Table of Contents

The rapid advance of India’s private banks (privately owned banks) will continue and possibly even accelerate, as these providers impress middle-market companies with high-quality platforms and service, and public sector competitors wrestle with deleveraging their balance sheet of nonperforming assets.

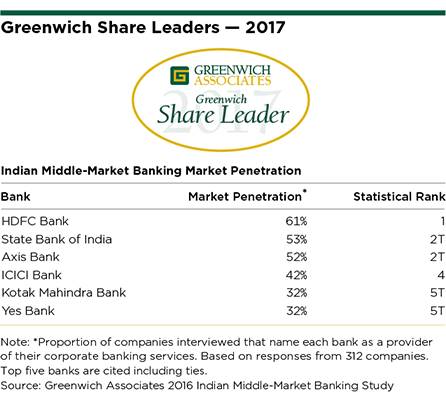

That’s one of the key findings of the Greenwich Associates 2017 Indian Middle-Market Banking Study. As part of this annual study, Greenwich Associates interviewed 312 companies, between INR 500 and 3,000 Crores in annual sales turnover, about their corporate banking relationships. Interviews took place between September 2016 and January 2017.

Although close to 70% of Indian banking assets are still held by public banks, the country’s private banks have been growing at a double-digit pace for at least the past decade. This is clearly evident in the middle-market banking segment, where the rapid expansion of private sector banks is being fueled both by the overall growth of the sector and by business captured from public sector peers.

A targeted approach and high levels of client satisfaction have helped fuel the rise of HDFC, which ranks first among all Indian banks in terms of number of relationships with middle-market companies. Although State Bank of India is far ahead in terms of assets, HDFC has experienced rapid growth in middle-market banking over the past three to four years. HDFC, which is widely recognized as one of the best-run banks in Asia, has built off its traditional relationships as a cash management bank to now position itself as a top corporate bank.

Among private banks, ICICI and Axis follow HDFC in terms of penetration among Indian middle-market companies. Next on that list are emerging private banks Kotak Mahindra and Yes, both of which have experienced explosive rates of growth, albeit from smaller initial client bases. Along with No. 2-ranked State Bank of India, these five banks are the 2017 Greenwich Share Leaders℠ in Indian Middle Market Banking.

The results of the Greenwich Associates 2017 Indian Middle-Market Banking Study show that private sector banks outperform their public sector counterparts in the quality of coverage and platforms delivered to middle-market clients—an advantage that is helping them win business relationships. “In the Greenwich Quality Index, which aggregates ratings given to banks by middle-market banking clients in a variety of product, service and relationship categories, India’s private banks outscore state-owned banks except State Bank of India, even surpassing scores of the leading global banks competing in the Indian marketplace,” says Greenwich Associates principal Gaurav Arora.

The list of 2017 Greenwich Quality Leaders℠ in Indian Middle-Market Banking is also dominated by private banks, both foreign and domestic. In Overall Relationship Quality, the 2017 foreign bank Leaders are Citi and Standard Chartered, while the domestic bank Leaders are Axis, IndusInd and HDFC. In Relationship Manager Quality, this year’s leaders are Standard Chartered and IndusInd.

Within the middle-market segment, IndusInd exemplifies the strong and improving quality of service that private banks are delivering to middle-market companies. The bank has invested heavily in training its relationship managers, who are now earning strong marks for their ability to provide advice across a range of critical topics. Other private banks are not far off; RM quality is improving across the board and now represents a significant competitive advantage over public sector banks. “State Bank of India scores quite highly for the quality of its RMs and overall institutional platform,” says Greenwich Associates Managing Director Paul Tan. “Outside of SBI, however, public sector quality ratings lag those of private banks by a large margin, and private banks are trying to exploit that weakness by directly targeting lessthan- satisfied public sector bank clients.”

Emerging Private Banks Show Momentum

Forty-two percent of mid-market corporates intend to shift share of wallet from an incumbent bank.

Although banks like Kotak and Yes will continue to expand, Greenwich Associates expects their rate of growth to slow to levels more sustainable over a long-term horizon. “The unfolding nonperforming loan crisis in India provides a clear demonstration of the need for prudence not just for public sector banks but among these emerging banks as well,” says Gaurav Arora. “A gradual slowdown in the pace of expansion could actually be viewed as a positive indication that these banks are being cautious and resisting the urge to maintain growth rates by lending aggressively.”

On the other hand, Greenwich Associates expects growth to continue accelerating among India’s “New Generation” banks. Albeit from a small base, upcoming banks like RBL, IDFC, Lakshmi Vilas, etc., are likely to increase their penetration within this segment. Banks such as IDFC, which offers companies a digital approach to transaction banking, provide examples of how these new banks are using agile technology platforms, strategic focus and nimbleness to allow them to win corporate relationships.

The NPL Challenge

Competition among Indian banks is playing out against the backdrop of a looming nonperforming loan (NPL) issue. Recent actions by RBI have forced banks to recognize huge amounts of previously undisclosed nonperforming loans. State Bank of India alone has recognized $17.2 billion in bad loans, resulting in a NPL ratio of 6.9% as of March 2017.

Leading private banks, including the likes of Axis and ICICI, have been forced to recognize and write down sizable nonperforming loans portfolios. More recently, Yes Bank announced that the RBI has pegged the value of its nonperforming loans at $769 million—much higher than previous estimates. Nevertheless, private banks generally report lower NPL ratios than their public sector counterparts. And over the past 24 months, private sector banks have moved relatively quickly to address the NPL issue by selling off assets and taking the required hits to their balance sheets. Although the issue is by no means eliminated, many of these banks have made fast progress. With their balance sheets slowly getting back in shape, they are again positioned to focus on growth.

Although private banks still have work to do in cleaning up their balance sheets, going forward the NPL issue could actually act as a tailwind for private bank growth. The reason: The burden of bad loans could fuel further consolidation in the public sector, potentially freeing-up middle-market corporate-banking relationships and creating new opportunities for private banks. “Non-performing loans are just one driver, and we expect to see much additional consolidation among public sector banks in coming years,” says Paul Tan.

Greenwich Associates Head of Asia Pacific Paul Tan and Head of India Banking Gaurav Arora specialize in Asian corporate banking and treasury services.

MethodologyFrom September 2016 to January 2017, Greenwich Associates conducted interviews with 312 Indian middle-market businesses and asked them to name the banks they use for a variety of services including corporate lending, cash management, trade services and finance, foreign exchange, structured finance, interest-rate derivatives, and investment banking. Study participants were then asked to rate their banks in 14 product and service categories.