This content is part of our new Greenwich MarketView product

and is not included in the Fixed-Income Subscription Service.

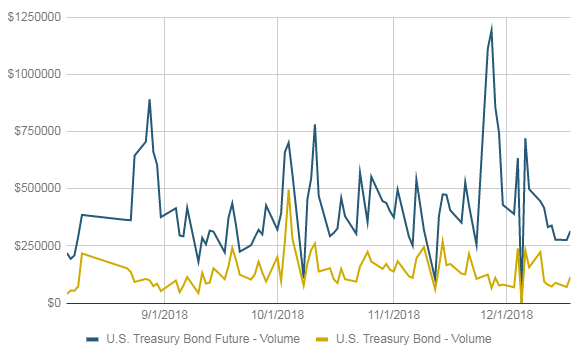

Senior analysts take a closer look at the U.S. Treasury market as of December 2018. Market activity in November slowed slightly after what turned out to be a busy October for U.S. Treasury markets with equity market declines and comments from Treasury Secretary Powell driving activity. Cash volumes were down 3% month over month as were volumes in core futures. E-trading activity in cash Treasuries also returned to what seems to be a new normal following a sharp jump in CLOB volume amidst October’s volatility. But despite the month-on-month decline, volumes remain elevated from a year ago as the bull market in both equities and fixed income appears to be faltering. Average daily volume in US Treasuries is up 6.5%.