High costs can be a barrier to success for any swap execution facility (SEF), but there’s more to it than that. Based on our conversations with the buy side, simple fee models are preferable. Thankfully most major SEFs have taken a transparent approach to pricing in response to this demand. It is also important to keep in mind the total cost of the trade, which includes not only the SEF ticket fee, but also the spread and, in some cases, an agency broker fee. Greenwich Associates believes that over time, pricing amongst the various SEFs will quickly fall in line, making it of less importance when selecting a liquidity venue. That said, creative pricing models that attract liquidity and incent the SEF’s target client base to trade while potentially discouraging others will also develop as the market matures.

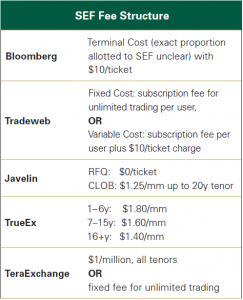

Keeping all of that in mind, we've list below our most recent understanding of dealer to client interest rate focused (more on credit and FX later) SEF fees. Expect that these models will remain fluid as the market evolves. Several of these SEFs also offer other services that have slightly different pricing structures (think compression, etc.). And lastly, we're only looking at traditionally dealer to client platforms here. Expect the traditionally interdealer SEFs to have an impact on overall pricing models - both their own and others - as they attract more client flow.

We discuss this pricing issue and several other things to think about when examining the evolving SEF landscape in a report published mid-October 2014 (clients can access the report via their Greenwich ACCESS login). Its probably also worth mentioning I'll be moderating the "What Have We Learned in the First Year of SEF Trading?" panel at SEFCON V on November 12 as well. And now with the sales portion of this post over, here are the numbers: