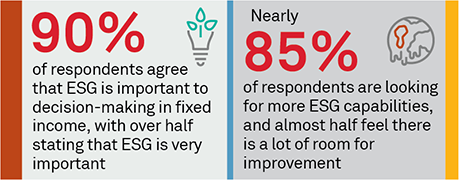

Environmental, social, and governance (ESG) factors comprise one of the dominant themes of the asset management industry. Each of E, S and G have very different criteria. For E, you need to examine emissions, water use or waste management. For S, it can be board diversity or employee turnover. For G, evaluations may include anti-corruption policies or board independence.

Managing data needs for each of E, S and G individually is difficult. Managing the entirety of ESG data needs and incorporating them into investment decision-making is all the more challenging. For investors looking to improve their ESG capabilities, acquiring and managing data is vital to this journey.

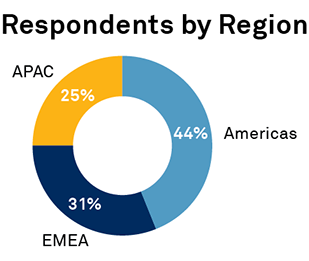

MethodologyBetween July and August 2022, Coalition Greenwich conducted interviews with 111 senior buy-side fixed-income professionals globally to better understand the market participants and the likely path ahead for ESG’s impact on this market. Study participants represent a range of functions, including portfolio managers, traders and analysts. Questions explored the importance of ESG, the challenges in today’s environment, and how firms will respond to ESG in fixed income.