Exchange-traded funds continue to attract new institutional users and assets in Asia, driven by significant growth among asset managers, institutional funds and insurance companies. The results of the Greenwich Associates 2016 Asian ETF Study reveal a steady increase in ETF allocations among existing institutional users in the region and the continued entrance of new users, as more institutions make their initial forays into ETF investing.

Fueling this growth in Asia—and indeed around the world—is institutions’ continued adoption of ETFs for an expanding list of functions within their portfolios. Most Asian institutions started investing in equity ETFs, often in U.S. and international equites. Within these markets, most early Asian users employed ETFs as an efficient and cost-effective means of obtaining core strategic investment exposures. In relatively short order, institutions began using ETFs to gain strategic exposures in other equity markets and in fixed income and other asset classes.

While many Asian institutions view ETFs primarily as a means of obtaining strategic exposures, the results of the 2016 study show they are broadening their use into portfolio applications ranging from strategic priorities like portfolio diversification, liquidity management and risk management to shorter-term tasks such as making tactical adjustments to portfolios, taking on interim beta, and cash equitization.

This advance of ETFs into new areas and applications will continue to drive growth in both equities and fixedincome. Forty-four percent of fixed-income ETF investors plan to increase allocations to bond ETFs. Half of current equity ETF investors in the study say they plan to increase allocations to these funds in the year ahead, with the majority of those expecting increases of more than 10%.

Several additional findings from the 2016 study suggest that the pace of ETF growth in Asia could actually accelerate in coming months. Among the most significant:

- Increasing volatility and rising rates should stimulate fixed-income ETF use. Asian institutions say they employ ETFs largely because they are easy to use, offer quick access and provide liquidity benefits. These characteristics become ever more valuable during periods of volatility. In particular, institutions with plans to increase allocations to fixed-income ETFs cite expectations for a shift in the interest-rate environment as the primary reason they plan to step up their use of bond ETFs.

- Multi-asset funds are accelerating demand for ETFs. Consistent with a global trend, Asian asset managers are building multi-asset funds using ETFs. Well over half of the asset managers in the study incorporate ETFs in their multi-asset funds, and some will use ETFs for more than 80% of the assets in the fund.

- Smart beta ETFs are gaining ground. Use of non-market-cap weighted/smart beta ETFs has nearly doubled in the past 12 months as the range of fund types used expanded. Looking ahead, 54% expect to increase their allocations to smart beta even further with investments in dividend/equity income, sector smart beta, smart beta commodities, and smart beta fixed income, among other categories.

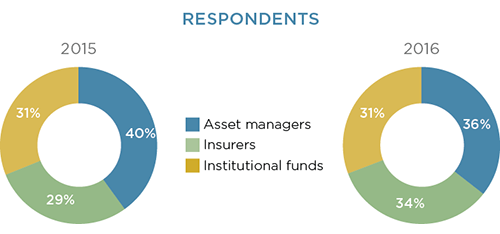

Between October and December 2016, Greenwich Associates interviewed 59 Asian institutional investors for its 2016 Asian Exchange-Traded Funds Study. Insurance companies and asset managers make up the largest proportion of study participants, with the remainder composed of a diverse mix of family offices, commercial and trust banks, corporate defined benefit and defined contribution plans, and central banks.

Most of the participants are large institutions. Forty-two percent of the institutions in the study have AUM of $5 billion or more, and about a quarter manage more than $20 billion. Relative to institutions in other parts of the world, these investors manage sizable shares of their assets in-house. Across all Asian institutions in the study, nearly 60% of assets are managed internally.