Table of Contents

- 1.Executive Summary

- 2.Introduction

- 3.Strategic Priorities—Investing in Efficiency

- 4.A Hybrid Approach: Buy, Build and Integrate

- 5.Balancing Integration and Specialization

- 6.The Trading Technology Trifecta

- 7.Changing Technology Providers: The Battle of Integration and Adaptation

- 8.The Pathway to Change

- 9.Conclusion

Executive Summary

Trading technology is crucial for asset managers, who face decisions about trading workflows and rely on providers offering exceptional performance and customer service. In a recent study, Coalition Greenwich, in collaboration with CMC Markets, asked equity-focused buy-side market participants around the world about their current usage, perceptions and future priorities.

Strategic priorities for buy-side firms revolve around core business growth and cost management. They aim to enhance middle/back-office processes, optimize costs and reallocate resources for greater efficiency.

The “buy, build and integrate” approach is gaining traction as buy-side firms combine pre-built platforms with proprietary systems. Hybrid setups are popular, favoring a mix of proprietary and third-party solutions. While larger firms often build fully proprietary systems, they are increasingly considering third-party platforms due to their cost-effectiveness and functionality.

Successful trading technology providers must prioritize ease of use, scalability, customization, comprehensive training, and high-quality support. Collaboration and customer-focused approaches are essential for building long-term relationships and unlocking growth opportunities.

As technology advances, buy-side firms remain vigilant, assessing the latest offerings. Providers must deliver reliable and user-friendly solutions that meet daily demands. By investing in the success of boutique buy-side firms and fostering collaboration, providers can establish trust, foster loyalty and achieve sustained excellence.

Introduction

Trading technology is the lifeline of asset managers, the pulse of their operations and the driving force behind their competitive edge. In an ever-evolving landscape filled with options and hidden risks, the choices buy-side traders make regarding their trading workflows have far-reaching consequences. They are torn between the allure of a single comprehensive platform and the promise of multiple interconnected systems. They are faced with decisions around building their own technology, acquiring it from external providers or—most commonly—a mix of both. Amid evolving regulations and the increasing need for interoperability, they rely on providers that deliver exceptional performance and offer top-tier customer service.

Trading technology extends beyond execution; it permeates every facet of an organization’s workflows. From operations to risk management and compliance, asset managers seek flexible, ingenious solutions that help navigate their unique workflows and pain points. Choosing the wrong providers can disrupt their business financially, operationally and culturally.

These issues are compounded among boutique buy-side firms—those with assets under management (AUM) of $1 billion or less—in a fiercely competitive arena. They struggle to receive high-quality support, service levels and tailored solutions from trading technology providers. Larger firms are showered with preferential treatment, leaving smaller managers scrambling to keep up with the latest advancements.

In this backdrop of dilemmas and disparities, Coalition Greenwich conducted a comprehensive study of buy-side behaviors and preferences, exploring equity trading technology usage and expectations in depth. The research yielded valuable insights, uncovering the types of platforms embraced, crucial attributes driving preferences, satisfaction levels with existing providers, and criteria for shortlisting potential partners. It shed light on asset managers’ selection and review processes, identifying influential departments and key decision-making factors.

Strategic Priorities—Investing in Efficiency

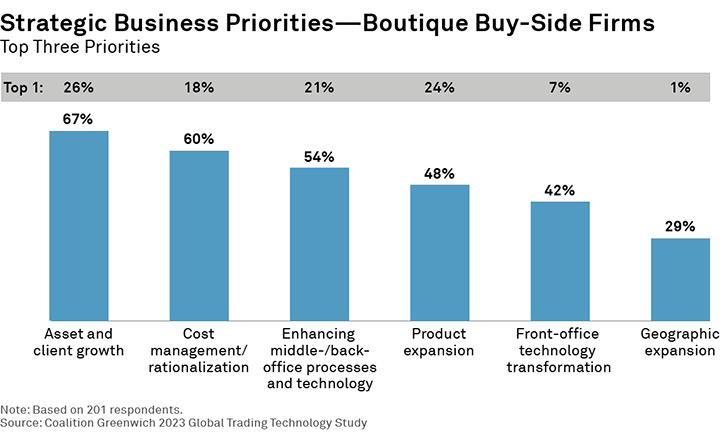

To gain insight into technology decision-making, it’s crucial to understand the strategic priorities of boutique buy-side firms. These firms, like many others, prioritize core business growth while keeping a close watch on costs. Our research shows that asset and client growth are top priorities for two-thirds of respondents, with 60% emphasizing cost management and rationalization.

