Primary Dealers Role in the Bond Market Evolving

September 19, 2023

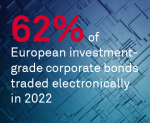

The biggest U.S. bond dealers are maintaining the bulk of their market share while morphing into bond brokers who facilitate trades without putting their own capital on the line.