Over the next decade, institutional investors believe the transformation of emerging markets from “old economy” to “new economy” will be the primary driver of growth in the space. In addition, active management will be investors’ preferred method of accessing these markets.

Greenwich Associates, in partnership with OFI Global Asset Management, reached this conclusion after interviewing 121 institutions across the United States and Europe, in the early part of 2017. The study revealed that the rapid development of emerging market economies is fueling a shift in how institutions view the investment opportunities these countries have to offer.

Here are five key findings from the study:

1. In the coming decade, economic development in emerging markets will be driven by rising levels of education, modernizing infrastructure and innovation.

2. Demand for active emerging market investments is expected to remain robust throughout that period.

3. Investment managers’ ability to generate alpha will require an integrated investment process, blending top-down fundamental macroeconomic and political analysis with a bottom-up approach.

4. Investment consultants and asset managers will play important roles in helping investors understand emerging markets.

5. Institutions in the U.S. and Europe plan to increase their use of environmental, social, and governance (ESG) principles from current modest levels.

As emerging market nations see their economies evolve from highly concentrated and resource-based to dynamic and diversified marketplaces, investment returns will be driven more by company, not country selection.

As this process unfolds, the bottom-up analysis that asset managers leverage to identify the most attractive industries and companies will become an even bigger determinant of manager performance.

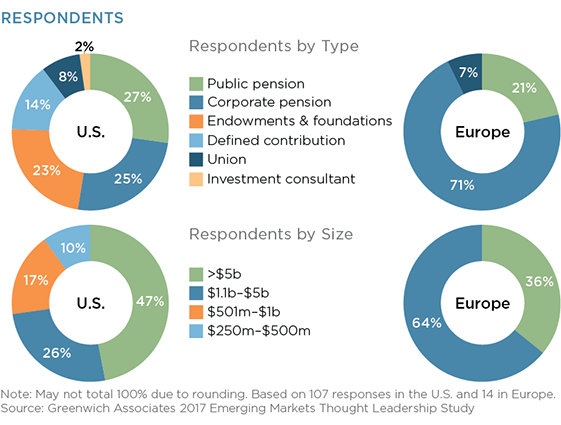

MethodologyFrom November 2016 to February 2017, Greenwich Associates, in partnership with OFI Global Asset Management, an OppenheimerFunds company, conducted a new study asking institutional investors how emerging market investing has changed and how they expect the asset class to evolve in the next decade. The study focused primarily on U.S. institutions, which have come to rely on emerging market allocations to meet performance objectives. However, to gain insights into how investors from other regions view emerging markets, the research sample includes 14 institutions from Europe in addition to 107 U.S. institutions.

Greenwich Associates targeted a diverse group of institutions. Most are active emerging market investors, but the sample also includes a small number of non-users, which were included to round out institutional perspectives on the asset class. According to the study, 91% of study participants invest in emerging market equities and 61% invest in emerging market fixed income.

The sample includes 37 corporate pensions, 32 public pensions, 25 endowments/foundations, and 15 defined contribution plans, as well as representation from the ranks of union plans and investment consultants. Study participants generally are large institutions. Approximately threequarters of U.S. institutions in the study and all the European institutions have AUM of more than $1 billion. Nearly half of U.S. participants and 36% of Europeans manage more than $5 billion.