Table of Contents

ESG

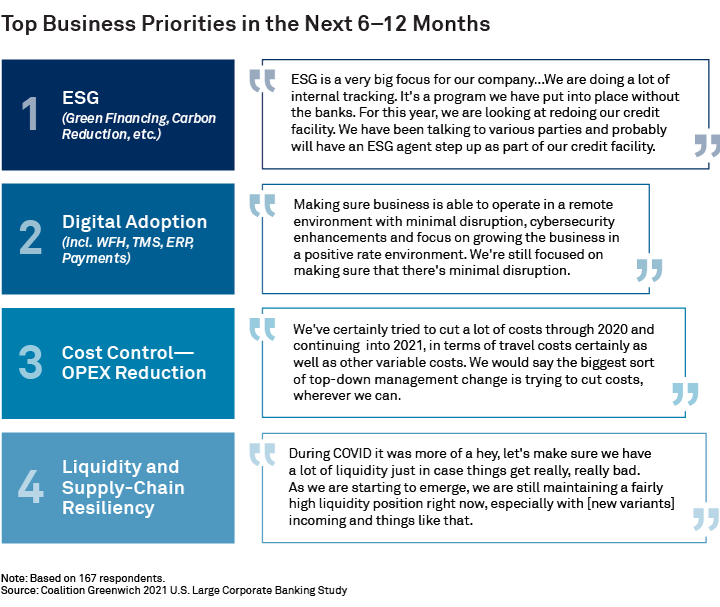

The tumultuous events of the past two years have caused a radical reordering of priorities among America’s largest companies. Eighty-five percent of the corporate treasury and finance executives participating in this year’s study reported a change in top business priorities in 2021. Eight in 10 large U.S. companies have established some internal ESG goals.

Spurred on by senior management, boards of directors, shareholders, and customers, corporate treasury officials are now working to expand ESG and more fully integrate ESG factors into finance and treasury operations. “As things have evolved on the financing front and on sustainability overall, we’re constantly trying to find ways to weave in ESG with what we are doing here,” says a treasury professional from a large U.S. corporate.

As they do so, companies are looking for banks and other advisors who can advise them on where and how to apply ESG standards, goals and products within these functions. On the corporate-banking front, companies in 2021 said they participated in ESG seminars and webinars hosted by their banks and spent time getting educated by their bankers about green bonds. In cash management, companies said they are relying on their banks for news, advice and education on ESG. In trade finance, companies are looking for specific advice on how to achieve ESG compliance up and down the supply chain.

Going forward, companies will partner with banks that can help them achieve their broad ESG goals. Corporate treasury officers say they are looking for two main characteristics in a partner: 1) A demonstrated commitment to ESG in the bank’s own business, including a strong brand association with positive environmental and social practices, and 2) The expertise and capabilities to help the company understand and execute on ESG strategies. These traits will become increasingly important as more companies adopt ESG standards as baseline criteria for participation in their banking groups.

Digital Adoption

Corporate banks are moving into the future. They are building out digital capabilities, and they are focusing on tech-forward companies best positioned to take advantage of innovation.

The sudden embrace of digital technologies by companies during the pandemic lockdown accelerated the advance of digital tools as a cornerstone of corporate banking relationships across the industry. For many companies in the technology space, however, digital solutions were already a top priority in assembling their banking groups. Companies like Amazon, Apple and Google represent some of the most attractive prospects for corporate banks. Because these companies are sitting on mountains of cash, credit provision plays a lesser role. These companies are looking for banking partners capable of operating at their speed. That means connecting digitally, achieving efficiencies through automation, optimizing processes and customizing service with data analytics and, increasingly, providing high-value ideas and advice through predictive analytics.

In many ways, that’s an entirely new and different relationship model. It’s also a very attractive model for the banks capable of achieving it. The Big Three US corporate banks have already started targeting these types of relationships and clients. Although the U.S. remains a buyer’s market for banking services, the biggest banks are beginning to demonstrate a preference for these tech-based relationships over companies in manufacturing and other industries that still require more manual, paper- and human-based service (in addition to more lending.)

Although it’s now the tech companies that are defining this new model, other companies are progressing down a similar path at their own pace. The corporate treasury officers participating in this year’s study rank “digital adoption” as their number-two business priority for the next 12 months, behind only ESG. Some of that emphasis is related to COVID-19 and the need to accommodate work from home and other remote business and communications functions. However, companies are also looking to integrate treasury management systems, enterprise resource planning solutions and systems to digitize a host of functions across treasury, cash management and trade finance. The share of companies using digital platforms from their banks and third-parties to initiate and manage trade services and finances has been steadily climbing. One treasury executive summed up the priorities expressed by many of her peers. In the year ahead, she said company’s goal is “making sure the business is able to operate in a remote environment with minimal disruption, cyber security enhancements, and focus on growing the business in a positive rate environment.”

Over the past several years, many of these investments have been funded with profits from investment banking, especially M&A. The strength of those business allowed the Big Three banks to continue funding their technology programs in an era of low interest rates and limited corporate loan demand. Other banks have not been so lucky. Banks without large investment banking businesses to diversify revenue streams and profits have been unable to match the Big Three in tech spending. As a result, the capabilities gap between the Big Three and the rest of the industry is widening. That will be bad news for smaller and regional banks as the corporate banking industry continues its transformation to a technology-based model.

International

Global supply chain disruptions have fueled a surge in demand for international trade finance services among large U.S. companies. Companies have spent the past two years responding to short-term break-downs, reassessing the makeup of their supply chains, and attempting build in new levels of resiliency. As they tackle those tasks, they are increasing their use of foreign exchange, international cash management and trade service products in Asia and other regions. Mounting demand for these products and services plays to the strengths of the biggest US banks. Banks with strong international networks are best positioned to help companies think through issues about supply chains, financing and risk management. In some cases, companies are turning to regional specialists in China and other Asian countries for expert advice and on-the-ground support. In general, however, until supply chain disruptions and geopolitical challenges are resolved, the largest global banks will have yet another advantage over smaller rivals.