In 2015 Greenwich Associates research found that the top five FX dealers, while still dominant, were ceding market share to regional and smaller firms. This shift was driven predominantly by top-tier dealers prioritizing more profitable clients and by the continued adoption of multi-dealer platforms by global FX investors. Two years, Brexit and a surprise U.S. election later, our latest research has found that these trends have continued.

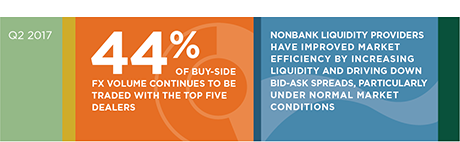

While the percentage of trading the buy side does with the top five dealers remains notably large at 44%, it has continued its decline from a peak of 53% in 2013, with regional dealers stepping up their game and, to a lesser extent, principal trading firms entering the fray. This now makes the FX market one of the least concentrated among over-the-counter markets, which provides welcome diversity for financial end-users, regulators and emerging dealers.

MethodologyGreenwich Associates conducted interviews with 2,393 users of foreign exchange globally, of which 1,536 are top-tier accounts, at large corporations and financial institutions on market trends and their relationships with their dealers.

To be considered top tier, a firm must be either a central bank, a government agency, a hedge fund, a fund manager, a FT100 global firm, a firm with reported trading volume of more than $10 billion, or a firm with reported sales of more than $5 billion. Interviews were conducted in North America, Latin America, Europe, Asia, and Japan between September and November 2016.