As cryptocurrency moves from a largely retail product at the edges of the market place to a product that engages a broad set of institutional investors across the financial markets, impediments to wider use will have to be solved. From the unknowns of the regulatory landscape facing the physical market to the challenges of adopting and fitting new technology into the existing tech stack and operational processes, financial institutions are looking to play a larger role in these markets and drive product innovation to surmount these issues.

Derivative products, which have a long track record and are easy to understand and transact, were naturally the first to be utilized to get exposure to the crypto market—namely futures and exchange-traded products (ETPs). However, they come with their own unique challenges that prevent wide adoption in the short term. As a result, another tried and tested instrument is now being repurposed as a vehicle to support institutional buy-side interest in this asset class: non-deliverable forwards (NDFs) on cryptocurrencies.

In this paper, we will examine some of the challenges the physical market has faced in gaining acceptance from traditional financial market participants, and the evolution of derivative and synthetic instruments that can help ease the transition of cryptocurrencies into the mainstream of financial markets.

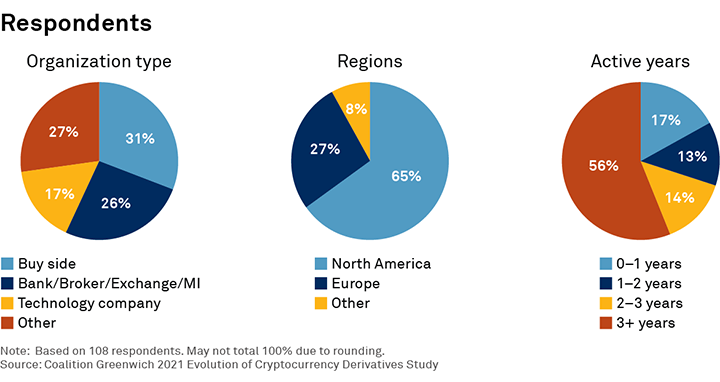

MethodologyBetween July and October 2021, Coalition Greenwich conducted 108 interviews across a spectrum of cryptocurrency users, augmented by targeted interviews of senior trading personnel at some of the largest cryptocurrency derivative market makers. We sought to understand the market’s view on the transition cryptocurrencies are making from the physical context to the financial.