Table of Contents

India’s domestic “private banks” (privately owned) are increasingly matching—or outperforming—foreign banks, when it comes to the quality of service they deliver to Indian companies.

That’s one of the key findings of the Greenwich Associates 2016 Indian Middle Market Banking Study. As part of this inaugural annual study, Greenwich Associates interviewed 185 companies, between INR 500 and 3,000 Crores in annual sales turnover, about their corporate banking relationships. Interviews took place between September and December 2015.

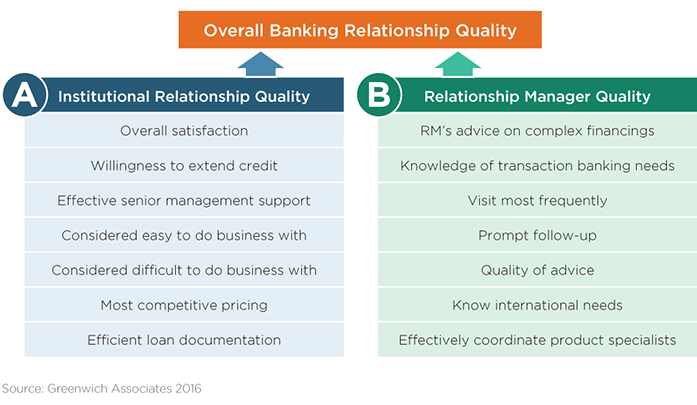

The unprompted (i.e., bank-neutral) study asked each respondent to name the banks they use for a variety of services including corporate lending, cash management, trade services and finance, foreign exchange, structured finance, interest-rate derivatives, and investment banking. Study participants were then asked to rate their deepest banking relationships across 14 “quality” factors, describing the relationship at both an institutional level and specific to the relationship manager.

Market Penetration and Competitive Landscape

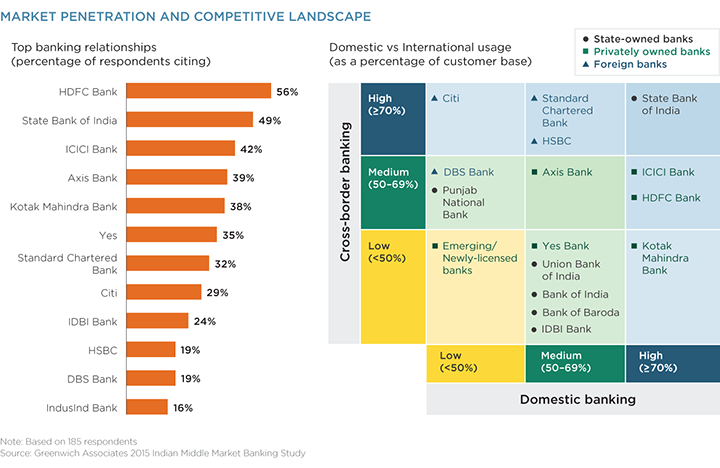

HDFC Bank is the market leader, with some 56%amarket penetration (percentage of respondents citing a relationship with the bank). State Bank of India (SBI) is the only public sector bank (PSU) in the top 12, with half the market acknowledging a relationship with the bank. ICICI Bank, Axis Bank, Kotak Mahindra Bank, and Yes Bank complete the top six, each with 35–42% market penetration.

Standard Chartered Bank, Citi, HSBC, and DBS Bank are the four foreign banks with the highest penetration, ranging from approximately 20–30%. These foreign banks naturally lead with cross-border banking services. StanChart and HSBC, nevertheless, are recognized significantly for domestic banking services.

HDFC and ICICI Bank are gaining increasing recognition for cross-border banking services, while SBI leads the pack—most notably in terms of cross-border trade finance. Greenwich Associates Head of India Banking, Gaurav Arora, notes, “India’s ‘national champions’ are upping their game with mid-to-large companies, going beyond their domestic and credit-centric banking needs.”

Client Assessment of Banking Relationship Quality

Market penetration alone is hardly the end-goal of wholesale banking. Greenwich Associates research centers on some 14 metrics of banking relationship quality. These capture corporates’ comparisons of their relationships with their closest banks across “institutional” elements and attributes of the relationship manager (i.e., coverage banker).

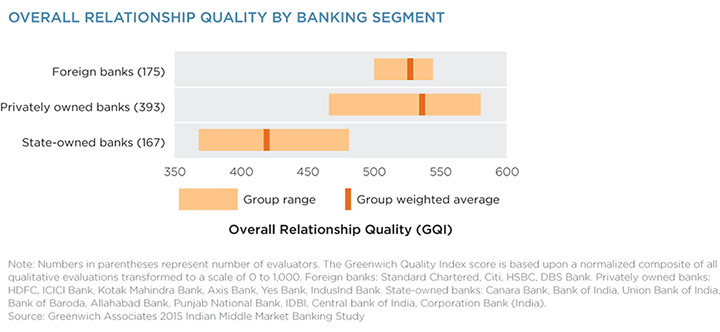

Through these metrics in aggregate, Greenwich Associates observes a clear differentiation in client perceptions of relationship quality. While the foreign banks form a relatively tight group with consistently high quality, the privately owned banks show increasing ability to compete with foreign banks on “quality.”

