In 2023, Coalition Greenwich conducted a study with institutional investors to assess the latest trends in OCIO usage. Globally, we interviewed over 1,400 institutional investors regarding their use of OCIO and spoke with a subset of 257 for more in-depth feedback. Current users shared their experiences working with OCIOs, and non-users described what has kept them from outsourcing to date and where they stand on future considerations.

Below are some key highlights from the full research results that are covered in 2023 Trends in OCIO Usage.

Current OCIO Use

OCIOs play an important role in helping institutional investors manage their investment portfolios in a complex and challenging environment. This model gained traction in the asset management industry due to its ability to provide specialized expertise, access to a broader range of investment opportunities, and tailored risk management strategies. While adoption of this model varies significantly by region, 11% of global investors are currently using an OCIO to manage a substantial portion of their portfolio.

Globally, where funds use an OCIO, they tend to allocate the entirety of their plan assets to their OCIO provider. However, the approach to granting discretion over these assets—whether full or partial—also varies significantly by region. In Europe, there's a prevailing practice of granting only partial discretion to OCIOs. North American and U.K. investors tend to lean toward granting full discretion to OCIOs, entrusting them with complete authority over investment choices.

Motivations for OCIO Adoption

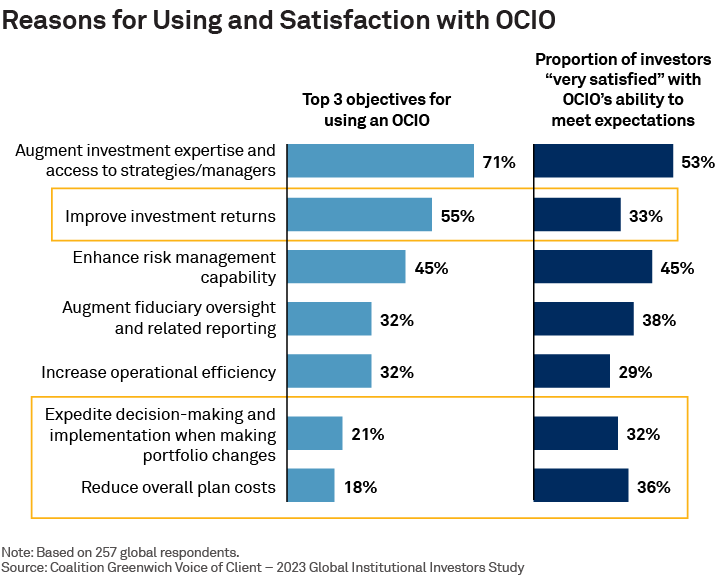

When asked about the top objectives in their decision to use an OCIO, the primary factor was the desire to augment their investment expertise and gain access to a broader array of investment strategies and managers. This reflects a strategic shift toward leveraging specialized knowledge and resources to enhance portfolio diversification and capitalize on unique market opportunities.

Second, investors cited the objective of improving investment returns as a key motivator for adopting an OCIO model. By tapping into the OCIO's expertise in asset allocation and manager selection, investors aim to achieve superior risk-adjusted returns over the long term.

Lastly, investors highlighted the importance of enhancing their risk management capabilities through the use of an OCIO. This includes developing and implementing customized risk management strategies to mitigate market volatility and safeguard the portfolio against downside risk.

Satisfaction with OCIO’s Ability to Meet Expectation

The majority of investors report being satisfied with their OCIOs, although asset owners in North America generally express a higher degree of satisfaction with their OCIOs than their counterparts in Europe.

For investors, the primary objective of using the OCIO model is to augment their investment expertise, an area where they also report the highest satisfaction with their OCIO. However, while improving investment returns was reported as the second most important objective for OCIO users, only a third expressed high satisfaction with their provider's ability to achieve this goal.

Relative to client priorities, OCIOs have been more effective in reducing costs and managing portfolio changes than in boosting returns. OCIO providers may benefit from adjusting their communication and rationale for OCIO adoption to focus on areas where their clients report the highest satisfaction.

Sophie Emler is the author of this publication.