Nearly every major market has seen electronic trading grow over the past decade. Some have seen an organic transformation, while others have had their hand forced by new regulations.

Regardless, the move to the screen has transformed the way in which the sell side services their institutional clients.

Despite the growing importance of e-trading and technology, the human touch is as important as ever. As clients look to their broker/dealers for an increasing array of services, simply acting as an order taker is no longer enough to ensure return business.

Today’s sell-side sales desk must provide proactive suggestions, understand market structure and offer clients advice on how to best leverage trading technology.

MethodologyDuring the months of December 2015 and January 2016, Greenwich Associates conducted telephone interviews with 20 professionals at sell-side firms to understand how how sell-side sale desks are evolving in today’s market.

Respondents were asked about the size and composition of the desk, the impacts of regulations and how the role of the sales trader has changed.

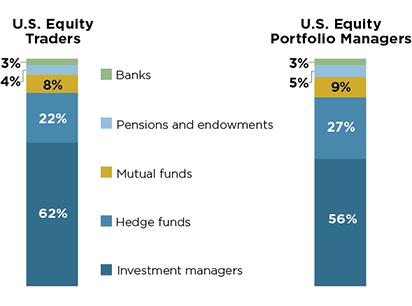

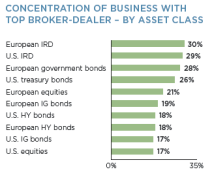

This paper also includes data based on in-person and telephone interviews regarding U.S. equity investing with 243 U.S. equity portfolio managers and 321 U.S. equity traders conducted in 2015. Respondents answered a series of qualitative and quantitative questions about the brokers they use and their businesses in the U.S. cash equity space.