Table of Contents

Introduction

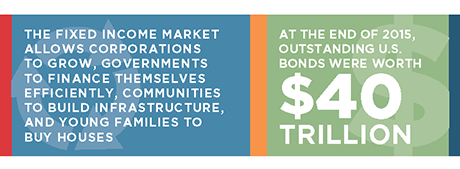

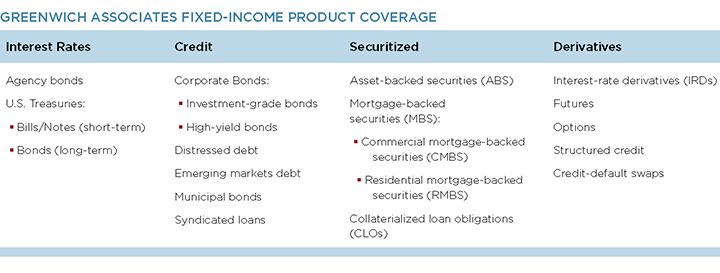

The fixed-income market is the picture of diversity. Case-in-point, the Greenwich Associates annual Global Fixed-Income Investor Study examines 17 different underlying product categories that make up the global fixed-income market. The markets, products and market participants create an ecosystem that allows corporations to grow, governments to finance themselves efficiently, investors to gain fixed returns with lower risk, communities to build infrastructure, young families to buy houses, and you to buy your cup of coffee in the morning.

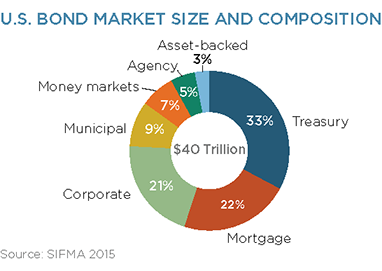

The foundation of this activity is the U.S. bond market, which was worth nearly $40 trillion at the end of 2015. Over the past 10 years, this market has consistently accounted for one-quarter to one-third of invested fixed-income assets around the world.

Fixed-income derivatives are also an important part of the market’s foundation. Derivatives are tradable contracts that "derive" their value from underlying assets such as bonds. They are critical to keeping the bond market efficient and allowing the necessary transfer of risk.

The Bank for International Settlements reported nearly $400 trillion of derivatives contracts outstanding at the end of 2015. Market structure changes have resulted in a decline from nearly $600 trillion at the end of 2013. The growth of central clearing, for instance, has allowed market participants to use the instruments more efficiently because it has promoted standardization and position netting.

Notably, these numbers represent the gross value of all contracts outstanding, as opposed to the lower net exposure. Furthermore, the amount of money at risk is in most cases well below the face value of the contract. For instance, a standard $100 million fixed-floating interest-rate swap which exposes the holder to movements in U.S. interest rates would see a loss or gain of only $500 thousand if interest rates moved one-half percent (50 basis points).

Fixed-income markets include a wide array of products, from government bonds to corporate bonds, and interest-rate swaps to securitized debt. For good reason, each sub-market or sector has its own market structure suited to its participants, liquidity, and overarching regulations.

Some sectors appeal more to institutional investors, such as banks and pension funds. Others, including the municipal bond market, attract more retail investors, requiring a higher level of oversight to ensure that a family investing their rainy-day fund is fully aware of the potential risks and rewards.

Grasping how each of those markets works and how they interact with one another is no small task. To that point, in some cases quite complex topics are oversimplified here. However, by recognizing the utility of these markets to the real economy, the goals of the market participants involved, how regulators help protect investors, and how the markets have evolved over time, the path forward becomes increasingly clear.

Fixed-Income Products

A Brief History

The fixed-income market, simply put, is a means of borrowing money, allowing those that need capital to borrow from those that have it, with the lender being compensated through interest payments. Unlike equity markets, fixed-income markets require the borrower to return the money to the lender at a pre-agreed point in the future.

For example, a tire manufacturer takes out a loan from a commercial bank to buy rubber. The bank wires the money to the manufacturer, and the manufacturer makes periodic payments that include both principal (actually repaying the loan) and interest (the fee charged by the bank for lending the money). The bank makes money from the interest charged, and the principal loan amount allows the tire manufacturer to make more, hopefully profitable, tires.

Having only two counterparties in a transaction doesn’t always work, however, which is how the bond market evolved. The bond market allows a corporation, government or other entity to borrow by selling bonds to many investors that, in aggregate, lend the amount of money the entity needs to borrow.

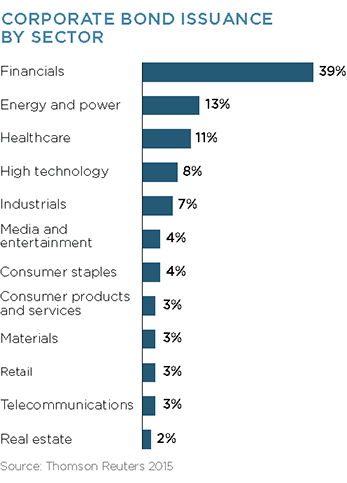

Bond market transactions both increase the pool of money available to the borrower and spread the resulting credit risk across a wide range of investors (rather than leaving it all with a single bank). Using the above tire manufacturer as an example, the industrial sector issued $97 billion in corporate bonds in 2015 alone.