Around half of the respondents are focusing on enhancing middle/back-office processes and technologies. They are investing in solutions to address trading workflow challenges and improve operational efficiency. While optimization helps control technology and other costs, it doesn’t necessarily mean reducing overall technology expenses. Instead, resources are reallocated to increase efficiency in a cost-effective manner. This may involve leveraging vendor-provided solutions with high price tags, often reaching seven figures annually. It’s important to note that cost-effective doesn’t mean inexpensive, as building and maintaining proprietary in-house systems may not be any cheaper. These managers prioritize avoiding short-term savings that could lead to long-term costs.

Priorities vary across regions, firm types and individual roles, however.

- The C-suite is less focused on cost management (13%) compared to trading roles (30%). Buy-side traders are more aware of bottom-line costs, including their own.

- Hedge funds are prioritizing cost management and rationalization, likely due to profit-sharing and ownership stakes. They are also prioritizing enhanced middle- and back- office processes and technology, and are being more flexible in experimenting with new technologies and customized workflows.

- Managers in Asia are taking a more risk-constrained approach, emphasizing cost management (29%) over asset and client growth (20%), and prioritizing operational process enhancements compared to other regions (20% versus 12–15%).

A Hybrid Approach: Buy, Build and Integrate

Most, if not all, of these buy-side firms’ strategic priorities are closely tied to their technology infrastructure. Trading technology serves as the lifeblood of their ecosystem, facilitating the flow of data and streamlining workflows across the organization. As businesses and technologies evolve, successful firms are adopting a hybrid approach, combining pre-built platforms with customization and integration of proprietary systems.

“Buy or build” is no longer the question, although “buy, build and integrate” is often the answer. This approach provides a middle ground, leveraging a pre-built foundation that can be expanded and tailored through additional development or integration with internal systems. It grants firms greater control, flexibility and adaptability while reducing development time and costs. However, customization and development efforts require resources, expertise and collaboration with vendors.

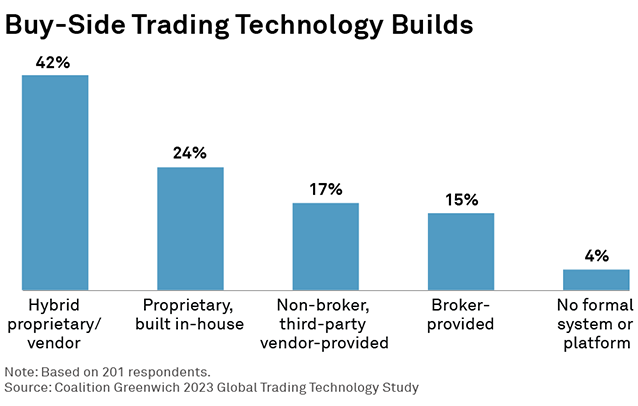

It’s no wonder then that almost half the boutique buy-side firms in our study embrace a hybrid approach, utilizing a mix of proprietary and vendor-provided systems. Only about a quarter rely solely on proprietary in-house platforms that demand dedicated resources, while a third rely exclusively on third-party setups from brokers and non-broker fintech providers. A big push by third-party providers in the early 2000s created an ecosystem that favored buying and customizing vendor technology over the more onerous and costly alternative of building technology from scratch. Additionally, vendor consultants and prime brokers hold significant influence, steering the buy side toward external systems.

The decision to build trading technology systems seems to be at least partly influenced by AUM, with larger and more sophisticated firms more likely to build fully proprietary systems. Only 15% of those with AUM up to $500 million run fully proprietary systems, versus 33% for those with $1 billion or more. However, as we noted in our 2021 research on order and execution management system (OEMS) usage,1 even the largest and most highly specialized buy-side firms are beginning to look externally, as third-party platforms outperform internal builds on cost and breadth of functionality.

Balancing Integration and Specialization

Choosing between a single platform or multiple specialized platforms involves a trade-off between integration and specialization. Factors such as trading strategies, operational complexity, regulations, scalability, and resource constraints should be considered. Some firms may opt for operational efficiency and consistency through a single platform, while others will prioritize specialized functionality and support. The most astute firms will configure unified platforms, picking the best components from multiple systems.

However, the majority (70%) are still forced to rely on multiple platforms for different asset classes, as few single-party platforms appear as viable options. Nevertheless, a significant portion of respondents express the importance of using a single platform (57% say it’s very important and over a third say it’s somewhat important), even if that remains somewhat aspirational.

Interestingly, this preference for a single platform is universal across firm types and AUM brackets. Buy-side firms aim for end-to-end technology solutions, favoring fewer vendors to streamline their operations. However, the challenge lies in finding a platform that fulfills most requirements without extensive customization or integration, as a platform that tries to do everything may not excel in any particular area.

