U.S. Treasury market volatility, or the amount that prices have or are expected to fluctuate in a given time period, has remained elevated since 2022 when the Federal Reserve began its rate-hiking cycle.

This prolonged period of uncertainty, despite an equity bull market that started in 2023, has surpassed the duration of heightened U.S. Treasury volatility observed during the 2007–2008 global financial crisis. Today’s sustained high volatility reflects the complex interplay of factors influencing the market and underscores the ongoing challenges and risks faced by traders and investors.

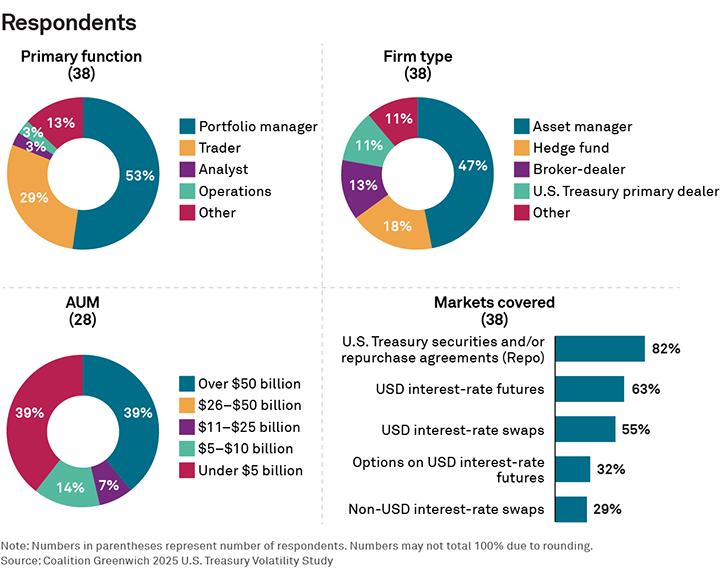

MethodologyIn an effort to better understand the use of volatility metrics in the U.S. Treasury market, Crisil Coalition Greenwich interviewed 38 interest-rate traders and portfolio managers at asset managers, hedge funds, dealers and market makers in the U.S. in Q2 2025.