Canadian institutional investors are utilizing exchange-traded funds (ETFs) as versatile tools to support active portfolio management. These investors are integrating ETFs into nearly every aspect of their portfolios, across asset classes and into critical functions like risk, volatility and liquidity management. As such, ETFs are on track to becoming common instruments in institutional portfolios, alongside stocks, bonds and derivatives.

The 53 institutions interviewed by Greenwich Associates for its 2016 Canadian Exchange-Traded Funds Study see ETFs first and foremost as a vehicle for obtaining strategic investment exposures, with nearly 60% of the institutions categorizing their ETF holdings as strategic in nature. Many institutions are using ETFs to obtain strategic exposures in the core components of their investment portfolios and to achieve portfolio diversification. At the same time, Canadian institutions are adopting ETFs for a range of more frequent short-term tasks like making tactical adjustments to portfolios, rebalancing, transition management, cash equitization, and interim beta.

ETFs have become important components of critical portfolio functions such as risk management and liquidity management. About half the institutional ETF users in the study and upwards of 60% of asset managers are using ETFs in liquidity management strategies, and 40% as part of risk management/overlay strategies.

Attracted to benefits such as liquidity, ease and speed of use and low costs, nearly 90% of the institutions in the study are using ETFs in equities, 59% are investing in bond ETFs, nearly 20% employ the funds in REITs and 16% in commodities ETFs. Canadian institutions that use ETFs invest an average 16% of total assets in the funds.

Use and allocations will continue to grow. Among current equity ETF investors in the study, 28% plan to increase allocations to the funds in the next year, with a full 57% of these institutions planning increases of 10% or more. A quarter of current bond ETF investors plan to increase allocations to the funds in the next year.

Several additional trends will contribute to future ETF expansion:

- Need for New Solutions Fueling Demand for Innovative Products. Canadian institutions’ need for new sources of returns in a low-rate environment and tools to manage volatility is fueling demand for smart beta ETFs. Thirty-one percent of Canadian institutions invest in these funds. Among these, more than half plan to increase allocations this year, with assets expected to flow into income-generating dividend/equity-income ETFs and volatility-mitigating minimum-volatility funds.

- Liquidity Concerns Fueling Demand for Bond ETFs. Roughly 80% of institutional bond ETF investors cite liquidity as a reason for using the funds.

- Institutions Diversifying Their Mix of Investment Vehicles. Almost 30% of Canadian institutions are diversifying the mix of investment vehicles they employ by swapping out certain positions in index mutual funds, active mutual funds, separate accounts, individual securities, and derivatives for ETFs. Over two-thirds of Canadian institutions that use futures say they plan to switch out a futures position for an ETF in the coming 12 months, and one-third of those institutions will evaluate such a move.

- Surge in Multi-Asset Funds Fueling ETF Demand. About a quarter of Canadian asset managers currently investing in ETFs are using them in multi-asset funds. Within these funds, the managers are allocating an average 26% of total assets to ETFs. Those allocations have significant room for growth, given that managers of multi-asset funds in other markets allocate up to 55% of asset to ETFs.

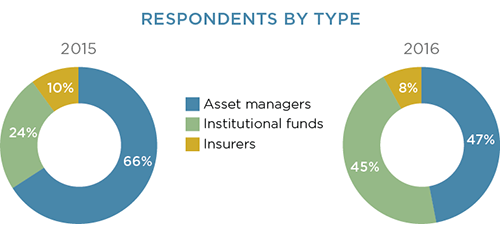

Greenwich Associates interviewed 53 institutional investors for its 2016 Canadian ETF Study, including 25 asset managers, 24 institutional funds, and four insurance companies/insurance company asset managers. The 24 institutional funds represent the biggest sample to date for the annual study in that important and sophisticated category. That group includes public pension funds, corporate defined benefit pension funds, and endowments/foundations.

Most of the participants are large institutions. Thirty-eight percent have assets under management (AUM) of more than $5 billion, 18% manage more than $20 billion, and 8% have AUM in excess of $100 billion.