The most effective thought leadership in asset management takes the form of short, punchy content, focusing on economic insights and investment ideas, delivered by email, on a weekly or monthly basis.

Press Releases

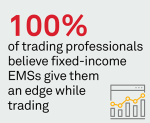

Fixed-Income Markets Approach a Tipping Point for EMS

June 20, 2023

The growing complexity of fixed-income market structure is accelerating the adoption of execution management systems (EMSs) that help traders navigate a market that is only partially electronic, fragmented and flooded with inconsistent data.

The combination of increasing demand for Latin American bonds from both international and local investors and continued technology innovation is driving rapid growth of electronic trading in Brazil, Mexico and other major Latin American markets.

Although the U.S. banking industry has, at least until now, avoided a much-feared run on small banks, steady deposit outflows are increasing funding costs for banks of all sizes and driving up the price of commercial loans.

Can AI Turn Bond Trading from Art to Science?

June 6, 2023

Artificial intelligence (AI) and machine learning (ML) are transforming the way investors trade highly liquid fixed-income products like U.S. Treasuries. Over a longer horizon, AI/ML could have an even bigger impact on markets for less liquid and transparent products like mortgage-backed securities, municipal bonds and interest-rate derivatives.

Regulations passed in the wake of the Global Financial Crisis are widely credited with ameliorating many of the most pernicious systemic issues previously inherent in the derivatives market. However, according to market participants, those rules could hurt liquidity and drive up costs.

More than a quarter of the world’s commercial payments and almost 30% of receivables now flow through nonbank or fintech alternative payment platforms.

Financial market firms globally are speaking out against a rule proposal by the U.S. Securities and Exchange Commission that would require more U.S. Treasury and repo market trades to be centrally cleared.

In Volatile Markets, Asset Owners Turn to Investment Consultants for Advice and Support

April 25, 2023

U.S. investment consultants are transforming themselves from curators of recommended asset manager lists into centralized sources of expertise, knowledge transfer and market information.

New Coalition Greenwich Report Examines the Future of Digital Content in Institutional Investing

April 20, 2023

Institutional investors are increasingly using digital media, along with traditional media sources like the Financial Times and the Wall Street Journal.

Pages

Media Contacts

Media Inquiry

Awards

- Investment Consultants Grow in Size and Influence

- 2023 Greenwich Best Brand Awards for U.S. Small Business Banking

- 2023 Greenwich Best Brand Awards for U.S. Middle Market Banking

- 2023 Greenwich Excellence Awards for U.S. Small Business Banking

- 2023 Greenwich Excellence Awards for U.S. Middle Market Banking