Prior to the global financial crisis, innovation in corporate finance and treasury meant the rollout of new and increasingly sophisticated banking products. A decade later, the innovation most important to Asian CFOs and treasury professionals has less to do with financial products and more to do with digital solutions that make treasury and banking operations better, cheaper, faster, and more transparent.

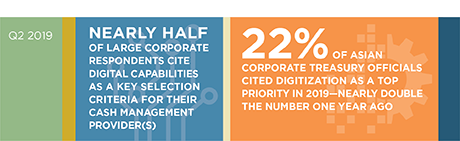

Digitizing treasury operations has become one of the biggest goals for corporate treasury departments across Asia in 2019. The share of senior Asian corporate treasury officials citing “digitization” as a top priority for their companies in the year ahead nearly doubled to 22% in Q4 2018 from 12% in Q4 2017. Digitization now ranks behind only core treasury functions like funding and liquidity management. Furthermore, digital capabilities are cited by nearly half of large corporate respondents as among the key selection criteria for their cash management provider(s).

MethodologyFrom September to November of 2018, Greenwich Associates conducted 765 interviews in large corporate banking and 955 interviews in large corporate cash management at companies in China, Hong Kong, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. Subjects covered included product demand, quality of coverage, and capabilities in specific product areas.