Table of Contents

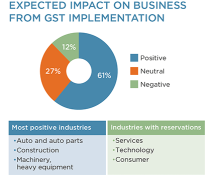

Approximately 60% of Indian middle-market companies expect the implementation of the national Goods and Services Tax to have a positive impact on their businesses.

The government of India expects the GST to take effect on July 1, 2017. The new tax will replace the patchwork of indirect taxes currently levied by the central and state governments. As part of its 2017 Indian Middle-Market Banking Study, Greenwich Associates asked 213 Indian companies about how they anticipate the new tax regimen will affect their businesses.

Sixty-one percent of companies in the study expect the new tax to have a positive impact on their business by lowering costs and their administrative and compliance burdens. An executive from an Indian engineering firm says the shift from the old tax system to the new GST will make it easier for his firm to do business across states. “It will ease the movement of goods,” he says. An executive from an Indian cement supplier agrees. “GST will reduce the cascading effect of taxes on the cost of goods and services,” he observes. “It could result in improvement in cash flows and inventory costs.”

Only 12% of respondents expect the GST implementation to negatively impact their businesses, with the remainder being neutral. Many of the companies projecting a negative impact cite the accounting and compliance challenges associated with the transition from one tax framework to another, along with fears of an increase in the overall tax burden or other costs.

“It will be very hectic and complicated to operate in terms of maintaining data on the old system and new GST for sales and purchases,” says an executive of an Indian gas company. “[The new tax] will lead to an increase in prices of raw materials and consumables,” contends an executive of an Indian educational publishing house. “Hence, it will have an inflationary pressure on our cost of materials.”

The most positive outlooks are found among companies in logistics-heavy industries and companies whose businesses cross Indian state borders, which will benefit from reduced paperwork and no longer having to navigate multiple state tax regimens. The industries most optimistic about the impact of the GST include autos/auto parts, construction, machinery, and heavy equipment.

Companies Looking to Banks for Help

The shift to the new GST provides an opportunity for banks to strengthen relationships with their clients and win relationships with new companies. Banks can provide critical advice on how to manage the transition to the GST from a procedural and documentary compliance perspective. This includes leveraging their own in-house expertise to help companies interpret aspects of the new law that are less clear in their meaning. Finally, corporates are increasingly considering bank-led technology as an enabler to reduce tax and documentary hurdles.

The companies participating in the Greenwich Associates study made clear that they looking to their banks for help in managing the transition:

- “[Our banks] can help us handle the burden of increased procedural and documentary compliance. The number of returns and information will increase significantly.” ~ Indian IT company

- “[Banks] are technologically advanced, and they will be the leaders in changing their online tools in line with the GST guidelines, while others will follow suit.” ~ Indian chemical company

- “We rely on our banks for updated information with regard to taxation and upcoming GST policies.” ~ Indian agricultural company

Greenwich Associates Head of Asia Pacific Paul Tan and Head of India Banking Gaurav Arora specialize in Asian corporate banking and treasury services.

MethodologyFrom September 2016 to January 2017, Greenwich Associates conducted interviews with 213 Indian middle-market businesses and asked them about how they expected the new tax regimen to affect their businesses.