By 2020, Millennials and Generation X will control $30 trillion of investable assets. Millennials’ different attitudes to wealth and expectations of customer experience are commanding major changes within the wealth management industry. Other forces that are uprooting the business models of today’s wealth managers include fintechs challenging incumbents and robo-advisors providing opportunities to automate portfolio allocations.

LinkedIn and Greenwich Associates conducted a study to identify how wealth managers can successfully engage HNW Millennials and Generation X along their customer journey.

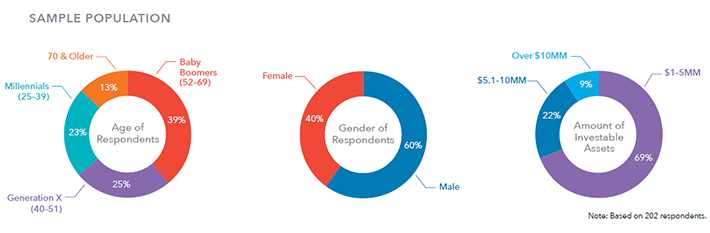

In April 2016, LinkedIn and Greenwich Associates conducted a study of 469 high net worth individuals, focusing on Millennials and Generation X, across the United States, United Kingdom, France and the Netherlands. This report focuses on data gathered from a subset of 202 respondents from across the United States. The 20 minute online survey measured respondent’s use of technology and what they are seeking in wealth managers.

The study targeted Millennials, Generation X, Baby Boomers and 70 years and older. The study further broke down these generations into subgroups of high net worth individuals (HNWIs), which refers to those with investable assets in excess of $1 million, excluding primary residence.

Study Objectives

- Understand HNWI's preferences and behaviors throughout the customer journey.

- Explore how HNWI's perceptions and realities of wealth managers have changed over the past few generations.

- Examine and define the key elements needed to attract HNW Millenials and Generation X and their assets.

- Determine the role emerging technologies play in managing HNWI's assets.