Asset managers around the world have worked to integrate ESG and sustainable investing practices into their investment processes, but noticeable differences persist across regions. While the employment of ESG in portfolios continues apace in Europe and Asia, asset owners in North America are pulling back amid political tensions. Asset managers that operate in this space face a wide spectrum of client needs. A recent study from Coalition Greenwich, which interviewed 310 senior investors at the largest tax-exempt funds across North America, Europe and Asia, explored the current landscape of ESG expectations and preferences.

Current ESG Usage

European investors continue to demonstrate a more entrenched commitment to sustainable practices—nearly all European investors reported that ESG is currently employed in their portfolio. Hot on their heels are Asian investors, with 86% stating that they employ ESG. Guided in part by regulatory frameworks and a strong cultural emphasis on corporate responsibility, the majority of institutions in these regions have ESG integrated in their investment policy. While overall North American investors tend to exhibit lower levels of engagement, over a third of U.S. and half of Canadian investors are still committed to employing ESG in their portfolios.

Thematic priorities further highlight regional differences in investor ESG preferences. In the United States, there was a notable emphasis on DE&I themes—a focus that was not mirrored by European or Asian investors, who instead demonstrated a robust thematic commitment to Net Zero.

Policies

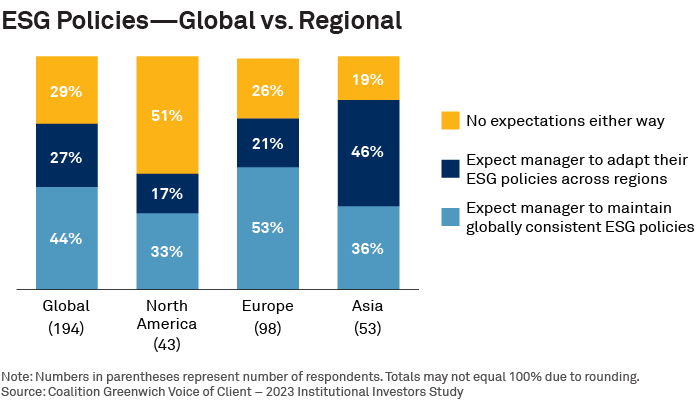

The regional differences continue with respect to managers’ ESG policies. European asset owners are more likely to expect managers to maintain globally consistent ESG policies, those in Asia expect that policies will be adapted to take account the varying ESG-related beliefs and needs across regions, while those in North America have no clear expectation either way. Some asset managers may feel inclined to cover the wide spectrum of client needs, but they face the danger of spreading themselves too thin or diluting their focus to do so.

While investors may not all have expectations of globally consistent policies, around two-thirds of asset owners across all regions agree that a lack of global ESG policies was a potential red flag for greenwashing.

One compelling reason for uniform ESG policies lies in the global nature of investment portfolios. Asset owners often have diversified holdings across various regions and markets, making it imperative for their asset managers to implement consistent standards. This approach ensures that ESG considerations are applied uniformly, mitigating the risk of divergent ethical and sustainability criteria being applied to different parts of an investment portfolio.

The rise of regulatory frameworks contributes significantly to the demand for uniform ESG policies. Many jurisdictions are implementing or enhancing ESG-related regulations. It may benefit managers to adopt and, indeed, lobby for globally consistent ESG policies to navigate this evolving compliance landscape effectively and avoid situations of regulatory arbitrage. In fact, over half of investors see a manager’s engagement with regulatory and industry bodies as a differentiator when making a decision to work with a manager in an ESG capacity.

Stewardship

While pursuing global ESG policies and practices may be tricky in the current environment, given differing regional preferences, manager approaches to investment stewardship is emerging as a key global area of focus. Notably, the No. 1 differentiator cited by asset owners was for managers to have robust stewardship or active ownership policies and practices.

Stewardship forms a key pillar of the investment process, whether one wants to apply an “ESG lens” or not. As such, asset owners’ expectations regarding the documenting and evidencing of stewardship activities will force managers to give renewed focus to their policies and the outcome of such engagements.

Sophie Emler and Liz McIvor are the co-authors of this publication.