Table of Contents

U.S. fixed-income markets remain in a transitional period between the now long-defunct pre-crisis model and whatever comes next.

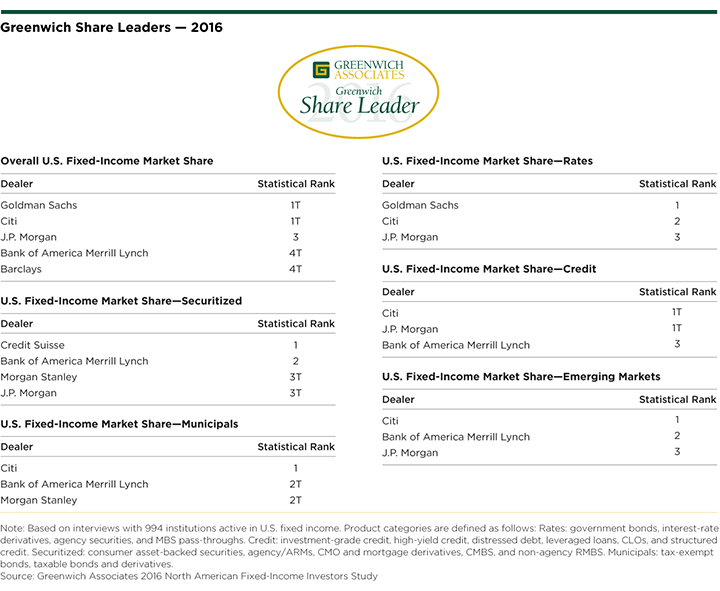

Greenwich Associates asked 1,302 investors at the 502 institutions participating in its 2016 U.S. Fixed-Income Study to name the dealers they use in a range of fixed-income products and to estimate the amount of trading business allocated to each dealer. Investors were also asked to rate the quality of these dealers in a series of product and service categories. Dealers that received quality ratings topping those of competitors by a statistically significant margin were named Greenwich Quality Leaders℠.

Citi is the 2016 Greenwich Quality Leader in Overall U.S. Fixed-Income Service as well as in U.S. Fixed-Income Sales Quality and Trading Quality. J.P. Morgan is the 2016 Greenwich Quality Leader in U.S. Fixed-Income Research.

The Greenwich Associates list of 2016 Share Leaders in U.S. Fixed Income is composed of familiar names, with Goldman Sachs and Citi tied at the top in terms of market share across all products, followed by J.P. Morgan in third place and then a tie for fourth between Bank of America Merrill Lynch and Barclays. These firms are the 2016 Greenwich Share Leaders℠ in Overall U.S. Fixed Income.

However, the period of transition in fixed income persists as banks continue to adjust their strategies to accommodate regulations put in place since the global financial crisis.

Regulatory Impacts

The primary effect of these new rules has been the sharp reduction in the inventories used by fixed-income dealers to provide liquidity. In step with that contraction, dealers that once fought for trading market share across fixed income are now carefully picking their spots in terms of both the products in which they compete and the clients they will service. These changes have caused swings in the competitive landscape in secondary trading, with some dealers ceding market share and others gaining.

For clients, strategic shifts on the part of dealers have dramatically cut back on available liquidity. Ninety percent of U.S. investment-grade and high-yield credit investors and two-thirds of U.S. Treasury investors say a lack of liquidity is having an impact their ability to trade or implement their investment strategies.

Some Investors have also complained about a deterioration of service quality from certain dealers. While part of this is ascribed to reduced capital and fewer people on sell-side desks, some is attributed to numerous banks’ decisions to reduce or even eliminate resources devoted to clients deemed too small or not sufficiently profitable.

New Strategies Around Liquidity

Institutions feeling the impact of these changes have been forced to come up with new strategies to obtain needed liquidity. Many institutions are doing more of their business with the remaining dealers that offer one-stop shopping. This trend has indeed led to a long-term increase in aggregate market share for the U.S. market’s top three dealers, which over the 12 months covered in the 2016 Greenwich Associates study captured 38% of overall trading volume (compared to 33% in 2013).

While investors are doing what they can to remain important clients to these larger banks, they are also doing meaningful business with a longer list of counterparties. Among the competitors moving up the ranks of buy siders’ counterparties lists are firms that demonstrate a commitment as liquidity providers, as well as up-and-coming firms that have hired top-name talent from the thinning ranks of bulge-bracket fixed-income departments.

Included in the group of dealers establishing new trading relationships are Jefferies, Nomura, RBC Capital Markets, and Wells Fargo. "Clients are interacting a lot more with these banks, and they’re grateful to have additional sources of liquidity. Plus, a lot of the people at these banks are folks they’ve known for a long time from their tenures at other shops," says Greenwich Associates Managing Director James Borger.

Greenwich Associates Managing Director Frank Feenstra notes that given the changes still unfolding in the market, it is too soon to tell exactly what the competitive landscape will look like in the months and years ahead. He concludes: "As institutional trading volume shifts among dealers and new market entrants, Greenwich Associates estimates that over $1 trillion in notional trading volume is up for grabs."

Consultants Frank Feenstra, Woody Canaday, Andy Awad, James Borger, and David Stryker advise on fixed-income markets in the United States.

MethodologyBetween February and May 2016, Greenwich Associates conducted 1,302 interviews across 502 institutions with investors active in fixed income in the United States. Interview topics included trading and research activities and preferences, product and dealer use, service provider evaluations, market trend analysis, and investor compensation.