The Trading Technology Trifecta

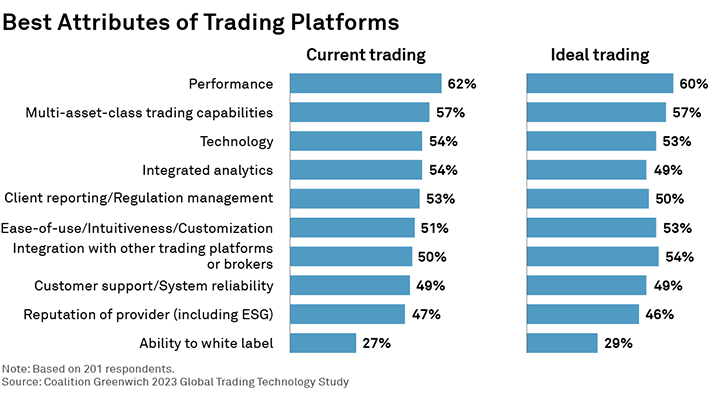

Today’s buy-side firms—especially the boutique ones—have to do more with less. Not surprisingly, they identify the best attributes of trading technology as tending to revolve around efficient performance and platform integration.

Overall, respondents say their ideal trading technology marries:

- performance (execution speed, response time, scalability, etc.) (60%)

- multi-asset-class trading capabilities (57%) and

- integration with other trading platforms or brokers (54%)

While system performance is their primary attribute, boutique buy-side firms clearly value multi-asset capabilities’ seamless integration with other trading and analytics platforms. Poor integration can lead to issues such as delayed orders, settlement breaks and manual interventions, especially during peak volume periods like market open or close.

As noted in previous Coalition Greenwich research,2 ease of use, intuitiveness and customization are also important attributes of ideal trading and workflow technology, as highlighted by over half of the respondents. Not surprisingly, firms with AUM under $500 million naturally place more emphasis on customer support and system reliability at a higher rate than those over $1 billion (19% vs. 8%). This presents an opportunity for a customer-focused platform to gain market share in this segment. On the other hand, larger firms, which often build their own systems in-house, place more emphasis on performance and technology.

Among respondent roles, traders put the most value on multi-asset capabilities that integrate well with other platforms and brokers, with less focus on performance metrics such as execution speed and response time. As our past research has shown,3 the “speed arms race” may be mostly over, as high-speed systems are table stakes. Traders are the front line, so good performance necessitates a platform where all their trading systems work together.

Overall, respondents are satisfied with their current trading technology, largely due to ease of use and intuitiveness that comes from experience—e.g., the technology works as expected, even if not as it should. However, conversations indicate expectations are relatively low among their trading technology providers, with few providers standing out. Again, the playbook is wide open—this presents an opportunity for customer-focused providers that excel in integration to gain market share among the boutique buy side.

Trade analytics capabilities are increasingly in demand among boutique firms, whereas larger firms historically handle them in-house. However, that balance is shifting and the “buy, build and integrate” approach applies to trading technology as a whole, including analytics platforms. Front-line traders across all AUM sizes indicate growing client demand for trade analytics and liquidity-sourcing/block-trading capabilities.

Changing Technology Providers: The Battle of Integration and Adaptation

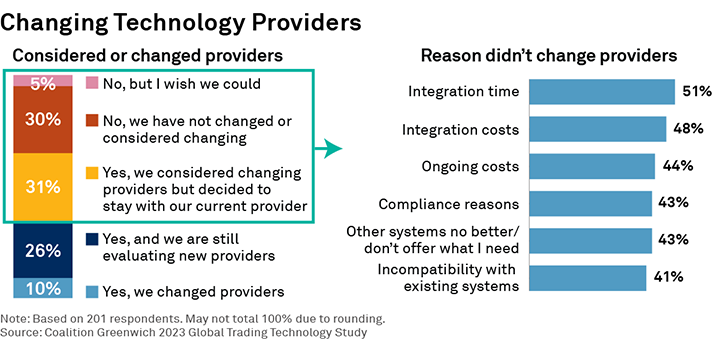

Technology advances quickly, so those that do not keep up with the latest offerings may quickly fall behind. It’s no surprise that about two-thirds of respondents have considered changing providers in the past year, seeking better customer service, improved trading and analytics, along with enhanced data and reporting functionality.

However, changing trading technology can be a massive lift, particularly at smaller firms with more constrained resources, whether human or financial. Once new technology is adopted, integration is crucial as the firm becomes committed to the system(s) for many years.

Consequently, 31% of respondents considered changing providers but ultimately decided to stay with their existing platforms.

Integration time and costs were the most common reasons cited, as onboarding a new platform is only half the battle; integrating it with existing systems poses another, often more difficult task. Other factors included ongoing costs, incompatibility with existing systems and compliance considerations. As a result, only 10% of respondents actually switched platforms, a rate of change consistent with our research over the past decade.

