming 12 months. That share is up from just 32% in 2013.

The surprising quantity of “money in motion” reflects a banking and corporate finance industry that has yet to find true equilibrium. Seven years after the crisis, banks are moving in dramatically different trajectories based on the individual strategies they are pursuing, and companies are still working out the best approaches to secure the credit and other services they need. Some previously global banks are retrenching out of regions or countries, while others are pulling back from certain segments or products due to regulatory, risk or capital issues. Corporates are acting accordingly to find long-term partners that can be relied upon to provide capital, advice and the necessary high-quality solutions.

One of the most important and widespread trends among corporate treasury departments is the reduction in the overall number of banks used. The average number of banks employed by large U.S. companies dropped to 26.4 in 2016 from 28.8 in 2015. The downward trend was consistent across companies large and small. Most of these cuts are coming at the tail end of corporate bank lists.

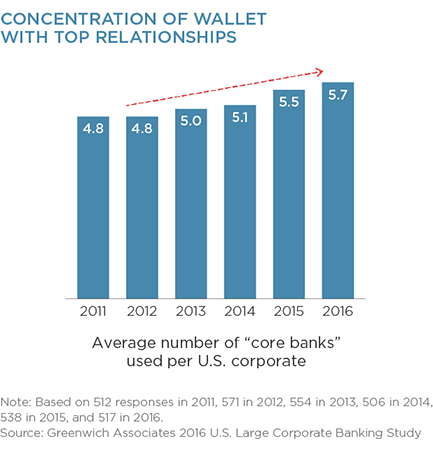

Companies are cutting ties with tertiary providers in part to concentrate business in the hands of their top banks. In turn, the number of banks that companies consider to be part of their “core” bank group has grown slightly.

Greenwich Leaders: Large Corporate Banking

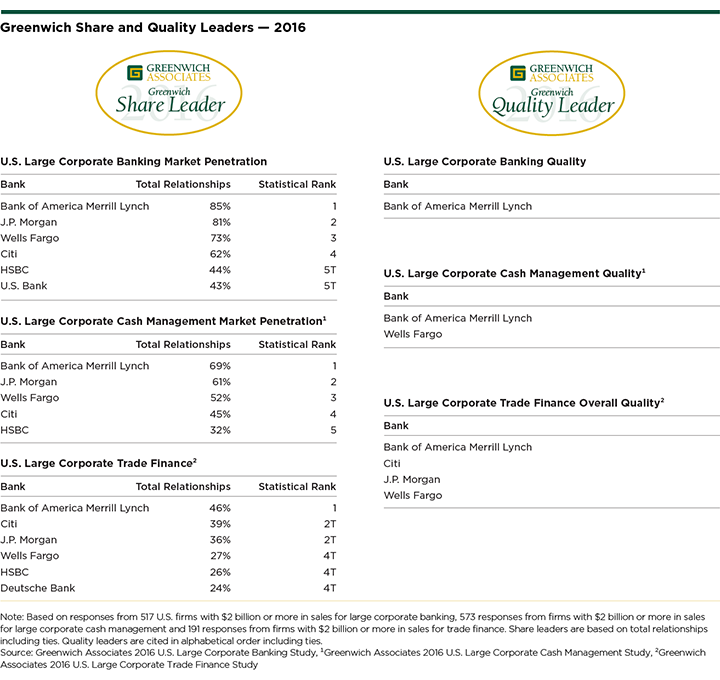

The clear winners in this process are the banks already established as market leaders. At the top of this list is Bank of America Merrill Lynch, which is named as a corporate banking relationship by an impressive 85% of large U.S. companies, J.P. Morgan, which boasts a market penetration of 81%, Wells Fargo at 73%, Citi at 62%, and the duo of HSBC and U.S. Bank, which tie for fifth place with market penetration scores of 43%–44%. These are the 2016 Greenwich Share Leaders℠ in U.S. Large Corporate Banking.

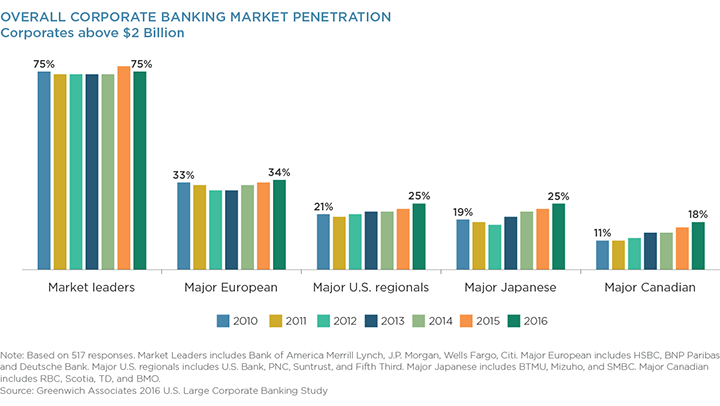

“Together, the Big Four of Bank of America Merrill Lynch, J.P. Morgan, Wells Fargo, and Citi maintain their dominance with a combined average of 75% of all large corporates in the U.S. citing a relationship,” says Greenwich Associates consultant Andrew Grant. “The really interesting change is that the group of banks outside of the Big Four universal providers have been able to consistently grow their importance to the market over the last five to seven years.”