Greenwich Associates Head of Asia Pacific, Paul Tan comments, “We hear foreign banks acknowledge the sophistication and service quality that Indian’s leading privately owned banks are bringing to market. This has translated to leading Indian banks increasingly winning over larger corporate relationships—and even some western multinational subsidiaries—which were previously dominated by global or foreign banks.”

SBI stands out among the PSUs as the best-performing state-owned bank. SBI’s quality ratings rank it at the top end of PSUs, hence within the lower quartile of privately owned banks. Greenwich Associates sees strong headroom for state-owned banks to follow the lead of privately owned banks.

“In the past, state banks’ links to Indian companies were secured by strong lending relationships,” says Gaurav Arora. “Although credit provision remains a vital component of corporate banking relationships, over time the quality differential is fueling a shift in corporate preferences and bank market share away from state-owned banks and to private providers.”

Greenwich Share and Quality Leaders

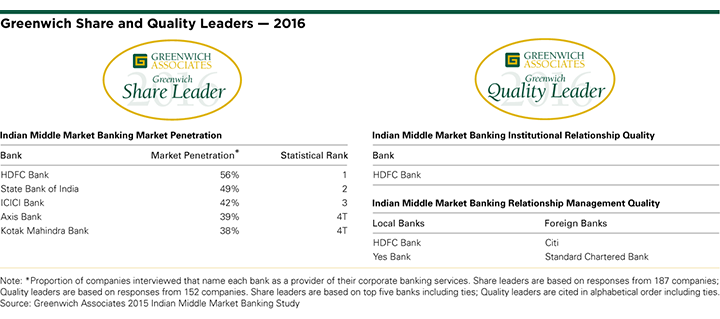

Each year, Greenwich Associates recognizes the market leaders in terms of both market penetration and relationship quality, as cited and assessed by the clients of these banks. The following tables provide the inaugural rankings for India’s middle market banking.

In 2016, HDFC secures the top spot in market penetration, followed by SBI in second place, ICICI in third and Axis Bank and Kotak Mahindra Bank statistically tied for fourth. These banks are the 2016 Greenwich Share Leaders in Indian Middle Market Banking.

Private Banks Delivering “People Quality”

HDFC and Yes Bank rank highest for relationship management quality among India’s privately owned banks. StanChart and Citi also earn top ratings for RM quality, as corporates have come to expect of foreign banks. These four banks share the title of 2016 Greenwich Leader in Indian Middle Market Banking Relationship Management Quality, while HDFC alone claims the title for Institutional Relationship Quality.

“Particularly impressive is the fact that these domestic banks are getting top marks for their coverage bankers and relationship managers,” says Gaurav Arora. Both Greenwich Associates consultants note that leading Indian banks increasingly prioritize “people quality,” recognizing the huge differentiator in the new environment—where credit provision alone does not cut it.

Paul Tan adds, “Traditionally, local banks have had a tough time competing with global players in terms of talent. That appears to be changing, both in the local banks’ prioritization of coverage qualities and in the foreign-bank-trained talent increasingly encouraged to take senior positions in the most sophisticated local banks.”

Private Banks to Remain on Growth Trajectory

Over the next five to 10 years, emerging privately owned banks like Yes Bank, Kotak Bank and others will be improving and expanding their capabilities and upgrading the quality of products and services they deliver to Indian corporate clients. This steady improvement will continue to narrow the gap between the private banks and global competitors, and will accentuate the discrepancy in service quality between these private players and state-owned banks. “For the private banks, we see consistent, prudent growth ahead—and in India, prudent growth is critical,” says Gaurav Arora.

“The next stage of development for India’s most sophisticated, privately owned banks will be to revisit and refine the business and operating models of their corporate-banking coverage and support functions. Account loading, account alignment with the RM skill set and an increasing focus on risk-adjusted cross-product return on capital are moving to the forefront in supercharging the corporate bank for profitable growth,” says Paul Tan.

Greenwich Associates Head of Asia Pacific Paul Tan and Head of India Banking Gaurav Arora specialize in Asian corporate banking and treasury services.

MethodologyGreenwich Associates conducted interviews with 2,964 users of foreign exchange globally, of which 1,633 are top-tier accounts, at large corporations and financial institutions on market trends and their relationships with their dealers.

To be considered top tier, a firm must be either a central bank, a government agency, a hedge fund, a fund manager, a FT100 global firm, a firm with reported trading volume of more than $10 billion, or a firm with reported sales of more than $5 billion.

Interviews were conducted in North America, Latin America, Europe, Asia, and Japan between September and November 2015.