Table of Contents

Financial institutions partner with us on sustainability and ESG analytics to understand values and behaviors amongst clients and prospects, gain actionable data-driven insights on trending topics and inform business decision-making.

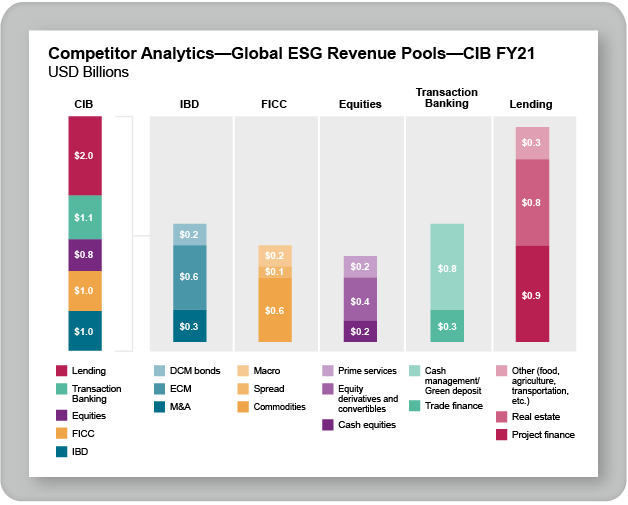

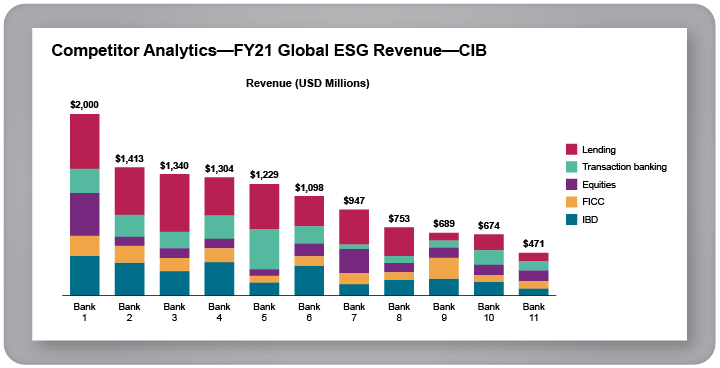

Competitor Analytics

Our competitor analytics empowers financial institutions to understand the dynamics and trends of industry revenue pools and the performance trajectory of named competitors within the ESG landscape.

These insights primarily focus on pivotal metrics such as revenue, headcount productivity as well as emerging facets in e-trading in fields such as Energy, Green Bonds, Emissions, Renewable Power, Lending, and Transaction Banking. Through these insights, financial institutions are able to navigate the ESG landscape, capture insights into competitor stances and calibrate ESG revenue aspirations.

Voice of the Customer (VoC) Sustainability Tracker in Corporate Banking

A Sustainability Tracker is available for Corporate Banks to understand the importance that corporate organizations are assigning toward a more sustainable business model, with a particular focus on the transition to net-zero. These insights explore the corporates’ current journey, expectations and experience with banking providers and product needs. Corporate banks benefit by understanding different and evolving levels of sustainability literacy and needs, as well as changing client perceptions of banks driving value proposition.

