Although exchange-traded funds are a relatively recent addition to institutional investing in Latin America, ETFs are quickly taking on an important role in institutions’ portfolio management toolkits. Based on the results of interviews with 50 Latin American institutions and trends among institutions in markets with a longer history of ETF investment, Greenwich Associates expects that process of integration to continue and even accelerate in Latin America.

Like their counterparts in other regions, most Latin American institutions are starting out with relatively small allocations to ETFs, mainly in equity portfolios. Through these initial investments, institutions are discovering the efficiency and versatility ETFs can bring to their investment portfolios. As they do so, they are expanding their use of ETFs to fixed income and other asset classes, as well as to a growing range of portfolio applications.

Institutions in Latin America are introducing ETFs to their portfolios first and foremost as a means of obtaining long-term strategic investment exposures and diversifying portfolios. They are then extending ETFs to a host of additional applications, ranging from tactical adjustments and portfolio completion to enhancing portfolio liquidity.

Latin American institutions that use ETFs now invest an average of 7.6% of total assets in them, with allocations poised for growth in 2017. Of Latin American institutions currently investing in equity ETFs, 68% expect to increase allocations next year, with 64% planning increases of more than 10%. More than two-thirds of Latin American institutions currently investing in fixed-income ETFs plan to increase allocations in the next year.

Greenwich Associates expects ETF growth rates to accelerate in 2017 and beyond due to several ongoing and emerging trends:

- Institutions around the world are experimenting with new and innovative ETF fund structures to help them manage mounting levels of volatility and other challenges facing their portfolios. In Latin America, more than 50% of institutional ETF investors invest in smart beta ETFs, and half of these users plan to increase allocations to them in the next 12 months. Demand appears strongest for smart beta ETFs that generate income and help institutions manage volatility.

- Current impediments to investment will give way as Latin American institutions gain experience with ETFs. Factors such as limited availability of ETFs, internal investment guidelines that limit or prohibit use, and concerns about ETF liquidity and expenses have initially slowed the adoption of ETFs in other markets. All of these factors have eased over time as institutions saw early adopters using them safely and effectively.

- Institutions will continue integrating ETFs into the mix of investment vehicles they employ in their portfolios, alongside and as replacements for derivatives and other products. Nearly 60% of institutions that use derivatives have diversified their mix of investment vehicles in the past year by replacing an existing futures position with an ETF—mainly for operational simplicity and reducing costs. Looking ahead, 42% of ETF users plan to evaluate existing futures positions in both equity and fixed income for potential replacement.

- Institutional demand for ETFs in Latin America will get a boost from the continued proliferation of multi-asset funds. Following a global trend, approximately 40% of Latin American asset managers that invest in ETFs are using them in multi-asset funds and are investing 14% of total assets in ETFs. As Latin American managers launch multi-asset funds, Greenwich Associates expects ETF allocations within those funds to increase.

- UCITS ETFs will provide new opportunities for investment. Latin American investors are beginning to initiate their first UCITS trades and are pleasantly surprised by their benefits, including tax and operational efficiencies. As institutions become more familiar with ETFs and seek new ways to employ them, UCITS ETFs will become a significantly larger part of the Latin American investment universe.

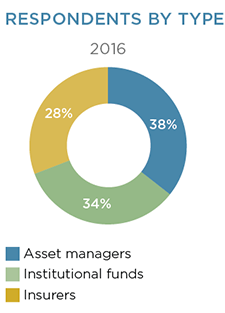

Greenwich Associates interviewed 50 Latin American institutional investors for its 2016 Latin American ETF Study—the debut edition in this region of a global research program that already covers the United States, Canada, Europe, and Asia. The research sample for Latin America was composed of 19 asset managers, 17 institutional funds and 14 insurers.

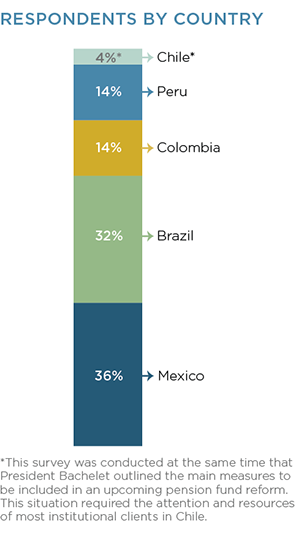

Thirty-six percent of study participants are located in Mexico and about a third in Brazil, with the remainder divided among Colombia, Peru and Chile. Nearly 40% of the institutions in the study have assets under management of $5 billion or more.

Relative to institutions in other regions, these investors manage sizable shares of their assets in-house. Across all institutions in the study, 88% of assets are managed internally. By way of comparison, institutions in the United States manage about 50% of assets internally on average.