The lines between the portfolio management system (PMS) and the order management system (OMS) are getting blurrier by the day. This is partially due to the rise of software as a service (SaaS) and cloud-native solutions that have features and functionality across solution categories. According to our 2020 Market Structure & Trading Technology Study, across all types of buy-side firms, 43% are using their OMS solution remotely via SaaS or cloud-native services (versus 45% on-premise).

But it is also due to more firms, particularly hedge funds, seeking to leverage a converged solution with a single version of the truth for portfolio management and accounting purposes alongside a well-orchestrated OMS. Moreover, even execution management system (EMS) functionality is a piece of the converged solution puzzle.

As a group, asset managers have a greater compliance burden and generally operate many more individual funds, tending to use a dedicated OMS and PMS for their siloed operations. However, hedge funds are a different breed, with the convergence trend most pronounced for those managing around $1 billion–$5 billion—or even below $1 billion.

Those funds are increasingly seeking a combined PMS/OMS solution delivered via SaaS or cloud, supporting wider functionality and integrated with back-end portfolio accounting. Sometimes, a combined system for hedge funds may also include basic EMS features. While today converged systems are used most often by hedge funds, they will likely become more relevant for some asset managers and even outsourced trading desks tomorrow.

A fully converged solution is sometimes referred to by the acronym P/O/E/MS or just “POEMS.” So, in the spirit of the Google auto-complete interview question videos, who are “POEMS” for?

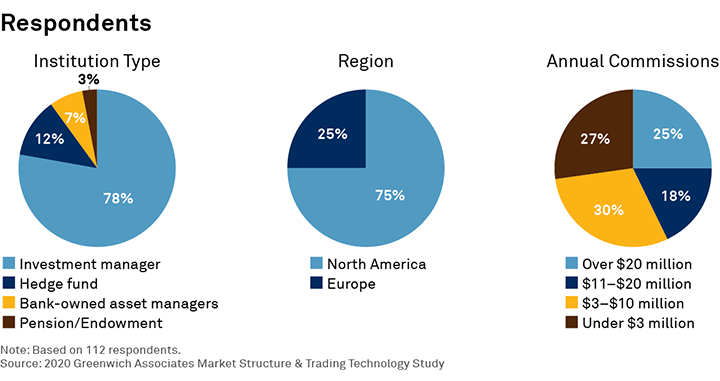

MethodologyBetween July and September 2020, Greenwich Associates interviewed 112 equity traders and portfolio managers, with respondents across North America and Europe. Topics covered include various market structure topics, such as trading desk tools and proposed regulatory reforms.