With the recent swell in retail investor trading in both equities and equity options, it is important to pay attention to the perennial proposals to make changes to the tax treatment for securities and derivatives. The growth of these markets, in particular the equity options markets, has been nothing short of astounding.

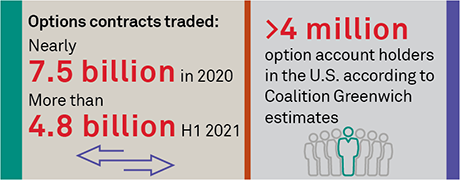

The modern options markets, founded relatively recently in the 1970s, now comprise 16 U.S. equity options exchanges listing upwards of 1.5 million options contracts on more than 4,900 underlying stocks every day. The volumes transacted on the option exchanges are no less impressive, with nearly 7.5 billion contracts traded in 2020 and more than 2.5 billion contracts traded in the first quarter of 2021.

Moreover, the retail investor is more engaged than ever in the markets. With the rise of zero commission trading, the retail trader has never had it better. Competition for their order flow is fierce, and they have flocked to the markets, opening an estimated 10 million brokerage accounts in 2020.

With more than half of American households having some form of ownership in the stock market, changes to the tax treatment of securities and derivatives need to be carefully examined. The current tax rules are well established and well understood. Changing to a “mark-to-market” treatment will negatively impact investment across both equities and options markets, hurting retail and institutional investors alike.

MethodologyBased on a detailed review of the history, purpose and interrelationship of the equities and equity options markets in the United States, market volumes in both markets, as well as data regarding brokerage account holdings in American households, Coalition Greenwich analyzed proposals to change current tax treatment for equities and derivatives to a “mark-to-market” methodology.