Table of Contents

Dramatic changes to the U.S. fixed-income market have left many investors worried about their ability to access liquidity. These concerns—combined with changes in the business strategies of some of the leading banks, expanded counterparty lists and willingness to trade more electronically—could free up market share in trading in coming years and significantly alter the competitive landscape of fixed-income dealers.

With new capital rules making the economics of fixed income less favorable for banks, dealers have cut back on the amount of capital allocated to the business. The most high-profile aspect of this move has been a reduction in dealer bond inventories, which have become much more expensive to maintain. At the same time, banks have become increasingly selective about when and to whom they will allocate capital to support trades.

These changes have caused a substantial decrease in market liquidity that has made it much more difficult for clients to execute large trades. The problem is most acute for smaller market participants, some of whom have been converted to low-touch service as clients by dealers who deem them as not having sufficient profit potential. Banks also have reduced fixed-income costs through more traditional cost-cutting measures. From the buy side’s perspective, this process has disrupted relationships, with high levels of turnover and the “juniorization” of key sales and trading roles.

The by-product of these changes, which are still unfolding as banks implement and execute their revised fixed-income strategies, is a growing number of buy-side institutions concerned about their ability to source essential liquidity and consistent sell-side coverage. “These concerns could open up opportunities for smaller players with a more narrow product focus,” says Greenwich Associates consultant Jim Borger.

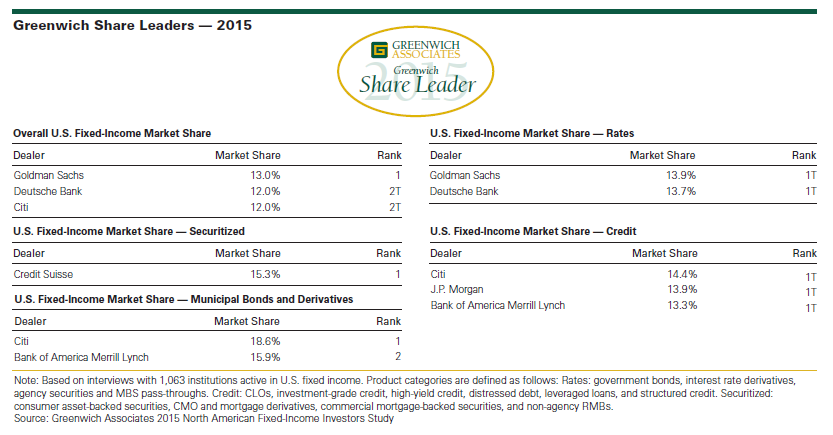

Greenwich Share Leaders

The list of Greenwich Associates 2015 Share and Quality Leaders is led by Goldman Sachs, which has a market share in overall U.S. fixed-income trading of 13.0%, followed by Deutsche Bank and Citi, which are tied with market shares of 12.0%.

A look at the Greenwich Leaders in specific fixed-income products reveals the sharp differences that have emerged in dealers’ strategic priorities. For example, Goldman Sachs’ and Deutsche Bank’s focus on rates products has propelled those firms into a tie at the top and are the 2015 Greenwich Share Leaders in that product category with market shares of 13.7% to 13.9%.

The picture changes in credit products, where the list of 2015 Greenwich Share Leaders is composed of Citi, J.P. Morgan and Bank of America Merrill Lynch, which are tied with market shares of 13.3% to 14.4%. Credit Suisse’s focus on securitized products has helped the firm secure the No. 1 spot by building a 15.3% market share, putting it well ahead of any other dealer.

The 2015 Greenwich Share Leaders in U.S. Municipal Bonds and Derivatives are Citi, with a market share of 18.6%, and Bank of America Merrill Lynch with a market share of 15.9%.

“Churn in client relationships is also creating opportunity for firms that aren’t Greenwich Share Leaders,” says Greenwich Associates consultant David Stryker. “At the top of that list is Wells Fargo, which has built significant momentum in terms of market share.”

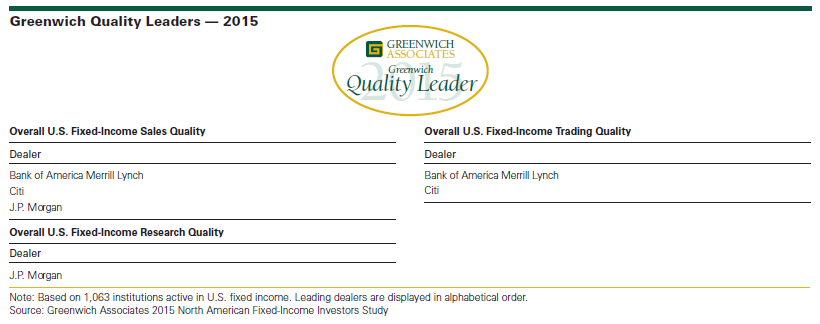

Greenwich Quality Leaders

At a time when many investors are experiencing turnover and “juniorization” in their sell-side coverage and having increasing trouble finding liquidity and completing trades, dealers that deliver high-quality service have the opportunity to stand out and win business.

Greenwich Associates asked the 1,063 investors participating in its 2015 U.S. Fixed-Income Investors Study to name the dealers they used in a range of fixed-income products and to estimate the amount of trading business allocated to each dealer. Investors were also asked to rate the quality of these dealers in a series of product and service categories. Dealers that received quality ratings topping those of competitors by a statistically significant margin were named Greenwich Quality Leaders.

The 2015 Greenwich Quality Leaders in U.S. Fixed-Income Sales are Bank of America Merrill Lynch, Citi and J.P. Morgan, and and this year’s Greenwich Quality Leader in U.S. Fixed-Income Research is J.P. Morgan. In U.S. Fixed-Income Trading, the 2015 Greenwich Quality Leaders are Bank of America Merrill Lynch and Citi.

Consultants Frank Feenstra, Woody Canaday, Andy Awad, James Borger, and David Stryker advise on fixed-income markets in the United States.

MethodologyBetween February and April 2015, Greenwich Associates conducted 1,063 interviews with institutional investors active in fixed income in the United States. Interview topics included trading and research activities and preferences, product and dealer use, service provider evaluations, market trend analysis, and investor compensation.

The findings reported in this document reflect solely the views reported to Greenwich Associates by the research participants. They do not represent opinions or endorsements by Greenwich Associates or its staff. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results.

© 2015 Greenwich Associates, LLC. Javelin Strategy & Research is a division of Greenwich Associates. All rights reserved. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, Greenwich ACCESS™, Greenwich AIM™ and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.

The Greenwich Quality LeaderSM and Greenwich Share LeaderSM designations are determined entirely by the results of the interviews described above and do not represent opinions or endorsements by Greenwich Associates or its staff. Such designations are a product of numerical scores in Greenwich Associates’ proprietary studies that are generated from the study interviews and are based on a statistical significance confidence level of at least 80%. No advertising, promotional or other commercial use can be made of any name, mark or logo of Greenwich Associates without the express prior written consent of Greenwich Associates.