Finding an edge in today’s hypercompetitive markets is no easy task. Tens of thousands of investment firms globally, staffed by experienced portfolio managers and the sharpest new graduates, consume terabytes of data each day in search of ideas and signals that will help them beat the market. Increasingly, this search for alpha is centered around alternative data.

The growing popularity of the alternative data approach has driven the creation of a new industry segment—a combination of firms that own unique data sets and other firms that aggregate and resell these alpha-enhancing data sets. The industry segment is still very young, with most companies operating for less than 10 years, but growing rapidly, with no ceiling in sight.

In this Greenwich Associates research, we investigate the changing size of the alternative data market, identify the leading companies in the space and examine the evaluation process for these data sets.

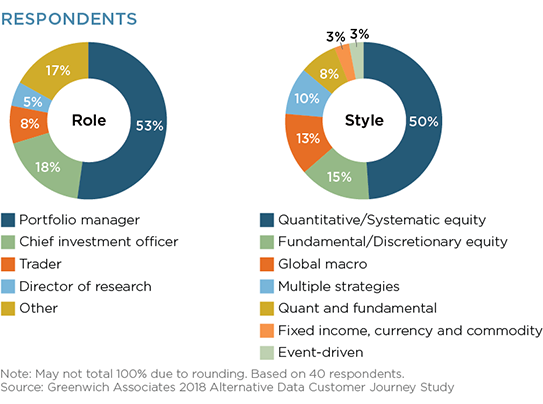

MethodologyBetween March and May 2018, Greenwich Associates interviewed 40 investment management executives around the world at institutional asset managers, hedge funds and proprietary trading firms, seeking to understand their usage of alternative data. A series of quantitative and qualitative questions were asked, covering the types of data sets used, budgets, and the purchase and evaluation process.