This idea has a long history. In fact, the first government bonds were issued by the Bank of England in the late 1600s to finance a war against France. American colonies and the Continental Congress issued bonds to finance the Revolutionary War. After independence, the newly formed American government issued bonds to redeem outdated Continental currency. The modern U.S. government bond market got its start about 100 years ago during World War I.

U.S. Treasury and Federal Agency Securities

Today, the U.S. government bond market has evolved into one of the most liquid and efficient markets in the world. The interest rate paid by the U.S. government to its borrowers is considered to be the "risk-free" rate and is a benchmark for millions of securities and transactions around the world.

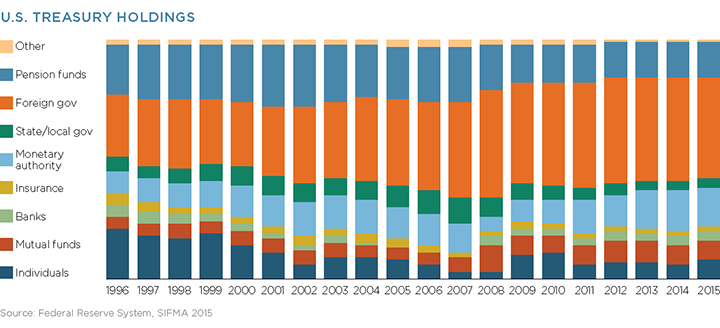

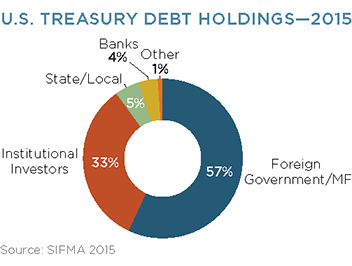

The $14 trillion currently lent to the U.S. government comes from a diverse set of investors. Foreign governments and monetary authorities (including the U.S. Federal Reserve) hold nearly 60% of this amount, with private investors, both institutional and retail, holding about a third. While this makeup has changed over time along with interest rates and global economic conditions, large governments and individual investors around the world continue to see U.S. government debt as a sure thing, hence the status of U.S. Treasury rates as the risk-free rate.

Credit Market

The U.S. government and agency debt markets are referred to as the "rates" markets, as the primary risk faced by bond holders is interest-rate risk. The government debt of other major markets around the world (e.g., the United Kingdom, Germany, Japan) also falls into this category.

Holders of most other bonds, including corporates, municipals, private mortgage- and asset-backed, and some sovereign bonds, must manage not only the risk of interest rates moving, but also the probability of the borrower defaulting—or credit risk.

Credit markets are critical to the growth of the U.S. economy. This is where corporations, municipalities, finance companies, banks, and others borrow money to expand their businesses. Credit markets generally provide higher yields than rates markets, as these bonds expose investors to credit risk. This risk/reward interaction between borrowers and investors incentivizes lending to both lower- and higher-risk entities.

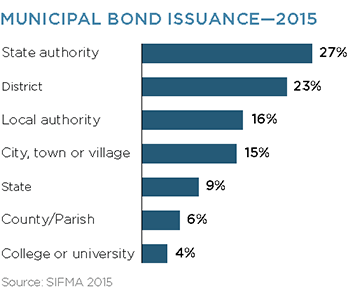

Municipal bonds are issued by state and local governments and by government agencies and authorities principally to finance investment in infrastructure such as schools, roads, airports, transit systems, water and sewer systems, public hospitals, and similar projects. With more than one million distinct municipal bonds outstanding, the efficiency of the municipal market allows governments to borrow for long terms at low interest rates, saving money for tax- and rate-payers. A key feature of most municipal securities is that the interest earned by investors is exempt from federal, and in some cases state and local income tax. This further lowers the borrowing cost for municipal issuers.

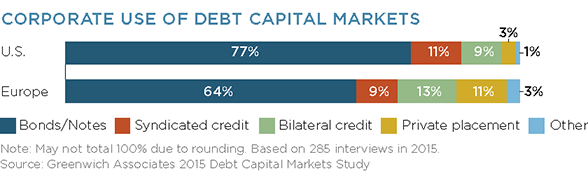

Corporate borrowing via the credit market is done through several different vehicles. Greenwich Associates interviews with nearly 300 treasurers of large U.S. corporations show more than three-quarters of debt outstanding is in corporate bonds, with the balance in the loan market. European corporations tend to favor the loan market, with more than a third of debt outstanding done via private credit agreements, although this regional difference is starting to normalize as the market adapts to the post-credit crisis world.

In both cases, corporate treasurers work with financial institutions to bring a "new issue" to investors via the primary market, where institutional investors can express their interest in lending money to the issuer.

