Environmental, Social and Governance (ESG) is one of the more ubiquitous topics in asset management, yet inconsistencies around taxonomies, data and regulation impact the investment process.

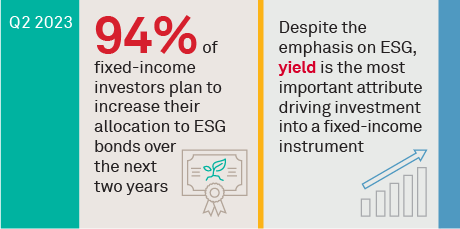

For example, certain fixed-income investors want to more effectively incorporate ESG criteria into their investment decision-making but, in order to do so, obstacles in areas such as data acquisition need to be removed to enable such decisions.1

While the ESG investing industry is not perfect, it is maturing. End investors are demanding ESG products, though of course, with different goals and desired styles.

MethodologyBetween July and August 2022, Coalition Greenwich conducted interviews with 111 senior buy-side fixed-income professionals globally to better understand the market participants and the likely path ahead for ESG’s impact on this market. Study participants represent a range of functions, including portfolio managers, traders and analysts. Questions explored the importance of ESG, the challenges in today’s environment and how firms will respond to ESG in fixed income.