Table of Contents

Over the past several years, institutions in Germany and across the Continent have been forced to devote significant resources and attention to complying with the ongoing implementation of new rules, including EMIR, Solvency II and MiFID II, and to shoring up risk management practices. This year, however, the 251 key decision-makers from German institutions participating in the Greenwich Associates annual research study are clear that their top priority is meeting the challenge of low interest rates and yields.

As they plot a course to meet this challenge, German institutions are increasingly relying on the counsel of asset management firms like Allianz Global Investors and PIMCO—the 2017 Greenwich Quality Leaders℠ in Overall German Institutional Investment Management.

German institutional investors name persistently low interest rates as their primary concern for 2017, and many are taking their first steps to adjust allocations to their fixed-income-heavy portfolios in an effort to reach long-term return targets. “Finding new sources of return requires German institutions to move into less familiar and more complex asset classes, and to consider the implications of these asset classes on risk management and regulatory compliance frameworks,” says Greenwich Associates Managing Director Markus Ohlig. “In this environment, large managers with broad capabilities like AllianzGI and PIMCO can be a valuable resource, and these firms’ abilities to provide knowledge and advice to large institutions is giving them a competitive advantage.”

German corporate pension funds in particular are becoming increasingly reliant on external asset managers in general, as they start moving assets out of government bonds—portfolios of which are often managed in-house—to specialized asset classes like high-yield bonds.

Investing in New Asset Classes Requires Expertise

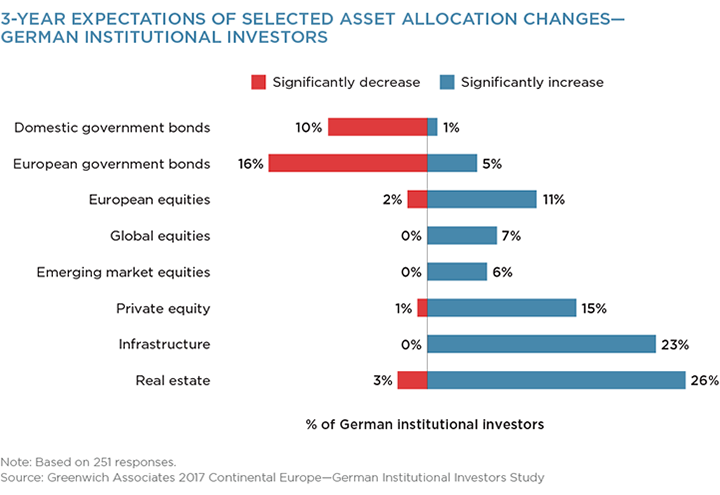

Over the next three years, German institutions expect to shift additional assets out of government bonds and into equities, real assets and specialized fixed-income strategies. In that final category, a narrowing of credit spreads seems to have diminished institutions’ appetite for products like bank loans, asset-backed securities (ABS) and even corporate bonds, while triggering increased demand for emerging market debt. Meanwhile, the data point to a surge in demand among German institutions for real estate, infrastructure and private equity.

New and expanded allocations to these asset classes are pushing the limits of German institutions’ internal expertise and triggering increased demand for external management and counsel. The share of German institutions describing their organizations as expert and well-resourced for portfolio management has declined to 58% in 2017 from 71% in 2015. “Meanwhile, the share of institutions describing themselves as reliant on external advice increased to 59% this year from 51% in 2015,” says Greenwich Associates consultant Mark Buckley.

Consultants Mark Buckley and Markus Ohlig advise on the investment management market in Continental Europe.

MethodologyDuring the first quarter of 2017, Greenwich Associates conducted in-depth interviews with 251 key decision-makers at the largest German institutional investors. Institutions included German corporate, public, and industry-wide defined-benefit, defined-contribution and hybrid pension funds, banks, Sparkassen, foundations and churches, insurance and reinsurance companies, sovereign pension reserve funds, and other non-pension institutional investors including official institutions, central banks, monetary authorities, sovereign wealth funds, and supranationals.