Securitized Products

While bond and loan markets work well for larger entities borrowing large sums, these markets are not efficient for borrowing at the retail level. A $1,000 loan made via a credit card isn’t all that interesting to an investor, as the cost of buying the loan would likely be higher than the return.

However, hundreds or thousands of smaller loans in aggregate can appeal to investors as an attractive risk/reward profile and offer the opportunity to diversify their portfolios beyond traditional corporate and government bonds. These securitized loans, packaged and sold as bonds, are easily traded and held by institutional investors, allowing retail consumers to get reduced-cost access to the credit they need.

Securitized products come in as many varieties as the underlying debt that they help to fund. Fannie Mae and Freddie Mac, for instance, securitize mortgages and guarantee payments to investors (also known as agency mortgage-backed securities, or agency MBS), which ultimately lowers mortgage rates for home buyers. Ginnie Mae does not securitize loans, but instead guarantees payment of principal and interest from approved issuers of qualifying loans, also helping to keep mortgage rates down.

Major banks fulfill a similar function, but also securitize student loans, car loans, credit card debt, and others in addition to mortgages. These products, while not guaranteed by the U.S. government, reduce borrowing costs for the end consumer by increasing the number of investors interested and able to lend them money. Securitization provides funding for commercial borrowers as well.

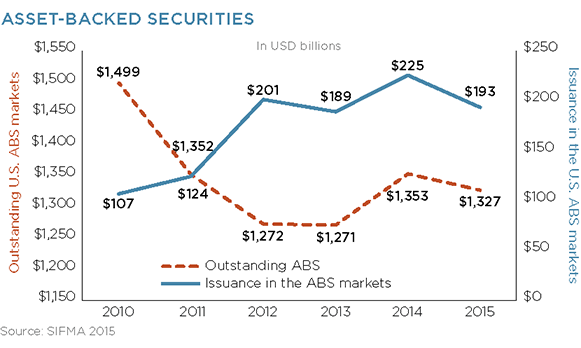

Despite recent declines, overall issuance of securitized products is up over the past five years, with stricter underwriting standards and a more stringent ratings process leaving investors more comfortable with the products. Since the financial crisis, however, issuance of certain private mortgage-backed securities remains low.

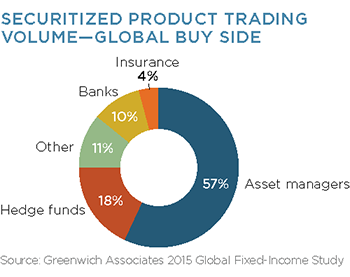

Greenwich Associates research also shows that asset managers now make up nearly 60% of investors trading in these products globally, reflecting their place in the market as a solid source of stable, low-risk returns for everyday investors.

Derivatives

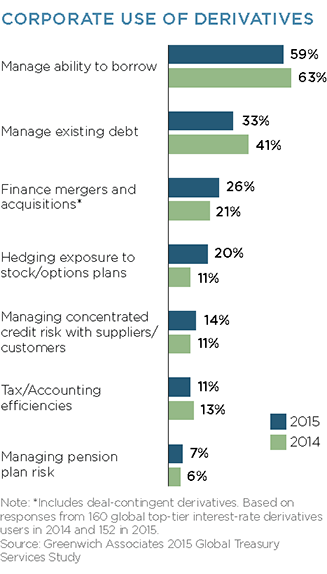

Interest-rate and credit derivatives are financial instruments closely related to bonds. While this research is focused primarily on the bond portion of the fixed-income market, it is important to understand the critical role that derivatives play in the real economy. Swaps, futures and options are used by companies and financial institutions mainly to hedge risk. For financial institutions, who are the largest users of fixed-income derivatives, this could mean managing the interest-rate exposure of a mutual fund, for example. Corporations might use derivatives to lock in pension plan obligations or to manage the interest rates associated with one or more of their bond offerings.

An interest-rate swap, for example, is an agreement between two counterparties to exchange interest-rate cash flows, such as a fixed rate for a floating rate. Interest-rate swaps are used by corporations around the world for debt management and managing interest-rate risk and pension plan liabilities. Greenwich Associates believes the price of goods in the U.S. would rise if corporations were not able to access the fixed-income derivatives market, as the risk of an interest rate move or counterparty ratings downgrade would then be priced into the underlying product.

Trading in Fixed-Income Markets

Primary to Secondary

Fixed-income products such as bonds, loans, and asset-backed securities help borrowers find lenders. But the needs of investors and borrowers often change over the life of a security. It is possible that a borrower will no longer have the same need for capital and may choose to pay back the loan (or repurchase the bond issue) early. Or the investor may no longer want the interest-rate or credit exposure. This is where the secondary market enters the picture.

If the primary market is where borrowers find their initial set of lenders, the secondary market allows current and prospective lenders to come in and out of fixed-income securities positions throughout the life of those instruments. It is here in the secondary market that the liquidity discussion begins.

