Table of Contents

Amid the many changes in regulations and technology unfolding in global fixed-income markets in 2016, one thing remained the same: Citi is at the top.

With a market share topping 10% across all fixed-income products around the world, Citi ranks as the number-one dealer on the list of 2016 Greenwich Share Leaders in Overall Global Fixed Income.

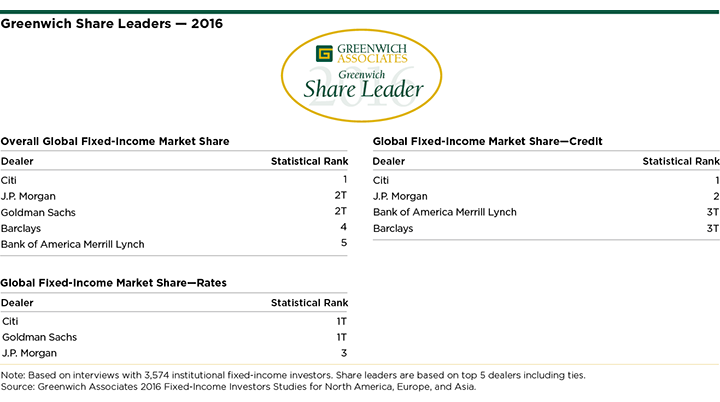

In terms of market share, Citi is followed by J.P. Morgan and Goldman Sachs, which tie for second place, then Barclays in fourth place and Bank of America Merrill Lynch in fifth. These firms are the 2016 Greenwich Share Leaders in Overall Global Fixed Income. Citi also claims the title of 2016 Greenwich Quality Leader in Overall Global Fixed-Income Service.

2016 Global Greenwich Share Leaders

Citi has achieved its current position of leadership through strength in both Rates and Credit products. In Rates products, Citi is tied with Goldman Sachs as the leading dealers in global market share, followed by J.P. Morgan. Citi holds the top spot on its own in Credit products, followed by J.P. Morgan with Bank of America Merrill Lynch and Barclays tied for third.

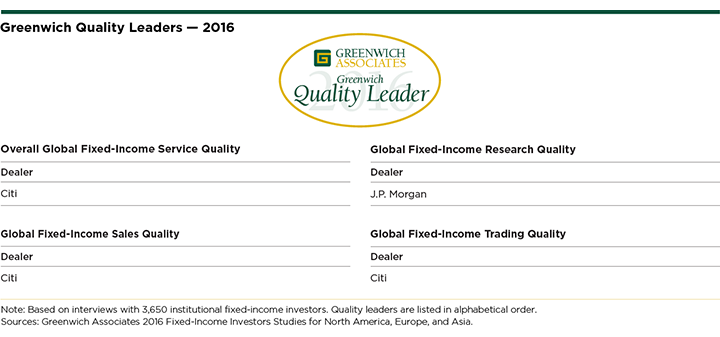

2016 Global Greenwich Quality Leaders

Citi is the Greenwich Quality Leader in Overall Global Fixed-Income Service. J.P. Morgan is the 2016 Greenwich Quality Leader in Global Fixed Income for Research and Citi earned the top spot in Sales and Trading.

In 2016, Greenwich Associates interviewed over3,500 institutional investors globally. Investors were asked to name the dealers they use for specific fixed-income products in each major market, and to rate the quality of service these dealers provided. Dealers receiving quality ratings topping those of competitors by statistically significant margins are named Greenwich Quality Leaders.

Consultants Andrew Awad, James Borger, Woody Canaday, Frank Feenstra, John Feng, Thomas Jacques, Peter Kane, Tim Sangston, Satnam Sohal, and David Stryker advise on the institutional fixed-income markets.

MethodologyInterview topics included service provider assessments, trading practices, market trend analysis, and investor compensation.

Asia (ex-Japan)

Between May and July 2016, Greenwich Associates conducted 815 interviews with fixed-income investment professionals at domestic and foreign banks, private banks, investment managers, insurance companies, hedge funds, corporations, central banks, and other institutions throughout Asia (ex-Japan). Countries and regions where interviews were conducted include Australia/New Zealand, China, Hong Kong/Macau, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Sri Lanka, Taiwan, and Thailand.

Americas

Between February and May 2016, Greenwich Associates conducted in-person interviews with 104 institutional fixed-income investors in Canada, 1,302 in the United States and 168 in Latin America.

Europe

Between May and July 2016, Greenwich Associates conducted 1,128 interviews with senior fixed-income investment professionals at banks, fund managers/advisors, insurance companies, corporations, central banks, hedge funds and other institutions throughout Europe. Countries where interviews were conducted include Austria, Belgium, Denmark, Finland, France, Germany, Greece, Italy, Luxembourg, Malta, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, the United Kingdom, and select interviews conducted in Central & Eastern Europe and the Middle East.

Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results.