About three years ago, the financial services sector seriously began exploring blockchain—the distributed ledger technology (DLT) behind bitcoin—for processing financial services transactions. The goal is ambitious: to completely rebuild the technology infrastructure that enables markets to function, from issuance to trading to settlement.

Accomplishing this across all markets will be a multi-year project, but significant progress has already been made. To increase adoption, speed development and foster community, many blockchain technology companies are deciding to distribute their software as open source. In turn, these companies are exploring new approaches and technologies to cyber-secure this new technology. In this latest Greenwich Associates research, we explore these issues and assess the current market perceptions of each.

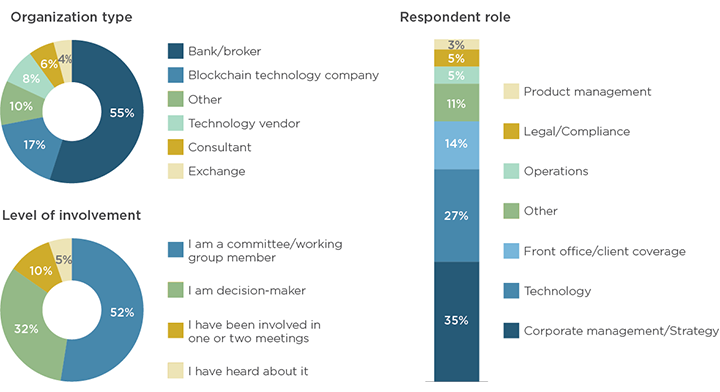

MethodologyDuring February and March 2017, Greenwich Associates interviewed 402 global market participants working on blockchain technology to assess opinions on some of the key trends and issues in the current state of distributed ledger technology (DLT) development. Respondents included representatives from a broad array of organizations. Ninety-five percent were either key decision-makers or actively involved in blockchain initiatives.