Liquidity

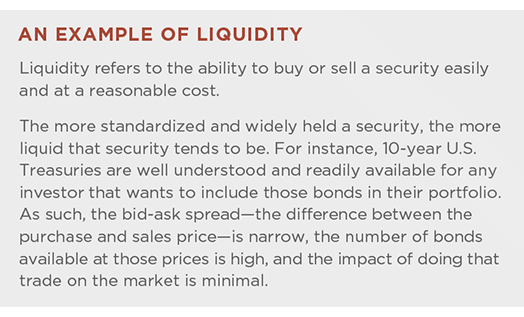

Ensuring that capital and risk can be exchanged safely and efficiently as the needs of market participants change is key to the global economy. Furthermore, the ability to buy and sell a security at a reasonable cost when needed lowers risks for investors and, therefore, the cost of capital for the borrower. This is why global regulators, legislators and market participants continue to focus on the quality of secondary market liquidity.

Liquidity is simultaneously abstract and quantifiable. A market’s liquidity is commonly defined as the ability to execute an order at the given price, with as little market impact as possible. While details about trades can, in fact, be quantified and tracked over time, how each market participant defines "large order," "right price" and "limited market impact" can vary greatly. Put simply—liquidity is in the eye of the beholder.

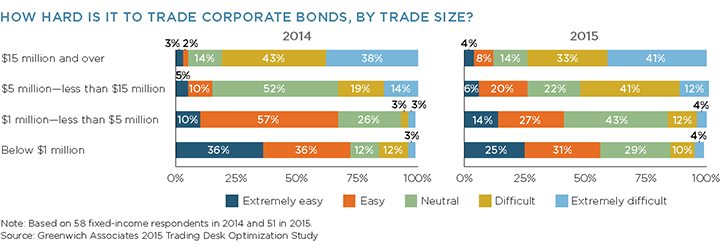

For example, Greenwich Associates recently examined these differing views of corporate bond market liquidity in the Q1 2016 report In Search of New Corporate Bond Liquidity. While many institutional investors felt that executing corporate bond trades over $5 million had become easier over the past year, others still saw these trades as difficult to complete. This, of course, does not take into account quantitative measures of liquidity, such as bid/ask spreads and market volumes, and so may not reflect the state of bond market liquidity day-to-day. However, given the level of sophistication of our research participants and their differing views, the perception of market participants offers critical insight into the state of market liquidity.

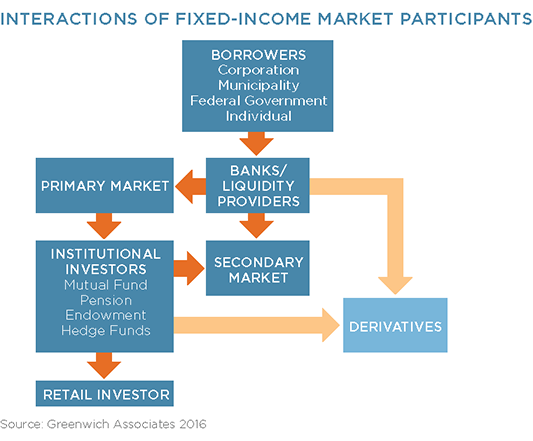

The Fixed-Income Marketplace

When evaluating fixed-income market liquidity, it is first important to understand the makeup of the market participants and how they interact with one another. The process begins as borrowers work with financial institutions to bring new securities to the market in the form of bonds, loans, etc.

With some important exceptions, most retail investors in the U.S. access the market through professional asset managers, who may suggest mutual funds, exchange-traded funds (ETFs) or separately managed accounts as vehicles to invest for retirement, education or a new car.

Institutional investors then work closely with banks, trading securities and derivatives to ensure that corporates and governments are funded, and that retail investors can put money in and take money out based on their individual needs. As such, ensuring this trading occurs seamlessly and safely is critical to the long-term growth and function of the fixed-income market.

While much of the fixed-income market is institutional in nature, individual investors do play a role. Mortgage borrowers, for instance, can obtain lower interest rates due to investor demand for mortgage-backed securities (MBS). In addition, individuals often lend to state and local development projects through municipal bonds, which offer tax-free interest and returns.

Bond markets operate primarily via an organized over-the-counter (OTC) market, with bonds moving from the buyer to the seller directly, rather than via a centralized marketplace such as an exchange. When an institutional bondholder wants to sell a bond, they contact one or more dealers who will, for the right price, buy those bonds into their own account and hold them for seconds, or in some cases, months until a buyer comes along. To do this, the dealer buys the bonds with its own money and takes the risk that the market will move against it before it is able to sell.

The breadth of the market means that it is uncommon that one investor wants to buy the exact bond another investor wants to sell at the exact same time. Unlike the equity market, which generally offers a single way to invest in a public corporation, the fixed-income market can offer dozens of opportunities to lend to that same corporation, with bonds of different structures, maturities and coupons available to buy. This is where dealers with the ability to commit capital work to keep the markets moving.

Bilateral Relationships

Fixed-income trading between investors and dealers takes many forms. The majority of bond trading, particularly of those products that trade either less frequently (i.e., some high-yield corporate bonds) or are more complex (i.e., some securitized products) continues to take place primarily over the phone. The same holds true for larger (where the definition of "large" differs by product type) and more sensitive trades where the dealers helping hand is seen as particularly beneficial.