This concentration of market share is due in part to the realization among corporate treasury departments that they need to reward primary credit providers with other types of business. However, the Big Four U.S. banks are also providing top-quality service, with Bank of America Merrill Lynch claiming the title of 2016 Greenwich Quality Leader℠ in U.S. Large Corporate Banking.

Other banks are also gaining ground. Even as they cut tertiary providers, companies are forming new relationships with banks that can deliver strong capabilities in specific products and/or geographies.

For example, RBC is one of the banks with meaningful momentum in the U.S., having dramatically increased its market share over the past several years. HSBC and BNP Paribas have as well, both leveraging their international banking capabilities to gain market share among large U.S. corporates. Leading Japanese banks are growing their U.S. presence through both acquisitions and

organic growth.

Meanwhile, some other large European banks that remain under balance-sheet constraints have seen their U.S. presence hold steady or decline. In addition, we have seen midsize U.S. regional banks move up market to participate in corporate loan syndications. “Domestically, the market has been tough for small regional players,” says Greenwich Associates Managing Director Don Raftery. “The ROE on loan participations has been modest when not accompanied by additional non-credit usiness, and several of the smaller regional banks are re-evaluating if this is a good use of capital. It is increasingly difficult to make the economics attractive in corporate banking without a large balance sheet, strong geographic presence or unique product specialization.”

Recommendation to Corporate Treasury Departments: Reward your credit providers and bring transparency into the partnership/dialogue. Companies around the world are becoming more aware of the pressure on banks from the industry’s new economics. Banks cannot afford to allocate large amounts of capital to client accounts that are not profitable under new capital reserve requirements and other rules. To ensure access to credit, sage advice and other essential bank services, corporate treasury departments should take a less transactional approach to the business and instead treat bank relationships as long-term partnerships.

Inherent in those close relationships is the assumption that credit providers will be rewarded with incremental, higher-margin business in capital markets, transaction banking and other areas. Banks are investing intellectual and financial capital into their most profitable relationships.

Corporations should be looking to capitalize on and reward those advisory types of relationships from their most important providers.

Large Corporate Trade Finance

While companies cut the number of banks with whom they do business overall, they are moving in the opposite direction in trade finance. The average number of banks used by large U.S. companies for trade finance has climbed steadily from 3.1 in 2014 to 3.6 in 2015 and to 4.0 in 2016.

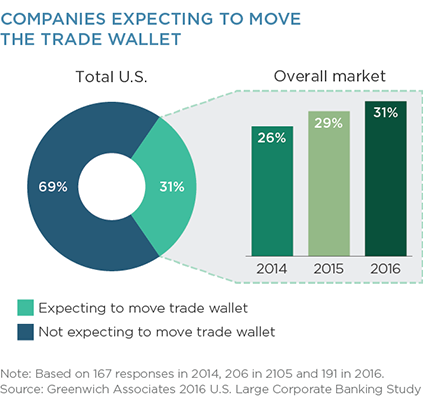

This growth trend looks set to continue. The share of large U.S. companies expecting to shift their trade finance wallet among banks has increased each year since 2014 and now stands at 31%. Greenwich Associates expects much of this business to flow to “new” trade finance providers. The reason: “Plain vanilla” trade finance has become commoditized, and companies are taking advantage of the ease with which they can switch providers in order to funnel business to banks that provide credit.

This broader distribution of trade finance business has created a relatively large pool of “winners” that have gained corporate relationships, including some European banks that have invested heavily in their trade finance platforms, as well as some Japanese providers.

Meanwhile certain other banks have seen their presence shrink, as they intentionally reduce the amount of business they do in some products and services or with some clients in line with strategic decisions made about capital allocations under new reserve requirements. In the midst of these shifts, Bank of America Merrill Lynch remains atop the market with a penetration score of 46%, followed by Citi and J.P. Morgan, which are statistically tied at 36%–39%, and Wells Fargo, HSBC and Deutsche Bank, which are tied for fourth at 24%–27%. These are the 2016 Greenwich Share Leaders in U.S. Large Corporate Trade Finance. The Greenwich Quality Leaders in this

category are Bank of America Merrill Lynch, Citi, J.P. Morgan, and Wells Fargo.

Recommendation to Corporate Treasury Departments: Companies that move too slowly to make their treasury operations compatible with digital trade finance systems might end up paying extra fees. Given the increasing price competitiveness in the business and an interest-rate environment that makes it difficult for banks to make money, banks can’t afford to continue servicing trade finance customers in a manual fashion. As a result, paperbased transactions could eventually be viewed and priced as an extra service.

Large Corporate Cash Management

One of the more interesting findings in Greenwich Associates 2016 research is the fact that 50% of large U.S. companies expect to shift cash management business among bank providers. This data point stands out because high switching costs associated with corporate cash management systems usually keep turnover rates low.

