Volumes in the U.S. Treasury market are up in the first few months of 2019, and as Greenwich Associates data shows, so too is competition among the electronic trading venues. Kevin McPartland had the opportunity to speak with Jill...

The profusion of accessible data, and the advance of computing power and machine learning, have transformed TCA from a check the box exercise meant to satisfy the regulators to something else. TCA has reached a level where it can see beyond the...

In December, Nasdaq announced they intended to acquire Quandl, an alternative data company. The early adopters of alternative data were the most sophisticated quantitative hedge funds who had the expertise and resources to take in the often...

On Tuesday this week Nasdaq announced they were buying Quandl – an alternative data company. This follows a previous initiative within the global exchange and data company to organically build their own alternative data business.

How Traders Trade When Treasury Markets Get Volatile

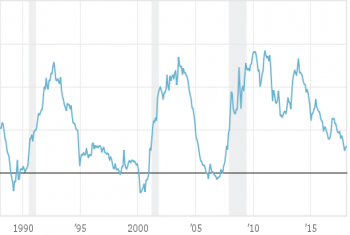

U.S. Treasury volumes in October hit their highest level since May 2018, with an average daily volume of $554 billion. The equity market's precipitous decline drove a drop in Treasury yields that brought with it the market volatility traders have...

With this bull market feeling like it will never end, market chatter is increasingly focused on the flattening – or inverting – of the yield curve.

TRACE "Unlocks" the Treasury Market for the Official Sector. Everyone Else Gets a Peek Through the Keyhole

On Friday the Federal Reserve posted a blog in which it gave the public a fresh glimpse into what the official sector is seeing in the “TRACE for Treasuries” data.

Lessons We Can Learn from the Failure of the Tick Size Pilot Program

The SEC recently announced that the Tick Size Pilot program will expire on September 28th. After two years, various studies have estimated that the cost to investors of this experiment to range from $350mm to $900mm and these costs do not include...

Planning your CX Program for 2019? You should focus on these 3 best practices...

Two years after the controversial approval of the IEX exchange, we look at the performance of speed bumps in the US and Canada, and argue that an asymmetric speed bump with a displayed quote, would enhance liquidity provision and improve market...

Pages

Access Free Research

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder

REGISTER

In The News

-

Financial News: The top 12 prime brokers made $20.4bn in 2023, up more than 25% in a decade,...April 24, 2024

-

Global Trade Review: “Payables has historically been the most popular product, generally...April 23, 2024

-

P&I Online: A new report from Coalition Greenwich, titled "Investment Consultants Grow in Size...April 23, 2024