This is not a bad thing, nor unusual. Think about buying a specialized product, such as a part for your car: You can buy one online and have it delivered directly to your house. However, buying without an expert first diagnosing the problem, confirming the exact part needed and the ability to install it properly is unwise. Furthermore, when that car part needs maintenance a few months later, that mechanic will likely provide that service for a lower fee or, in some cases, at no cost—something no online retailer will offer. The same holds true for complex, large or hard-to-value transactions in the fixed-income market.

Electronic Channels

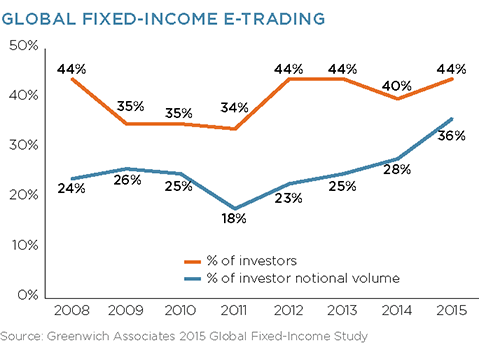

The use of electronic channels, however, has grown sharply over the last five years. Greenwich Associates research shows that in 2011 only 18% of global fixed-income trading by notional volume was executed electronically. Today, 36% of fixed-income trading by notional volume between institutional buyers and sellers is done "on the screen" via electronic execution, with well more than half of trades executed electronically (not weighted by volume).

The jump has been driven by a combination of new regulations (e.g., CFTC swaps trading rules) requiring trading of certain products on electronic trading venues and the organic evolution of both investors and fixed-income dealers to a more efficient way of doing business.

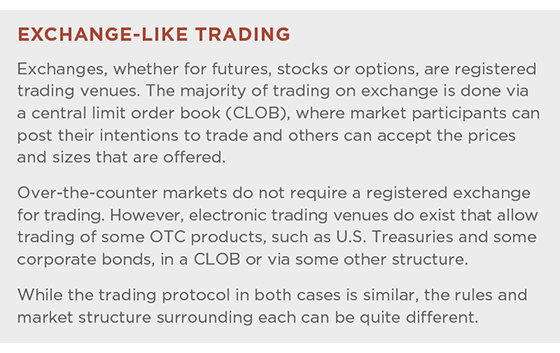

Each product within the fixed-income spectrum can trade differently based on the counterparties to the trade and liquidity of the given instrument. For instance, when institutional investors electronically trade U.S. Treasury bonds with bond dealers, they often do so via the request for quote (RFQ) model. This allows investors to request one or more quotes from specific counterparties in search of the right price for that order. Knowing which dealers to include based on past activity, knowledge and trust is key to this process.

When dealers trade U.S. Treasury bonds with one another, a practice now used most commonly to manage risk arising from trading with clients, a central limit order book (CLOB) is often used. This style of trading tends to move more quickly, with order sizes often smaller than those executed via RFQ or over the phone. A CLOB can be defined as a list of everyone in the marketplace willing to buy or sell a bond and the quantity and price they seek. If another market participant wants to trade at the price and size listed, they can simply point and click to execute that trade. Benchmark U.S. Treasuries trade this way, with three separately owned venues operating active central limit order books.

In some cases this style of inter-dealer trading includes a voice component as well, often referred to as the hybrid model. Here, the matching of buyers and sellers is done both via point-and-click trading and phone conversations with an inter-dealer broker.

Electronic trading will continue to grow beyond current levels, having brought tremendous benefits to the market. However, it also is important to acknowledge the importance of the expert advice and guidance gained through trusted relationships when trading in the fixed-income market. Greenwich Associates research consistently shows that, other than the obvious metric of execution quality, sales and research service provided by a fixed-income counterparty is the top consideration when an investor determines where to trade.

Pricing Beyond Bond Math

Size also plays a part in the pricing of fixed-income instruments. At first blush this might sound unfair, as the value of a given security should be based solely on its underlying economics. However, it is important to realize that financial markets work similarly to nearly every other industry, with wholesale and retail transactions handled differently.

When Target buys cereal, it buys millions of boxes at once. Because such a large transaction locks in revenue for General Mills, limits the sales work required to sell those boxes separately and ultimately provides General Mills with wider distribution than they can get on their own, they are willing and able to sell those boxes to Target at a cheaper price than they would sell a single box to an individual consumer.

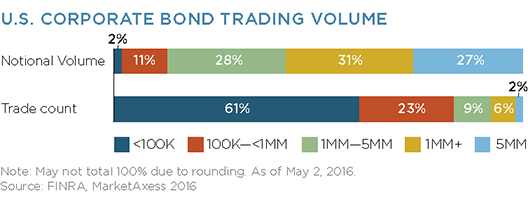

In the bond market, similar dynamics apply. Trading between institutions, which most often occurs with wholesale-like order sizes over $1 million, allows dealers to offer slightly better prices than they could for small retail trades, while still ensuring profitably.