However, savvy technology providers can help navigate these challenges by offering:

- Flexible implementation options that allow clients to gradually adopt and integrate the new platform

- Scalable pricing models, such as subscription- or value-based, that are more aligned with the constrained resources of smaller firms

- Customization tools that ensure interoperability with other systems and workflows

- Comprehensive training and high-quality ongoing support

The Pathway to Change

About half of those who have not changed trading technologies or are not currently considering a change say there is a high or very high likelihood they would consider adding or changing providers in the next two years. They recognize the necessity of evaluating new offerings and are open to enhancing their technological workflows.

However, the process of considering and evaluating providers is difficult and time-consuming. It involves multiple departments, budget considerations and review processes. Respondents say the biggest challenges in comparing providers is evaluating the ongoing costs (43%), assessing ease of integration and compatibility with existing systems (41%) and ensuring overall reliability (39%). Unfortunately, these factors and pain points often remain unknown until firms have already invested significant time and resources in the integration process, leaving them with little option but to make the best of the situation.

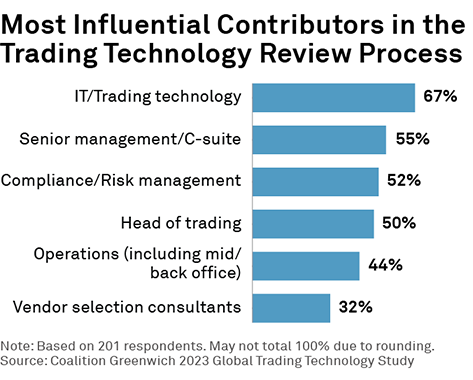

Interestingly, the most influential contributors in the trading technology review process among these boutique firms aren’t necessarily the front-office traders or other daily users. Across all respondents, the IT and trading technology departments (67%) and C-suite management (55%) have the most influence when it comes to decision-making. Compliance and risk management carry similar influence as the head of trading (52% vs. 50%).

Notably, there are differences among firm types and sizes. Compliance and risk management hold more influence among asset managers, while IT and operations play a larger role at hedge funds, possibly due to their need for customization and flexibility. In terms of AUM, smaller firms rely more on input from compliance and vendor consultants compared to their larger counterparts, where IT and senior management have the most influence.

Conclusion

Buy-side firms, particularly boutique firms, are prioritizing growth alongside cost management as their strategic business focus. This entails incorporating efficient trading technology solutions, adopting a comprehensive “buy, build and integrate” approach that seamlessly combines pre-built platforms with in-house development and integration with existing systems.

Successful technology providers must understand the unique value and potential of boutique buy-side firms, catering to their specific needs and priorities. By offering superior service, personalized attention and flexible solutions, providers can cultivate long-term relationships and unlock new growth opportunities.

To thrive in the ever-evolving trading technology landscape, providers must embrace the “buy, build and integrate” mindset. They should develop scalable and flexible solutions that easily adapt and accommodate the growth trajectories of boutique buy-side firms. These solutions should seamlessly integrate with other bespoke systems, allowing for a cohesive and efficient workflow.

Flexible pricing models, such as subscription- or usage-based, will make the technology more accessible and affordable for smaller firms pursuing the hybrid approach. Providers should offer highly customizable and configurable technology, empowering clients to tailor systems to their specific requirements.

Intuitive and user-friendly interfaces are paramount, enabling seamless adoption and minimizing training requirements. Tomorrow’s trading technology providers will add value through robust compliance monitoring and reporting, supporting boutique buy-side firms in managing regulatory obligations effectively.

Furthermore, successful providers will go beyond delivering technology solutions. They will provide dedicated account managers, timely and comprehensive support, and tailored training programs, ensuring that clients can fully leverage the benefits of the “buy, build and integrate” approach.

Importantly, collaboration with boutique buy-side firms is key. Providers should actively seek feedback, involve clients in product development and remain attentive to their evolving needs. By investing in the success of their smaller clients, trading technology platforms can establish trust, foster loyalty and build a reputation for sustained excellence in the industry.

Jesse Forster advises on market structure and technology globally.

2https://www.greenwich.com/equities/globalization-algorithmic-equity-trading-buy-side-view

3https://www.greenwich.com/equities/trends-european-equity-e-trading

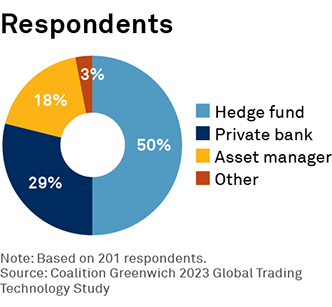

MethodologyCoalition Greenwich gathered feedback from 201 equity-focused buy-side market participants across Europe, Asia, Latin America, North America, and the United Kingdom in April 2023. Respondents included traders, heads of trading, investment advisors, wealth managers, private bankers, and C-suite executives who possess knowledge of their firms’ trading technology. They represented a range of firm types, including hedge funds, private banks, asset managers, and other financial institutions.