The sharp rise in interest rates has increased the discount rate for U.S. pension plans, lowering plan liabilities and pushing most corporate defined benefit (DB) plans to fully funded status. This historic shift has changed the goal for most corporate DB plan sponsors from maximizing investment returns relative to their liabilities to maintaining their newly healthy funding ratios and minimizing volatility.

However, many corporate pension plans—including those that devote a majority of assets to liability-driven investments (LDI)—still have asset allocation profiles built for the previous low-rate, low-yield, lower funded status environment. As a result, a significant number of the corporate plan sponsors taking part in a new study from Coalition Greenwich are re-evaluating their current lineup of LDI managers. In an effort to secure funded status gains, many are looking at issues such as excessive overlap in holdings, inadequate hedging of liabilities and insufficient downside protection in their LDI manager lineup.

This report provides the complete results of that study, including data on plan funding ratios, plan sponsor challenges and investment priorities, and strategies that plan sponsors are using to diversify LDI manager rosters and otherwise prepare their plans for this new phase of pension plan management.

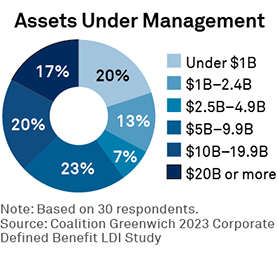

MethodologyFrom August through October 2023, Coalition Greenwich conducted 30 interviews with institutional investors targeting key decision-makers at corporate DB plans based in the United States to understand how they manage diversification and plan/funding risk, select an LDI manager and navigate overall risks on the economic horizon. As part of this study, Coalition Greenwich also held in-depth discussions with some of the world’s biggest and most prominent investment consultants. Throughout this report, we present excerpts from those interviews that present perspectives from these informed and influential intermediaries.

The study that is the basis for this report was commissioned by Franklin Templeton. Coalition Greenwich/CRISIL is not affiliated with Franklin Templeton.