This does not mean retail consumers are paying the wrong price for their bonds. Servicing thousands of customers trading in $1,000 increments is much more costly to the dealer than servicing a handful of large institutions trading $1 million or more at a time. Furthermore, retail investors can, in fact, get access to institutional pricing via mutual funds and other similar investment vehicles, thereby leveling the playing field.

Connecting Buyers and Sellers

While relationships will remain critical to the fixed-income market, a combination of challenging market conditions, new regulations and innovative technology are beginning to shift the ways in which fixed-income market participants interact with one another.

Through most of fixed-income market history, dealers were the primary buyers from and sellers to the investment community. Investors were willing to pay for this service, with dealers buying and holding the bonds they wanted to sell, often until another investor could be found to take on that position—sometimes days and sometimes months later. Bridging this time gap between supply and demand was and is a key role of bond dealers.

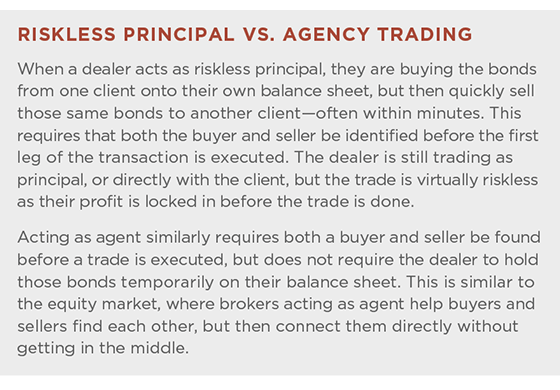

Due to new banking regulations and bank investors demanding a higher return on equity, holding bonds for customers is considerably more expensive and less profitable than it was 10 years ago, discouraging the practice. Therefore, dealers are more inclined to find both the buyer and the seller simultaneously, known as "crossing bonds" or "riskless principal" trading, removing the requirement that they hold the bonds on their balance sheet.

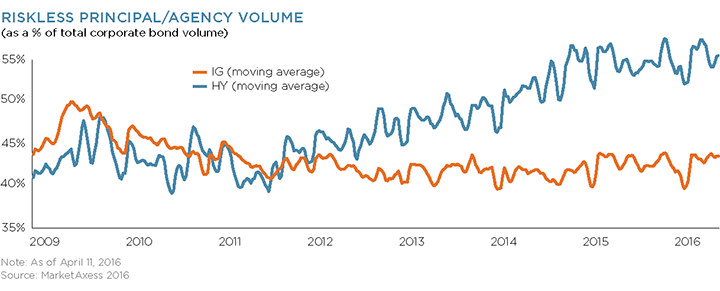

This change has limited the speed with which investors can buy and sell securities, and requires investors to bear additional market risk while the dealer searches for the other side of the trade. While it is unclear exactly how much volume is traded via this riskless principal/agency model, reported corporate bond trading data does provide a strong indicator of its growth.

All-to-All Trading

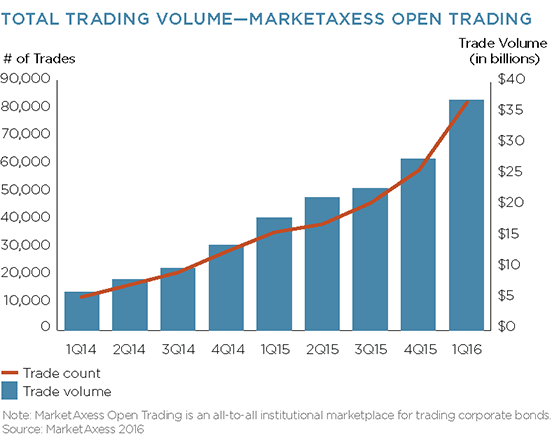

The growth of riskless principal/agency trading in the bond market has encouraged the creation of new electronic trading venues that, unlike the incumbent platforms, do not specify dealers as liquidity providers and clients as liquidity takers, but instead allow all market participants to trade with one another directly—often referred to as all-to-all trading.

Investors are generally supportive of this approach, with nearly 40% of U.S. bond investors in a recent Greenwich Associates study citing all-to-all trading as a top feature they look for when selecting an electronic trading venue. (See the Q4 2015 report The Continuing Corporate Bond Evolution.) Growing interest in MarketAxess’ all-to-all Open Trading corporate bond platform, among others, also shows investor interest in the new paradigm.

Greenwich Associates does believe that all-to-all trading in various parts of the fixed-income market will continue its steady growth over time.

However, it is important to remember the difference between liquidity providers and investors. Liquidity providers are expected to provide on-demand liquidity for a fee—a role only bond dealers have and will continue to fill. They take risks with their balance sheet to service clients and profit accordingly.

Professional money managers make money by generating return for their clients. So if an investor is matched with another investor via an all-to-all trading platform, the two have opposing views of the market at that moment in time—one is buying while the other is selling.

This can happen often in more heavily traded markets, such as those for U.S. government bonds and well-known corporate bonds. In other markets where trading happens less frequently, however, that perfectly timed opposing view is hard to find, hence the role of the dealers.

