Separating Industry-Leading Capabilities from Marketing Hype

The commercial payments business is rapidly transforming due to market pressure to be faster, more efficient and less expensive. Additionally, customers want the innovative idea flow and rapid development cycles of fintechs combined with the trustworthiness, stability, scale, and security of major financial institutions.

Banks will need to harness digital innovation to improve operational efficiencies, as well as create new revenue streams using their rich proprietary datasets to unlock advanced analytics and drive client insights. There is high potential for long-term differentiation for those that can balance finite investment capital with a proliferation of technologies.

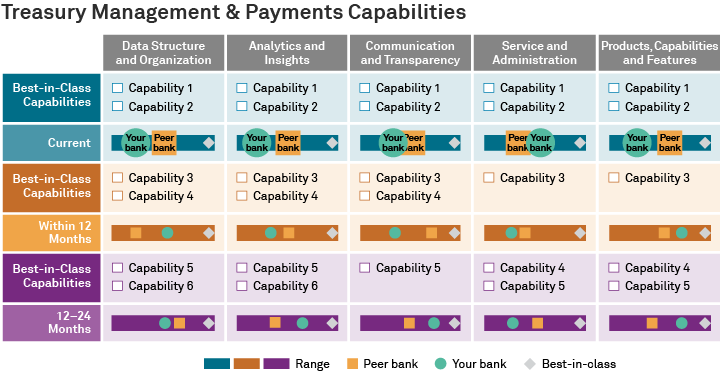

Our Treasury Management & Payments Benchmarking program helps banks to prioritize investment spend by allowing management teams to:

- Discover where they are on their digitization journey

- See capability gaps today, one year out, two years out and beyond

- Gain insight into which capabilities peers are developing internally vs. externally

|

Topics include:

|

|

Participation is easy and anonymous.

To learn more, fill out the form to receive a sample deck or ContactUs