Table of Contents

With the implementation of MiFID II just months away, equity brokers and institutional investors in Europe have been holding fast to their “wait-and-see” approach to what could be revolutionary change to their business when new rules on payments for investment research take effect at the start of 2018.

The stakes are high for global, regional and specialist brokers. To put the European equities market into context, the Greenwich Associates universe of 340 European institutional equity investors generated an estimated $2.9 billion in cash equity commissions for the 12 months ended Q2 2017. Of that amount, 46% was used to compensate brokers and other providers for equity research and advisory services.

Those numbers suggest the market for European equity research and advisory services is worth at least an annual $1.35 billion to the Street. “Capturing a share of that revenue is more important than ever for brokers, since both the total amount of commissions generated on European equity trades and the proportion of that total used for research are shrinking,” says Greenwich Associates consultant Satnam Sohal.

Despite that building pressure, things are remarkably stable in the industry at the moment. Brokers are waiting to see how large institutional investors will alter their research consumption and payment practices, while investors are sounding out brokers on how they will price their research and advisory services under the new regime. The list of 2017 Greenwich Share and Quality Leaders in European Equity Research/Advisory and European Equity Trading reveal no obvious signs of MiFID-induced upheaval. Rather, the list of Greenwich Leaders is generally consistent with that from 2016, with the few notable changes in position attributable to the performance of individual brokers, as opposed to any shifts in strategy in advance of MiFID II.

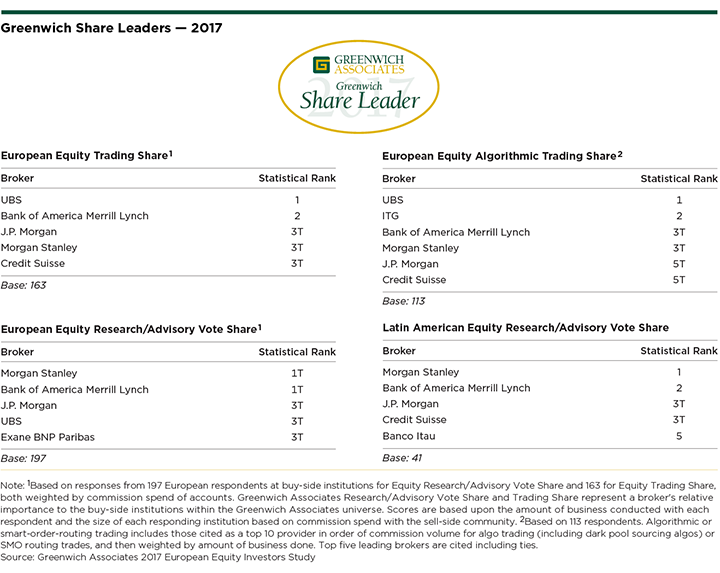

Greenwich Share Leaders

In fact, the roster of 2017 Greenwich Share Leaders℠ in European Equity Trading is virtually identical to that from last year, with first-place UBS, second-place Bank of America Merrill Lynch and third-place co-winners J.P. Morgan, Morgan Stanley and Credit Suisse all retaining their positions from 2016.

While there was a bit more shuffling of position year-to-year among the Greenwich Share Leaders in European Equity Research/Advisory, all the brokers on the 2017 list also made an appearance in 2016, including Morgan Stanley and Bank of America Merrill Lynch, which are currently tied at the top of the market, and J.P. Morgan, UBS and Exane BNP Paribas, which are statistically tied in terms of the institutional “Advisory Vote Share.”

“Any shake-up will likely come at the beginning of 2018,” says Greenwich Associates Managing Director Jay Bennett. “People are holding off strategic decisions until they get a better idea of how this will play out. Right now, there is a scramble among brokers for insight and data about how investor behavior will change under the new rules—and vice versa.”

Greenwich Quality Leaders

As MiFID II forces the market closer to an “unbundled” structure, research providers will be forced to compete for customers more directly, based on the quality of the research and advisory services they deliver. Firms that achieve the title of Greenwich Quality Leader in this business should be well positioned to compete under that new model. The 2017 Quality Leaders in European Equity Research and Analyst Service are Bank of America Merrill Lynch, Exane BNP Paribas, J.P. Morgan, Morgan Stanley, and UBS. The following chart shows the full list of 2017 Greenwich Quality Leaders℠.

Greenwich Associates asked the 362 institutional investors participating in the 2017 European Equity Investors Study to name the brokers and providers they use for trade execution and research and advisory services, to estimate the share of their businesses allocated to each broker and provider, and to rate the quality of these sell-side firms in a series of product and service categories. Brokers and providers that received client ratings topping those of competitors by a statistically significant margin are named Greenwich Quality Leaders.

Determining the Future Economics of Equity Research

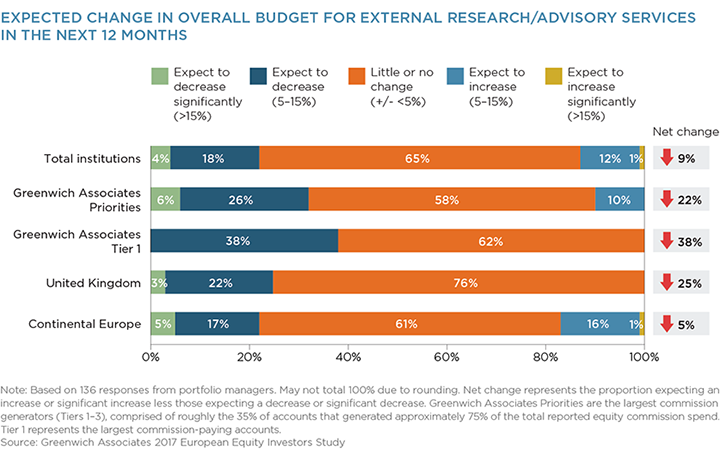

According to the results of a recent study conducted by Greenwich Associates to help its clients gain insight into these issues, the majority of institutional investors in continental Europe and the United Kingdom do not expect to change their research budgets in the coming year. However, a meaningful minority of the biggest institutional investors in the market—between 20% and 25%—do expect to reduce their research spend during that period.

A host of variables will determine the economics of the European equity brokerage and research industry in the years to come, including:

- Will investors curtail their use of sell-side research and advisory services under the new rules?

- How will investors pay providers for research and advisory services?

- Will research payments gravitate to “hard dollar” payments from fund managers or regulated commission payments executed through so-called “enhanced CSA/RPAs”?

- Will institutions adopt the “Swedish model” and bill clients directly for sell-side research employed on their behalf or absorb these costs by paying out of their own P&L?

In its special study on the impact of MiFID II, Greenwich Associates attempted to answer these and other questions by interviewing 164 buy-side European equity traders and 198 portfolio managers across the U.K. and Continent. Interviews were conducted in Q2 2017.

Consultants Jay Bennett, John Colon, John Feng, Thomas Jacques, and Satnam Sohal advise on the institutional equity markets globally.

MethodologyFrom March to May 2017, Greenwich Associates interviewed 198 portfolio managers and 164 traders at European institutions about the research, sales and trading services they receive from their brokers. These portfolio managers and traders were also asked about current market practices, trends and compensation.