Transaction cost analysis (TCA) has been around in some form for over three decades.

Pioneers in the space (e.g., Plexus Group, now known as Zeno Consulting) originally focused on targeting the product to plan sponsors, allowing them to evaluate the trading performance of asset managers. Others, such as Abel Noser, got into the TCA business as they sought to demonstrate their own trading desk’s execution quality.

Despite the relative maturity of TCA, the market is still highly competitive, with many companies seeking to displace the incumbent providers. To have a chance at winning this business, vendors need to focus on functionality around venue analysis, integration with order and execution management systems, and peer comparison analytics.

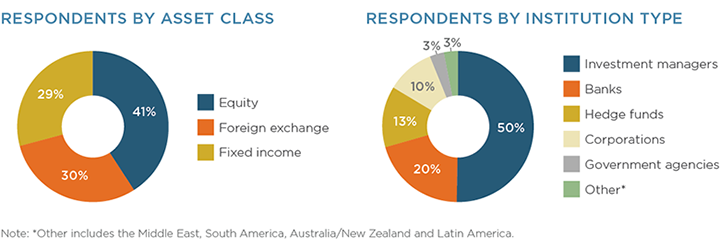

MethodologyFrom June through November 2016, Greenwich Associates interviewed 270 buy-side traders across the globe, working on equity, fixed-income and foreign-exchange trading desks. Topics included trading desk budget allocations, trader staffing levels, OMS/EMS/TCA platform usage, and the impact of market structure changes on the sector.