What Trading Costs

The U.S. equity market is often considered one of the most efficient in the world, and as such, allows investors to execute at a low cost. Greenwich Associates research shows that in 2016, the average all-in commission rate for institutions trading U.S. equities is 2.63 cents per share, down from 3.2 cents per share in 2007 before the financial crisis. If we assume, based on Greenwich Associates research, that the average stock price across the entire U.S. market is roughly $70, then a 15,000 share institutional order would cost about $1 million, with a commission charge of $184.

The cost of trading in the OTC bond market is higher, at about $500 per $1 million traded. Dealer revenue comes not from commission charged, but from capturing the difference between the bid and ask price—the spread. Taking a conservative approach, Greenwich Associates estimates the average spread for U.S. corporate bonds to be roughly 10 basis points.

With most customer orders executed at the midpoint, that leaves dealers earning five basis points of the total value of the trade, or $500 in this example. The more liquid the bond, the lower this spread (and cost) becomes. While more expensive than equities markets, given the complexities of sourcing corporate bonds and the risk that dealers often face in holding bonds for a period of time or the cost of hedging that risk, the difference is understandable.

Rules, Regulations and Their Impact

Market Oversight

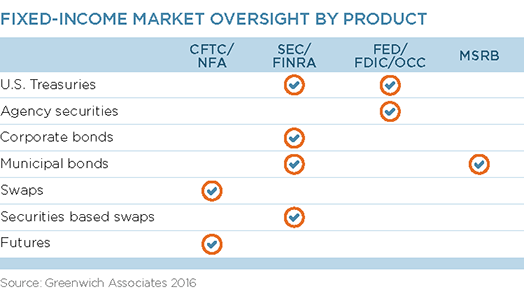

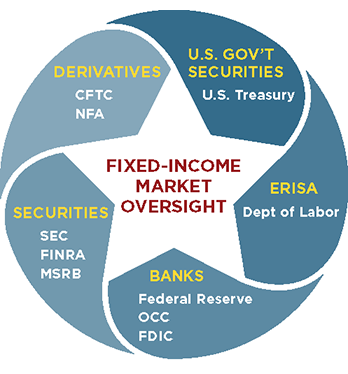

A total of 10 federal agencies and self-regulatory organizations are critical to rulemaking and/or enforcement for fixed-income-related products, creating a strong, albeit somewhat complex, degree of oversight. Federal regulation of the bond markets can be categorized under three areas of focus: investor protection, market transparency and systemic safety and soundness, also known as prudential regulation.

All broker-dealers who participate in the fixed-income markets are required to be registered with the U.S. Securities and Exchange Commission (SEC) and one or more self-regulatory organizations (SROs) such as the Financial Industry Regulatory Authority (FINRA) or the Municipal Securities Rulemaking Board (MSRB).

The SEC makes rules governing dealer and, in some sectors, issuer participation in the securities markets. These rules cover such issues as fraud, capital requirements, trading activity, margin lending, and disclosure, among many others. The SEC also oversees mutual fund companies and registered investment advisors.

The rules of SROs cover such areas as suitability, pricing, interaction with investor customers, and professional qualification testing. The SEC and FINRA also regularly examine bond dealers to check for regulatory compliance.

Bank regulators, including the Federal Reserve Board (the "Fed"), the Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) make rules that govern bank and bank holding company participation in the markets, including areas such as capital and liquidity. The OCC also examines banks active in the bond markets with regard to compliance with SEC and SRO rules. The U.S. Treasury Department is the primary rule-maker with regard to U.S. government securities.

The Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) oversee the markets for fixed-income derivatives. Finally, the Department of Labor oversees entities that manage investments that fall under the Employee Retirement Income Security Act of 1974 (ERISA), and also protects investors in those plans.

Investor Protection

In the area of investor protection, U.S. regulators have several areas of focus with customer disclosure as a key tenet. FINRA and the MSRB require dealers to have a "reasonable basis to believe" that investments they recommend to retail customers are suitable. As a result, firms must ask customers about such issues as investment objectives, risk tolerance, and investment time horizon. In short, dealers are required to learn as much as possible about their customers before recommending investments.

In addition, dealers are required to provide potential customers with prospectuses, official statements, or other key disclosure information at the time they recommend an investment. Additionally, FINRA and the MSRB have rules in place to help ensure that investors receive fair prices for the securities they buy or sell and that dealers report to the customer relevant information about an investment at the time of a transaction.

Also related to investor protection, the SEC oversees mutual fund companies, ensuring that investors receive clear information about investments in their funds, and registered investment advisors, who must adhere to a fiduciary duty—agreeing to always do what is best for their clients—with regard to customers’ investments.

Market Transparency

Market transparency relates to both information transparency—ensuring that investors have the information they need to make informed investment decisions—and price transparency—ensuring that investors have information to evaluate the prices they pay and receive for securities.

