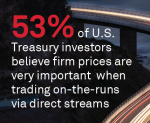

Streaming Prices Underpin U.S. Treasury Market

Greenwich Report

The majority of the U.S. Treasury market is traded electronically.

New

U.S. Treasury market volatility declined in March, with the MOVE Index monthly average at 98.63, 35% below its March 2023 value.

New

U.S. corporate bond activity slowed slightly in March, although it remained elevated on a historic basis.

New

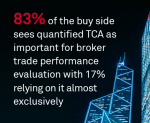

Equities TCA 2024: Analyze This, a Buy-Side View

Greenwich Report

83% of the buy side sees quantified TCA as important for broker trade performance evaluation with 17% relying on it almost exclusively.

New

Stock Market Rally Drives New Demand for Japanese Equity Research

Greenwich Report

Institutional investors are increasing their proportion of spending on Japanese equity research in the face of a long-awaited surge in Japanese stocks.

New

Over the past three years, leveraged loan markets have been on the same roller coaster as the rest of the fixed-income market. The mostly floating rate market was a port in the storm as interest rates rose and drove down bond prices.

March 2020 was the highest volume month in the history of the U.S. Treasury market with the average daily notional volume (ADNV) hitting $944 billion.

Are you wondering if the growth of corporate bond electronic trading in the past decade limits its growth in the next 10 years.

Contact Us

Research Subscription

Greenwich MarketView

Identify market structure trends and changes as they happen with a centralized resource and monthly analysis.