Based on interviews with 46 bond dealers in the U.S. and Europe, this study examines the differences in how bulge bracket and regional dealers are adapting to the post-crisis market structure. The research analyzes the current competitive landscape for:

- Bond dealers utilizing Greenwich Associates market share estimates

- Penetration of regional dealers among top-tier buy-side clients

- How sell-side bond dealers differentiate

- Bond dealers’ biggest obstacles to growth going forward

- The impact that electronic trading has had on both bulge bracket and regional dealers around the world

Overview

Bond-dealing desks are different than they once were. Phones are used less, computers more, and compliance requirements are now handled with the highest priority—all while technology budgets and headcounts have been reduced. But as we edge closer to the 10-year anniversary of the credit crisis, global and regional dealers alike are finding their place in the new market structure.

Whereas the bulge bracket collectively has scale and technology, regional dealers have doubled down on the sector and the region-specific expertise they bring to their clients.

Similarly, the buy side continues to trade the majority of their bonds with the biggest dealers. But the list of market specialists with which they trade has grown, proving local focus and relationships still thrive in this era of Amazon.com.

To that end, understanding the fixed-income dealer competitive landscape requires nuanced knowledge of what the buy side needs and how the sell side is adapting to provide those services. And have no doubt, the sell side is, in fact, adapting.

Charts/Data Included

- Corporate Bond Dealer Market Share Concentration

- Percentage Of Buy Side Trading With Non-Bulge Bracket Dealers

- Differentiating Factors For Sales/Trading Desks

- Challenges To Success In The Coming Year

- Changes To Composition Of Trading Desks Over Past Year

- Changes To Provision Of Liquidity In Corporate Bond Market Over Past Year

- Changes To Number Of Clients In Last Two Years (Bulge Bracket Vs. Regional Dealers

- Top Skillsets To Add To The Trading Desk In Coming Year

- Average Age And Level Of Experience On The Trading Desk

- Perception Of The Growth Of Electronic Trading*

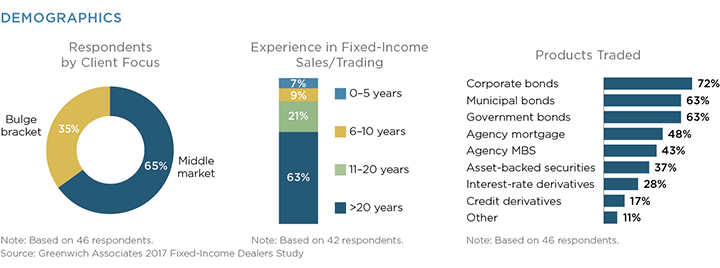

In the second quarter of 2017, Greenwich Associates interviewed 46 fixed-income traders and sales professionals at sell-side organizations in the U.S. and Europe in an effort to understand the changes facing their business models and careers. Participants included both global and regionally focused banks, with individuals comprising a mix of traditional voice sales and those focused on e-commerce initiatives.