Recent revelations of impropriety at certain dark pools have made traders more diligent in assessing the design, liquidity and protections offered by competing venues.

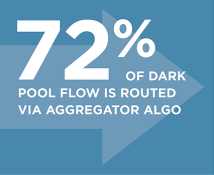

In certain cases, these considerations lead traders to send trading volume directly to a particular dark pool. In most cases, however, traders utilize algorithms that aggregate trades and direct them to the dark pools that will deliver the best outcomes.

This Greenwich Report does a deep dive into the world of dark pools, identifying the different types of venues in operation, analyzing their features, strengths and weaknesses, and ranking some of the market’s biggest dark pools in a series of categories critical to investors.

MethodologyFrom June to November 2016 Greenwich Associates interviewed 85 North American buy-side traders to learn more about their usage of dark pools.