Table of Contents

With our connectivity to the buy-side, Coalition Greenwich conducted a “flash study” on investor sentiment in the context of the Russia-Ukraine war.

We asked equities, fixed-income and foreign exchange (FX) institutional investors about the impact of the war on financial markets and buy-side behavior, including:

- The most influential factors in determining which dealers won business during high market volatility

- Which dealers stood out for standing by their buy-side clients during the first few weeks of volatility

- The impact of the war on future asset allocation

- The influence of ESG on investment decisions

What Mattered Most to the Buy Side Early in the War?

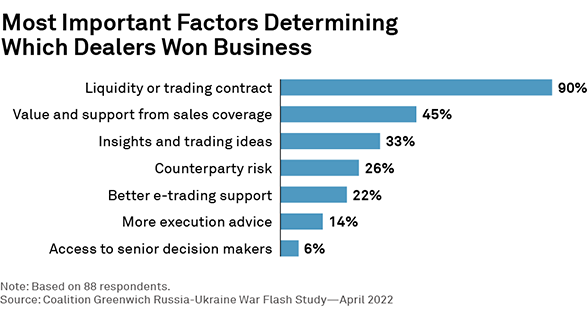

To the surprise of no one, 90% of respondents cited liquidity provision and contact with traders as a top determinant as to which dealers won their business during the high market volatility. Getting strong value and support from sales contacts was the second most important factor, emphasized most by FX and fixed-income investors. As we often hear buy-siders say in conversations or on conference panels, “Relationships don’t really matter, until they do.” Trade ideas were the third-most-cited factor, particularly among fixed-income clients.

Dealers That Responded Best for Clients

Similar to what we saw during the onset of the COVID-19 crisis in March 2020, buy-side/sell-side relationships played a particularly important role early on during Russia’s invasion of Ukraine, as institutions scrambled for liquidity.

When we asked which dealers stood out most for standing by clients during this time, we saw a tie in equities between Goldman Sachs and Morgan Stanley. Goldman Sachs also stood out as the leader in FX, while J.P. Morgan stood above the rest in fixed income.

The Impact on Future Asset Allocation

When asked how the war would impact their asset allocation, energy was front-and-center for many respondents. Many noted an anticipated increase in green energy investment going forward, while others expected to see an increased allocation in commodities, including fossil fuels. Unsurprisingly, numerous institutions expect a decreased allocation to emerging markets.

What Effect Will the War have on ESG Investment Going Forward?

The overarching theme among respondents is that ESG is more relevant than ever, with Russia's invasion of Ukraine underscoring the need for a focus on alternatives to fossil fuels. Furthermore, some institutions expect even more official spending on alternative energy and thus see an increased opportunity in green energy products. Hand-in-hand with what we saw above regarding decreased emerging markets investment, several institutions noted that the Russia-Ukraine war emphasizes the need for increased ESG screening when considering investment in less-stable countries and economies.

Those respondents anticipating less of a focus on ESG within their shops tended to point to a perceived need for a more balanced playbook, noting that environmental, social, and governance improvements are important but need to be weighed against investment costs, speed of improvements and opportunity costs.

METHODOLOGY

In the several weeks following Russia’s invasion of Ukraine, Coalition Greenwich surveyed buy-side investors across equities, fixed income, and FX, receiving responses from 88 institutions, mainly across EMEA/Americas.