To provide information transparency, the SEC requires a corporate securities issuer to produce a prospectus and other disclosures at the time that bonds are offered for sale. A prospectus contains information about the issuer and the investment, including comprehensive financial information and a discussion of risks an investor in a bond might face. SEC rules also require corporate securities issuers to publish annual audited financial statements, quarterly financial statements and notices of certain events that could affect the value of their securities.

Disclosure rules in the municipal bond market do not apply directly to issuers. However, the SEC has rules to help ensure that, at the time of issuance and on an ongoing basis, investors have ready access to issuer financial and risk information. Financial information from corporate and issuers is available to investors free on the SEC’s EDGAR platform, and municipal bond information is available on the MSRB’s EMMA platform.

In the area of trading, both FINRA and the MSRB drive price transparency by requiring dealers to report the prices of all corporate securitized products and municipal bond transactions to a central repository. Much of this trade information is publicly disseminated in real time through FINRA’s TRACE system and the MSRB’s EMMA platform. The CFTC has similar requirements for many fixed-income-related swap transactions as enacted by the Dodd-Frank Act.

The impact reporting has had on liquidity remains a topic of great debate. Some market participants are of the view that trade reporting has improved liquidity by lowering transaction costs. Others believe it has harmed liquidity by discouraging dealers from participating as actively in the market.

Prudential Regulation

Prudential regulation is primarily the purview of the federal banking agencies—the Fed, the OCC and the FDIC. These agencies require banks to hold minimum levels of capital against the investments they hold, providing a "cushion" against losses the bank may suffer if positions they hold perform poorly. SEC and CFTC regulations similarly set minimum capital requirements for non-bank broker/dealers and swap dealers.

The bank regulators’ "risk-based" capital rules account for the relative risks of various categories of investments. Banks are generally required to hold more capital against riskier positions. Banking agencies also have rules in place, such as the supplementary leverage ratio, to limit leverage and liquidity requirements, and to help ensure that banks have sufficient liquid investments that can be easily sold if the need arises.

In addition, the Volcker Rule, a provision of the Dodd-Frank Act, prohibits banks from engaging in "proprietary trading" of many categories of investments, including certain fixed-income securities.

Moving Forward

In the years since the financial crisis, nearly every element of the fixed-income market has received renewed focus and, in most cases, a modernization. The Dodd-Frank Act catalyzed the process for new swaps-market regulations impacting each of these four categories— dealers, investors, trading, and market transparency.

By enhancing the roles of the CFTC and the SEC (for securities-based swaps), these agencies gained the authority to oversee swap dealers and markets, ensure that transactions meet business conduct standards and require reporting that adds to the market’s transparency.

Dodd-Frank also brought a slew of new rules and revisions to existing rules which have had a major impact on market participants and the market’s functioning. For example, enhanced bank capital, leverage and liquidity requirements have increased the cost of capital for banks, making it less economical for them to hold bonds in order to service customers. The Volcker Rule that limits proprietary trading has had a similar impact, limiting bond dealers’ ability to hold bonds in inventory even when done to service institutional clients.

Conversations about future rule changes also continue—adding reporting and registration requirements for the U.S. Treasury market, for instance. Rules have also been proposed that would require dealers to disclose markups on municipal and corporate bond trades with investors.

While Greenwich Associates fully supports enhanced transparency of the fixed-income market, it is critical that regulators perform a cost-benefit analysis of any changes, ensuring that the cost of additional oversight does, in fact, improve market functioning for the end investor in a meaningful way. More specifically, while the value of reporting to regulators is hard to argue, weighing the pros and cons of broad public reporting is a much more difficult task. To that end, we believe that enhanced reporting requirements for the U.S. government bond market are an important addition to the regulators’ toolbox for oversight purposes.

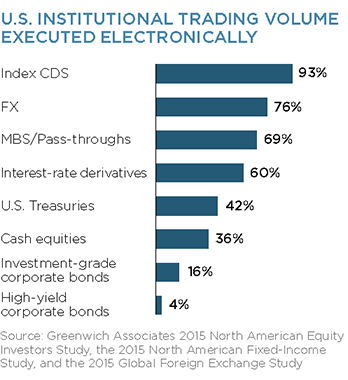

Exactly what must be reported and to whom, however, is still a source of ongoing debate. Prescribing specific methods for trading bonds, such as the CFTC rules requiring certain swaps be traded in specific ways on registered venues, is not advisable, as market participants has shown they will naturally gravitate to the most efficient methods of trading. Nearly three-quarters of foreign-exchange trading volume and nearly half of global government bond trading volume is already done electronically, for instance.

Conclusion

The fixed-income market is a central piece of the U.S economy, allowing money to flow from those who have it to those who need it. Ensuring those transfers take place requires an increasingly diverse set of market participants, trading venues, technologies, regulations, and incentives to enable the market to function smoothly.

To that end, market regulators must ensure that rules, both current and future, keep retail investors safe, while not being so burdensome that market efficiency is impacted.

Throughout 2015, Greenwich Associates interviewed 3,933 institutional investors active in fixed income globally. Interview topics included trading and research activities and preferences, product and dealer use, service provider evaluations, market trend analysis, and investor compensation. Analysis for this study was performed in the first half of 2016.