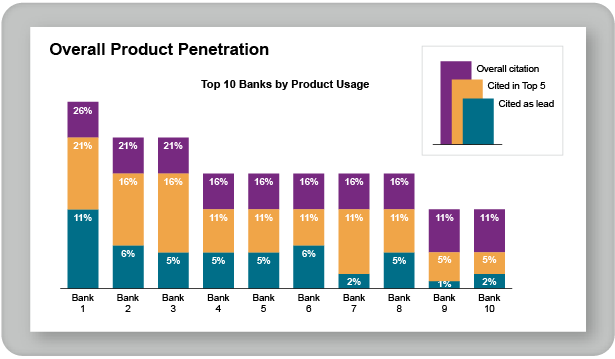

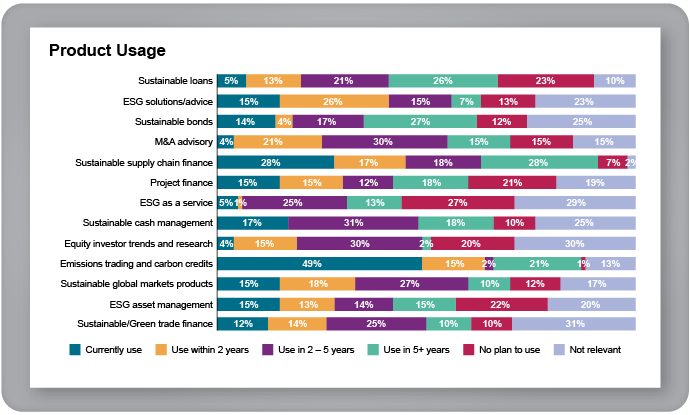

Product Usage provides insights into current and future needs for corporates, while Product Penetration provides banks visibility over their market position across financing, transaction banking, capital markets, markets and trading, M&A, Asset Management, ESG Strategy and ESG as a Service Products. Current and future use of products in the short, medium (2-5 years) and long term (5+ years) shows the movement corporates expect to support their sustainability journey, allowing banks to anticipate their clients’ future needs.

ESG in Investment Management

Widely considered a defining issue of this generation, ESG’s impact on institutional investing is broad and long lasting. Social trends, regulatory changes and a post-pandemic environment are continuing to accelerate institutional focus on ESG investing. As a result, investors’ ESG-related needs are increasingly sophisticated and their expectations for asset managers continually rising.

Asset management providers subscribing to our ESG Insights receive a deeper understanding of institutions’ latest ESG practices and future plans, asset owner requirements for their managers, and competitive data on perceived leaders in ESG as well as what sets them apart.

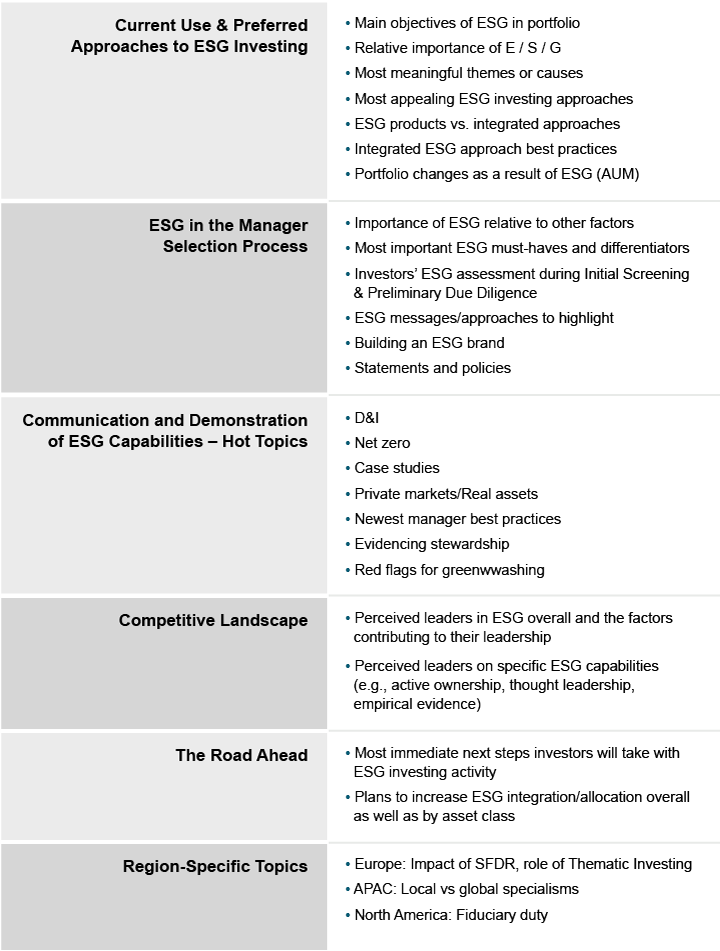

Topics & Analysis