Separating Industry-Leading Capabilities from Marketing Hype

Businesses are expecting easier, faster and simpler interactions with their financial institutions, especially through the onboarding process. Shortened cycle times, less effort, higher transparency and simplified documentation and information requests are all becoming the expected norm, yet most banks are still falling short.

The onboarding process presents a key area of opportunity for banks to streamline and make a good impression early in the relationship. Making this process easier through digitization will result in higher ease of doing business scores from their new relationships. In an environment of rising client expectations, banks not making the necessary investments risk being negatively differentiated.

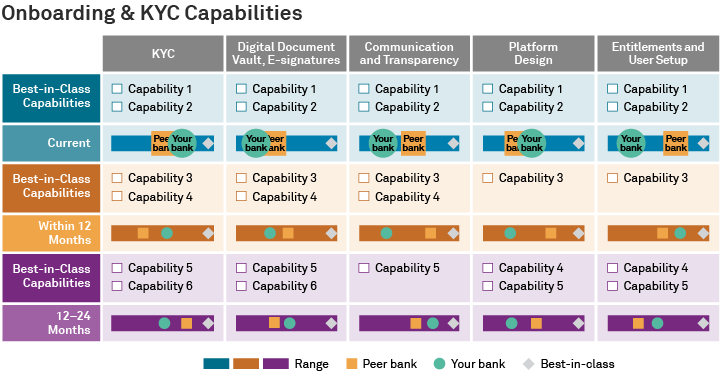

Our Onboarding & KYC Benchmarking program helps banks to prioritize investment spend by allowing management teams to:

- Discover where they are on their digitization journey

- See capability gaps today, one year out, two years out and beyond

- Gain insight into which capabilities peers are developing internally vs. externally

|

Topics include:

|

|

Participation is easy and anonymous.

To learn more, fill out the form to receive a sample deck or ContactUs