Cost and Capital Analytics conducts anonymized competitor performance analysis on a normalized basis for banks delivering cost and capital efficiency and insights.

Leveraging peer cost and headcount submissions with relevant comparisons vs. a customizable peer group, two main offerings form Cost and Capital Analytics:

- Group Function Cost Analysis is a multiple-view analysis of total Group functional costs and headcount to provide actionable insights to relevant stakeholders.

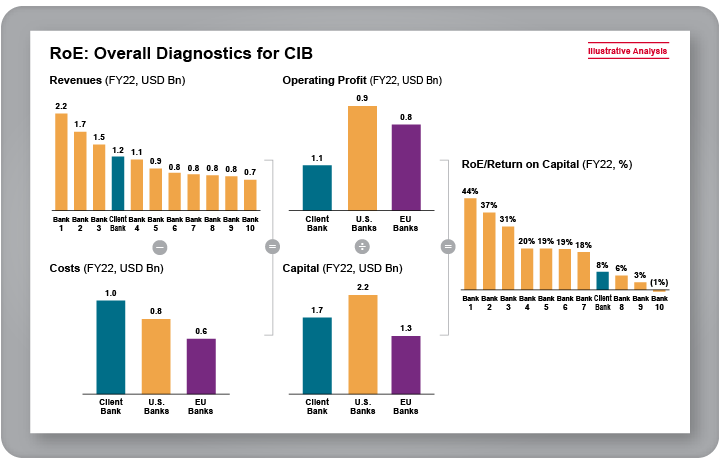

- CIB Cost and Capital Analysis provides corporate investment banks with business intelligence by measuring global performance in detail across the CIB Front Office to drive efficiency and improve productivity. Analysis can also be focused on assisting smaller banks and regional peers with planning and actions required to achieve target state.

Communicate the strengths behind your strategy, enhance your understanding of market dynamics, and unlock business improvement by reviewing firm-wide financial performance across:

- $ operating cost and % operating cost

- Cost income ratios

- Absolute RWA and Leverage Exposure (by risk type and exposure component)

- RWA productivity and Leverage Exposure productivity

- Returns on capital deployed (calculated by combining cost and capital analysis)

Use Cases

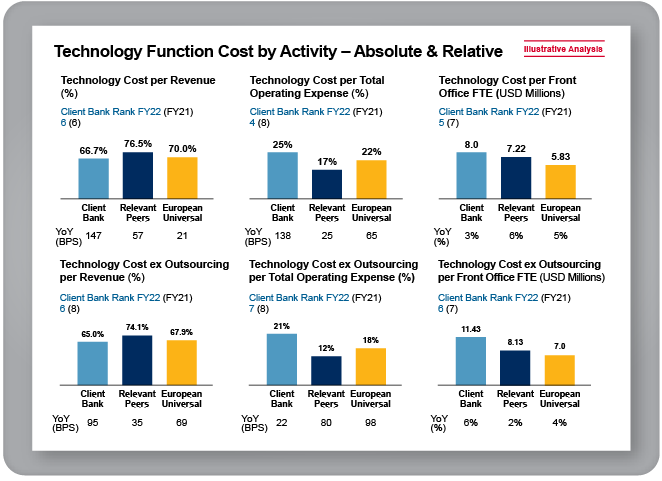

- Group Function Cost Analysis: Ranging from the holistic review of a specific function’s cost and location strategy (e.g., Technology, Compliance, Finance) to understanding business mix and the impact on your bank’s cost-base.

- CIB Cost and Capital Analysis: In-depth review of your bank’s highest-returning or most profitable businesses and products, pinpointing cost levers and productivity opportunities based on gaps to peers.

Benefits

- Group Function Cost Analysis: Spotlight where rightsizing or investment is required, understand the appropriate size and shape of functions for your bank model, or refine business strategy and quantify the impact of scaling down specific functions.

- CIB Cost and Capital Analysis: Understand relative positioning, define key opportunities for cost and capital management, and inform strategy and resource allocation.