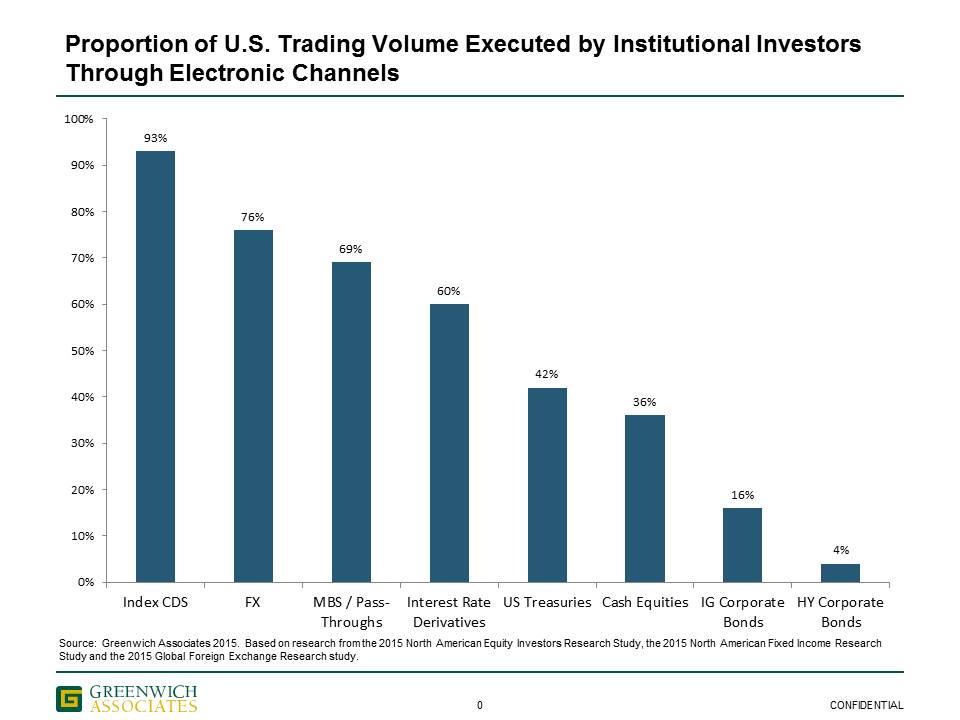

US equity markets are always touted as the poster child for electronic trading, but our most recent electronic trading study results (see chart below) prove that view is somewhat misguided. Driven primarily by new rules requiring index CDS trades to be executed on a swap execution facility, the dealer-to-client market for CDX.IG trades is now the most electronically traded in the US, followed closely by FX that for the last several years held the crown. Interest rate swaps also saw a huge jump in e-trading catalyzed by Dodd-Frank.

A few points to note in examining these numbers: Our study results represent use of e-trading by institutional investors in the US. So trading directly between dealers for instance is not included, nor are principle trading firms in most cases. Furthermore, these numbers represent how the investor interacts with the dealer, and don't necessarily reflect how the dealer ultimately executes the trade. Equities is a prime example - while investors continue to pick up the phone for the majority of orders, the brokers on the other end of the phone execute nearly all of those orders on the screen. And while we're talking about equities, we calculate e-trading percentages in equities based on commission flow whereas the other asset classes are notional based. Lastly, electronic trading means different things in different markets. Corporate bonds and dealer-to-client US Treasuries trade mostly via RFQ, electronically traded MBS often still include phone communication between counterparties and US equities are traded mostly via execution algorithms for instance.

The one element that remains constant across the board however is the trade is consummated on the screen. Looking ahead we certainly expect the bars on the right to slowly grow over time. If new regulatory mandates arrive than changes can happen quickly (such as with CDX and IRS), otherwise organic change happens slowly albeit surely. Lastly, we appreciate that comparing these very different markets results in a bit of an apples and oranges situation, however we believe it puts the e-trading evolution in perspective as market structures continue to evolve across markets.