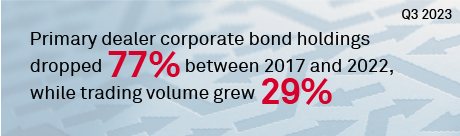

U.S. bond markets have evolved dramatically over the past two decades, transformed by technology and regulatory changes. As a result, business models have advanced, profit margins have changed and firms that didn’t exist at the turn of the century are now major market players. Yet, while bond-dealer business models have changed, the size and influence of the biggest bond dealers remain fairly consistent. The revenue generated by the top 12 bank dealers from trading U.S. Treasuries, investment-grade (IG) and high-yield (HY) corporate bonds with investors accounted for 71%, 61% and 49%, respectively, of the market-wide revenue generated by client-facing liquidity providers in 2022.

MethodologyThis research is based on an analysis of Coalition Greenwich competitor analytics and voice of the client investor studies as well as data captured in Greenwich MarketView. Conversations with key market participants were also conducted as an input into the analysis.