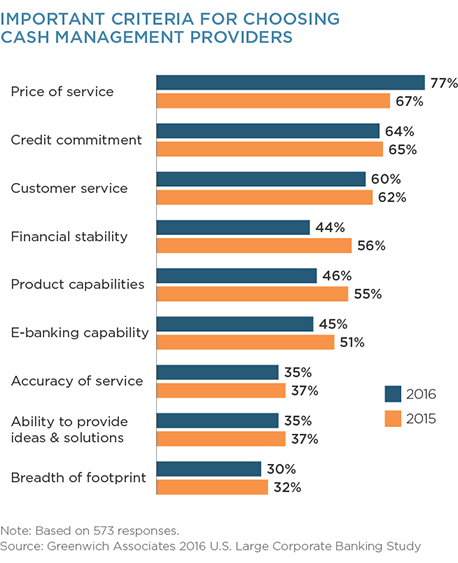

Traditionally, companies have favored cash management providers that: 1) price the most competitively, and 2) provide the company with credit. These factors remain in place, with pricing actually emerging as a most important driver from 2015 to 2016. However, companies today are also seeking out banks that have strong service/relationship support that can help improve efficiency in working capital and cash management.

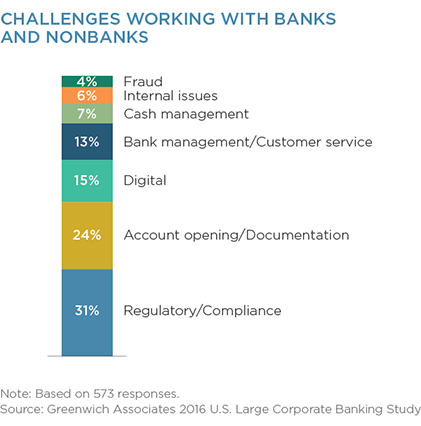

While not explicitly addressed above, “ease of doing business” also is an important consideration. Thirty-one percent of companies cite regulatory and compliance issues as a major factor in working with cash management providers, with an additional 24% citing the account opening and documentation process.

The 2016 Greenwich Quality Leaders—Bank of America Merrill Lynch and Wells Fargo—demonstrate how banks can deliver these benefits. First, both have invested heavily in transaction banking and provide top-notch service across cash management, trade finance and supply chain. Second, they meet the preferences of the nearly 60% of treasury professionals who want their primary cash management contact to be a cash or treasury specialist, as opposed to a generalist banker. Companies want specialists that can provide ideas on how to make their cash management and other functions more efficient, and oversee day-to-day service,” observes Andrew Grant. “This includes the ability to understand the more technical aspects of the business and the willingness to get down into the weeds with the back office to support the client, which is where most breakdowns occur.”

Based on all these factors, a market-leading 69% of large U.S. companies use Bank of America Merrill Lynch for cash management. J.P. Morgan is second at 61%, followed by Wells Fargo at 52%, Citi at 45% and HSBC at 32%. These are the 2016 Greenwich Share Leaders in U.S. Large Corporate Cash Management.

Recommendation to Corporate Treasury Departments: Don’t be complacent in cash management. Despite the big monetary costs and operational disruptions associated with changing cash management providers, there are a host of banks that have invested heavily in this business and are prepared to provide the kind of service that can make a real, positive impact. If anything, the U.S. cash management business will become increasingly competitive as banks vie not just for the domestic business, but the international as well.

“Having a corporation’s operating accounts is critically important to bank profitability under the new capital guidelines,” notes Don Raftery. “Banks are competing not just with capabilities, but also with well-conceived global advice to increase profitability through better trade-offs of risks, returns, costs, and liquidity across various tax and FX frameworks. This is complex, and savvy bankers leveraging broad capabilities can make a big difference in profitability to a corporate treasury team over time.”

These advisory capabilities are being replicated using artificial intelligence (AI) based on algorithms, economic data, country risk, payee risk/payment patterns, returns for alternative short-term investment vehicles, local tax rates, FX, liquidity needs, bank costs, etc., and are assessed against company goals to create the optimal solutions. “Digitizing the advisory element will enhance what can be a complex set of inputs to help corporates increase profitability. While none of the banks are fully there with AI, many are working on IBM Watson-like solutions,” says Don Raftery.

Consultants Don Raftery and Andrew Grant specialize in corporate banking, cash management and trade finance services in North America.

MethodologyFrom April through October 2016, Greenwich Associates conducted interviews at U.S.-based companies with $2 billion or more in annual revenue with 517 chief financial officers, treasurers and assistant treasurers and 573 cash management specialists and other financial professionals in cash management. Participants were asked about market trends and their relationships with their banks.

From April through October 2016 Greenwich Associates conducted 191 interviews in trade finance with financial officers (e.g., CFOs, finance directors and treasurers) in the United States. Subjects covered included product demand, quality of coverage and capabilities in specific product areas.