Separating Industry-Leading Capabilities from Marketing Hype

Businesses are expecting easier, faster and simpler interactions with their financial institutions, including the credit process. From increased decision speed, lower turnaround times and less effort and business disruption, clients’ expectations for credit approval do not align with current bank processes.

Digitization of credit processes is a critical area of near term transformation. Those that get it right will see significant customer value from higher speed and efficiency, major reduction in RM touch time, better execution quality and regulatory compliance, and lower risk from better credit decisions.

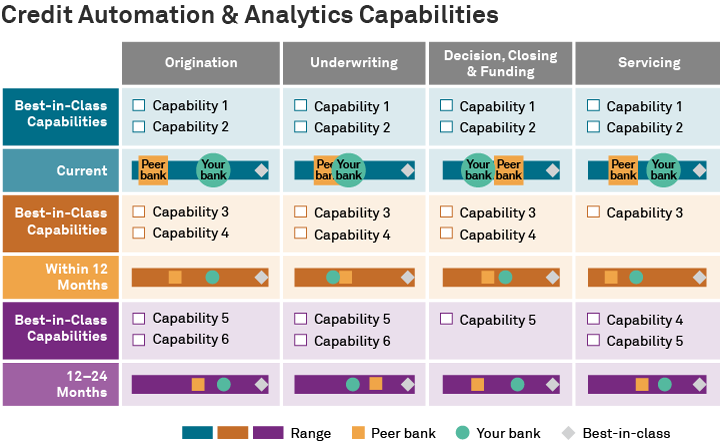

Our Credit Automation & Analytics Benchmarking program helps banks to prioritize investment spend by allowing management teams to:

- Discover where they are on their digitization journey

- See capability gaps today, one year out, two years out and beyond

- Gain insight into which capabilities peers are developing internally vs. externally

|

Topics include:

|

|

Participation is easy and anonymous.

To learn more, fill out the form to receive a sample deck or ContactUs